For the last few months (since June), I stopped blogging about our expenses because there were just too many things ongoing - our house was doing renovation with a few hiccups, CZM deciding to do a semi-retirement (it ended after 1 month. lol.), I was looking out externally and went for a few interviews (decided to stay on now - shall blog about this another time), visited and returned from Canada/USA (yet to blog about this too) and planning for our RTW (Singapore - Mexico - Peru - Bolivia - Brazil - Switzerland - Singapore) which is happening next month.

Anyway, I should not be procrastinating too much before the year ends and finally took some time and tabulated the expenses for the last few months as well as our annual expenses. You will soon understand why we barely buy/invest this year.

Current Profile: 29 years couple who got married last year but are still staying separately with our own parents while waiting for the renovation of our BTO to be completed.

Our total expenses were $14,035.27! The breakdown would be as follows:

KPO Expense Fund (our common fund): $9,129.03

KPO: $2,421.26

CZM: $2,484.98

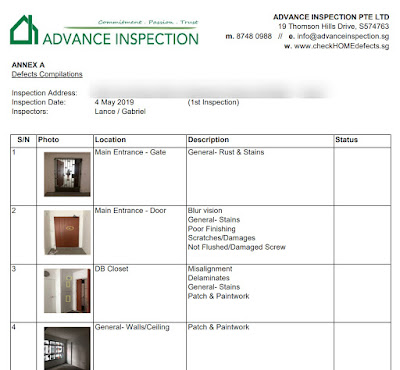

House

House will be our biggest expenses for the next few months. We made the first 10% downpayment for our renovation and you can read more about it here - Renovation Cost for Our New House.

We have started paying for our mortgage/housing loan. The loan amount is about $380k, amortized across 25 years will mean we need to pay $861 each. We are paying this using our CPF OA. Why are we not using cash? Long story short, we are generating higher returns with our cash. You can read about our strategy here - Chiong Housing Loan or Take It Slow?

Vacation

Vacation is still one of our biggest expenses. Most of it would be for the upcoming Canada vacation. The increase in other subcategories is because we went to KL for a few days and I just got reminded that CZM owes me another travel post. lol.

Parents

$1,360 - This is the total amount we are giving to our parents as allowance.

Darling/CZM

$484.51 - 3 x Lancome Advanced Génifique Serum bought from Duty Free (forgot the size)

$200 - CZM signed up for some massage/facial thingy.

$64.04 - Watson

Food

$473.98 - Our combined food expenses are still on the low side because we are still staying with our parents and I usually skip lunch.

Treat

$339.95 - Treated family, friends and colleagues to food/drinks. I can't really remember what's the special occasion but I had a Chope reservation at New Ubin. Guess that's where the majority went to.

Credit Card

$241.57 - Paid annual fee for Citi Premier Miles to get 10k miles and some processing fees for the transfer of miles.

Insurance

$189.00 - This is a fixed monthly cost for the basic coverage - $1 million term life ($71), Early Cancer Care - 150k ($64) and hospitalization ($53).

Transportation

$110.28 - Our EZ Link/Account-Based Ticketing (ABT) for the month. Read about this Samsung Pay x SimplyGo x Visa Hack if you are a Samsung mobile phone user.

$56.4 - Cab

Gift

$138.00 - Wedding red packet for a colleague at JB Pekin Restoran (北京楼).

$2.90 - CZM bought something for a friend.

Mobile

$98.33 - First month of my mobile plan (pro-rated + 1 month in advance) M1 Corporate Individual Scheme (CORI), mySim70.

Entertainment

$20 - CZM and I went to watch a movie.

Summary

January 2019 - $11,712.06

February 2019 - $7,301.63

March 2019 - $6,954.84

April 2019 - $5,236.49 ($30,027.34 including the next 5% downpayment)

May 2019 - $4,860.15

June 2019 - $14,035.27

Our total expenses for 2019: $50,100.44

Average expenses per month for 2019: $8,350.07

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

Anyway, I should not be procrastinating too much before the year ends and finally took some time and tabulated the expenses for the last few months as well as our annual expenses. You will soon understand why we barely buy/invest this year.

Current Profile: 29 years couple who got married last year but are still staying separately with our own parents while waiting for the renovation of our BTO to be completed.

Our total expenses were $14,035.27! The breakdown would be as follows:

KPO Expense Fund (our common fund): $9,129.03

KPO: $2,421.26

CZM: $2,484.98

House

House will be our biggest expenses for the next few months. We made the first 10% downpayment for our renovation and you can read more about it here - Renovation Cost for Our New House.

We have started paying for our mortgage/housing loan. The loan amount is about $380k, amortized across 25 years will mean we need to pay $861 each. We are paying this using our CPF OA. Why are we not using cash? Long story short, we are generating higher returns with our cash. You can read about our strategy here - Chiong Housing Loan or Take It Slow?

Vacation

Vacation is still one of our biggest expenses. Most of it would be for the upcoming Canada vacation. The increase in other subcategories is because we went to KL for a few days and I just got reminded that CZM owes me another travel post. lol.

Parents

$1,360 - This is the total amount we are giving to our parents as allowance.

Darling/CZM

$484.51 - 3 x Lancome Advanced Génifique Serum bought from Duty Free (forgot the size)

$200 - CZM signed up for some massage/facial thingy.

$64.04 - Watson

Food

$473.98 - Our combined food expenses are still on the low side because we are still staying with our parents and I usually skip lunch.

Treat

$339.95 - Treated family, friends and colleagues to food/drinks. I can't really remember what's the special occasion but I had a Chope reservation at New Ubin. Guess that's where the majority went to.

Credit Card

$241.57 - Paid annual fee for Citi Premier Miles to get 10k miles and some processing fees for the transfer of miles.

Insurance

$189.00 - This is a fixed monthly cost for the basic coverage - $1 million term life ($71), Early Cancer Care - 150k ($64) and hospitalization ($53).

Transportation

$110.28 - Our EZ Link/Account-Based Ticketing (ABT) for the month. Read about this Samsung Pay x SimplyGo x Visa Hack if you are a Samsung mobile phone user.

$56.4 - Cab

Gift

$138.00 - Wedding red packet for a colleague at JB Pekin Restoran (北京楼).

$2.90 - CZM bought something for a friend.

Mobile

$98.33 - First month of my mobile plan (pro-rated + 1 month in advance) M1 Corporate Individual Scheme (CORI), mySim70.

Entertainment

$20 - CZM and I went to watch a movie.

Summary

January 2019 - $11,712.06

February 2019 - $7,301.63

March 2019 - $6,954.84

April 2019 - $5,236.49 ($30,027.34 including the next 5% downpayment)

May 2019 - $4,860.15

June 2019 - $14,035.27

Our total expenses for 2019: $50,100.44

Average expenses per month for 2019: $8,350.07

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)