Regular readers will know that we are currently on an HDB housing loan (~1 year). The reasons were we didn't want to fork out any cash for downpayment and wanted to repay the loan as slow as possible. Had we taken a bank loan then, we would need at least 5% cash for downpayment and the remaining 20% in CPF/cash as compared to just 10% CPF for downpayment for an HDB housing loan.

Let me illustrate with some numbers:

Our BTO purchase price - $420k

HDB housing loan - $42k in CPF (downpayment) + $378k loan

Bank loan - at least $21k cash + $84k in CPF (downpayment) + $315k loan

Hence, it is very unlikely for young couples to take a bank loan for their first HDB purchase as the initial cash/CPF outlay is simply too large. For more information, you can take a look at this Seedly article - A Homeowner's Ultimate Guide: Bank Loan Vs HDB Loan Which Is Better?

Seeing how interest rates are pretty low and will likely remain low due to the current economy/COVID situation (my opinion), I was tempted by the possibility of paying lesser interest and refinancing out only if the bank is willing to loan me the full amount. What do I mean by that?

Existing HDB housing loan - $370k

Bank can only loan up to 75% of the purchase price - $315k

We do not want to pay this difference of $55k just to refinance out. Hence, I decided to try out these 2 mortgage brokers (Redbrick and iCompareLoan recommended by Google) to "test the water" since they do not charge any fee (they earn through the referral from the banks). Separately, I also contacted my RM and asked about SCB's housing loan.

Redbrick

Redbrick was the most efficient, someone (let's call him RBG - RedBrick Guy) was assigned to me the very same day. A call was made and he explained a couple of refinancing concepts/fees that were new to me, followed by a report on the possible savings.

Type of loan packages:

1. Fixed

2. Floating based on board rate (bank's internal rate e.g. DBS FHR8) + spread/margin

3. Floating based on SIBOR + spread/margin

Fees involved:

1. Legal fee ~ $1,500 - $2,000+

2. Valuation fee ~ $160 - $200+

3. Fire insurance with the bank

Depending on the loan amount, some banks will offer a cash incentive that can be used to offset the above fees to attract/entice you to take up their loan package. For instance, my RM recommended me not to refinance with SCB because there is no incentive for my loan amount (too small). The cash incentive has a separate lock-in period of 3 years and has to be paid back if one refinance out to other banks within that period.

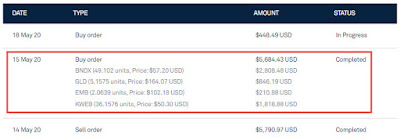

As you can see, there are significant savings (~8k - 11k) on the interest in just 3 years which makes a lot of difference. A housing loan is an amortized loan where one pays off the interest first before the principal and one has to pay the principal to clear the loan. Assuming if we had stayed with the HDB housing loan, we would have paid $62k but only cleared $34k of principal.

The packages he recommended (all with cash incentives) were:

May Bank - 1 Year Floating @ 3M SIBOR + 0.48% ~ 1.308%

UOB - 3 Years Fixed @ 1.68%

DBS - 5 Years Fixed @ 1.80%

iCompareLoan

iCompareLoan (let's call this person ICL - iCompare Lady) reached out a day later, explained those concepts and fees, and offered almost similar packages:

May Bank - 1 Year Floating @ 3M SIBOR + 0.48% ~ 1.308%

DBS - 3 Years Fixed @ 1.70%

After discussing with CZM, we decided to submit an application for the DBS - 3 Years Fixed @ 1.70% loan package as we are using the Multiplier account too. In addition, there is no way of knowing how much the bank is willing to lend unless we submit an application. Most importantly, there is no commitment until we sign the LO (Letter of Offer) by the bank.

A few days later, RBG reached out and asked if I have any questions or made any decision to refinance and I told him about the 3 Years Fixed @ 1.70% with ICL. He asked if I am interested in UOB new package - 2 Years Fixed @ 1.60%. Of course, the lower the better! So I submitted another application to UOB too. Besides lower interest, it is important that the bank is willing to loan us the full amount.

This is where it gets interesting. I told ICL about RBG and his UOB package and she didn't seem too happy as though it is an extramarital affair. I guess the competition is pretty fierce as she tries to win me over by submitting for an exception/special application with DBS for 1.6% fixed rate too. RBG also tries his best to convince me that UOB is better. lol. Anyway, this makes things a lot easier since we just need 1 of them to lend us the full amount.

Surprise surprise! It turns out that the indicative valuation of our house is now more than $600k and both banks are willing to lend us the full amount. In the end, I decided to go with UOB because the 3rd year rate is better (both are based on their internal board rate + spread/margin) and DBS's spread/margin was much higher than UOB + ICL accidentally revealed her unhappiness/unprofessionalism during the negotiation. Those kinds where one bad mouth people in a private chat but it accidentally went into a group chat and had to be deleted quickly. lol.

The best part about RBG was even after he has gotten our business and UOB has already sent the LO. He kept us updated on the UOB new package - 2 Years Fixed @ 1.55% and took the initiative to get the banker to update the LO. Honestly, I thought that was very commendable since even if he had not done that, we would not have known. Anyway, all these happen in the last 2 weeks with banks launching new packages almost every week. Right now, we are serving the 3 months notice to HDB and our monthly repayment will decrease by about $200 every month after that!

Interestingly, these packages are not published on the banks' own website so I will recommend that you contact these mortgage brokers instead of going directly to the banks.

Let me illustrate with some numbers:

Our BTO purchase price - $420k

HDB housing loan - $42k in CPF (downpayment) + $378k loan

Bank loan - at least $21k cash + $84k in CPF (downpayment) + $315k loan

Hence, it is very unlikely for young couples to take a bank loan for their first HDB purchase as the initial cash/CPF outlay is simply too large. For more information, you can take a look at this Seedly article - A Homeowner's Ultimate Guide: Bank Loan Vs HDB Loan Which Is Better?

Seeing how interest rates are pretty low and will likely remain low due to the current economy/COVID situation (my opinion), I was tempted by the possibility of paying lesser interest and refinancing out only if the bank is willing to loan me the full amount. What do I mean by that?

Existing HDB housing loan - $370k

Bank can only loan up to 75% of the purchase price - $315k

We do not want to pay this difference of $55k just to refinance out. Hence, I decided to try out these 2 mortgage brokers (Redbrick and iCompareLoan recommended by Google) to "test the water" since they do not charge any fee (they earn through the referral from the banks). Separately, I also contacted my RM and asked about SCB's housing loan.

Redbrick

Redbrick was the most efficient, someone (let's call him RBG - RedBrick Guy) was assigned to me the very same day. A call was made and he explained a couple of refinancing concepts/fees that were new to me, followed by a report on the possible savings.

Type of loan packages:

1. Fixed

2. Floating based on board rate (bank's internal rate e.g. DBS FHR8) + spread/margin

3. Floating based on SIBOR + spread/margin

Fees involved:

1. Legal fee ~ $1,500 - $2,000+

2. Valuation fee ~ $160 - $200+

3. Fire insurance with the bank

Depending on the loan amount, some banks will offer a cash incentive that can be used to offset the above fees to attract/entice you to take up their loan package. For instance, my RM recommended me not to refinance with SCB because there is no incentive for my loan amount (too small). The cash incentive has a separate lock-in period of 3 years and has to be paid back if one refinance out to other banks within that period.

As you can see, there are significant savings (~8k - 11k) on the interest in just 3 years which makes a lot of difference. A housing loan is an amortized loan where one pays off the interest first before the principal and one has to pay the principal to clear the loan. Assuming if we had stayed with the HDB housing loan, we would have paid $62k but only cleared $34k of principal.

The packages he recommended (all with cash incentives) were:

May Bank - 1 Year Floating @ 3M SIBOR + 0.48% ~ 1.308%

UOB - 3 Years Fixed @ 1.68%

DBS - 5 Years Fixed @ 1.80%

iCompareLoan

iCompareLoan (let's call this person ICL - iCompare Lady) reached out a day later, explained those concepts and fees, and offered almost similar packages:

May Bank - 1 Year Floating @ 3M SIBOR + 0.48% ~ 1.308%

DBS - 3 Years Fixed @ 1.70%

After discussing with CZM, we decided to submit an application for the DBS - 3 Years Fixed @ 1.70% loan package as we are using the Multiplier account too. In addition, there is no way of knowing how much the bank is willing to lend unless we submit an application. Most importantly, there is no commitment until we sign the LO (Letter of Offer) by the bank.

A few days later, RBG reached out and asked if I have any questions or made any decision to refinance and I told him about the 3 Years Fixed @ 1.70% with ICL. He asked if I am interested in UOB new package - 2 Years Fixed @ 1.60%. Of course, the lower the better! So I submitted another application to UOB too. Besides lower interest, it is important that the bank is willing to loan us the full amount.

This is where it gets interesting. I told ICL about RBG and his UOB package and she didn't seem too happy as though it is an extramarital affair. I guess the competition is pretty fierce as she tries to win me over by submitting for an exception/special application with DBS for 1.6% fixed rate too. RBG also tries his best to convince me that UOB is better. lol. Anyway, this makes things a lot easier since we just need 1 of them to lend us the full amount.

Surprise surprise! It turns out that the indicative valuation of our house is now more than $600k and both banks are willing to lend us the full amount. In the end, I decided to go with UOB because the 3rd year rate is better (both are based on their internal board rate + spread/margin) and DBS's spread/margin was much higher than UOB + ICL accidentally revealed her unhappiness/unprofessionalism during the negotiation. Those kinds where one bad mouth people in a private chat but it accidentally went into a group chat and had to be deleted quickly. lol.

The best part about RBG was even after he has gotten our business and UOB has already sent the LO. He kept us updated on the UOB new package - 2 Years Fixed @ 1.55% and took the initiative to get the banker to update the LO. Honestly, I thought that was very commendable since even if he had not done that, we would not have known. Anyway, all these happen in the last 2 weeks with banks launching new packages almost every week. Right now, we are serving the 3 months notice to HDB and our monthly repayment will decrease by about $200 every month after that!

Interestingly, these packages are not published on the banks' own website so I will recommend that you contact these mortgage brokers instead of going directly to the banks.

Do like any of the following for the latest update/post!1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)