SIA halted yesterday and has resumed today with an announcement for more cash through a mixture of rights issue and convertible bonds. A few friends came asking if it is attractive (opportunity to enter at $3) since it is our national airlines with the government backing/support right? I glanced through the announcement, there was no fundamentals/numbers presented, so I decided to calculate them instead and have extracted the important information below.

The rights shares will be issued at an issue price of S$3.00 for each Rights Share (the “Issue Price of the Rights Shares”) on the basis of three (3) Rights Shares for every two (2) existing ordinary shares.

The Issue Price of the Rights Shares represents a discount of approximately 53.8 per cent. to the last transacted price of the Shares on the Official List of the SGX-ST of S$6.50 on 25 March 2020, being the last trading day on which trades were done on the Shares prior to this announcement, and a discount of approximately 31.8 per cent. to the theoretical ex-rights price (“TERP”), of S$4.40 per Share.

Before I even start the calculations, a general rule of thumb is that heavily discounted rights issue is a red flag. Regular readers will know that I have a rights issue calculator so let's just use that - KPO Rights Issue Calculator but we will need a few information (NAV, DPU, etc.).

The latest NAV I found was $10.25 from their FY2019-2020 Q3 presentation slide.

The current number of issued shares is 1,183,665,134 based on their FY2018-2019 Annual Report. We need this number to calculate the new NAV and PB after the rights issue.

If you are wondering how the theoretical ex-rights price (TERP) is calculated, simply take the existing number of shares multiply by the current price and add the new rights/shares that will be issued multiply by the issued price divided by the total number of shares. Similarly, we can use that to calculate the new estimated NAV which fell from $10.25 to $4.09! Having said that, the actual NAV is probably lower because they took on more debts, hence highly likely to be < $4.

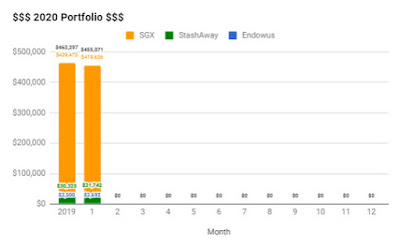

Now we enter the relevant information to the calculator to determine if it is a good deal. What is a good deal? I look at it in 2 ways - yield on cost and PB on cost. Assuming that there is no rights issue and SIA does not have any cash flow issue, based on the current/entry price of $6.30, my yield would have been 4.7% and the PB would have been 0.615.

However, after the rights issue, my assumption that dividends will remain constant (we know that is definitely not happening. In fact, there will probably be no dividend this year) which would be diluted due to more shares meant a drop of dividend yield to ~1-2%. In addition, with the significant drop in NAV, without oversubscribing the rights issue, I would end up buying the shares at a premium or much more than the initial 0.615 PB. As you can see, the calculator is simply screaming bad deal everywhere.

I would also like to point out that the above calculations did not take into account the convertible bonds. To put it simply, it means that the bonds can be converted into shares which means more dilution in the future...

Last but not least, if we were to look into the purpose of the cash call, unlike REITs, SIA is not expanding the business or buying more property, the cash is used for their operating expenses and to repay other debts. If the coronavirus (COVID-19) pandemic does not end soon, with fixed operating cost and no way to generate revenue, will history repeats itself (more rights issue)? Sorry to dash some of your hopes but SIA has been trading around its NAV historically, hence it will never go back to $10 or anywhere near it anymore with this rights issue.

Yes, we love playing the miles game to take SIA First/Suite/Business flight but definitely not as a shareholder. Personally, I would rather put my precious cash in REITs now. On the bright side, this is a renounceable rights issue which means you can sell the rights or sell the shares now.

All the best to the shareholders!

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

The rights shares will be issued at an issue price of S$3.00 for each Rights Share (the “Issue Price of the Rights Shares”) on the basis of three (3) Rights Shares for every two (2) existing ordinary shares.

The Issue Price of the Rights Shares represents a discount of approximately 53.8 per cent. to the last transacted price of the Shares on the Official List of the SGX-ST of S$6.50 on 25 March 2020, being the last trading day on which trades were done on the Shares prior to this announcement, and a discount of approximately 31.8 per cent. to the theoretical ex-rights price (“TERP”), of S$4.40 per Share.

Before I even start the calculations, a general rule of thumb is that heavily discounted rights issue is a red flag. Regular readers will know that I have a rights issue calculator so let's just use that - KPO Rights Issue Calculator but we will need a few information (NAV, DPU, etc.).

The latest NAV I found was $10.25 from their FY2019-2020 Q3 presentation slide.

The current number of issued shares is 1,183,665,134 based on their FY2018-2019 Annual Report. We need this number to calculate the new NAV and PB after the rights issue.

If you are wondering how the theoretical ex-rights price (TERP) is calculated, simply take the existing number of shares multiply by the current price and add the new rights/shares that will be issued multiply by the issued price divided by the total number of shares. Similarly, we can use that to calculate the new estimated NAV which fell from $10.25 to $4.09! Having said that, the actual NAV is probably lower because they took on more debts, hence highly likely to be < $4.

Now we enter the relevant information to the calculator to determine if it is a good deal. What is a good deal? I look at it in 2 ways - yield on cost and PB on cost. Assuming that there is no rights issue and SIA does not have any cash flow issue, based on the current/entry price of $6.30, my yield would have been 4.7% and the PB would have been 0.615.

However, after the rights issue, my assumption that dividends will remain constant (we know that is definitely not happening. In fact, there will probably be no dividend this year) which would be diluted due to more shares meant a drop of dividend yield to ~1-2%. In addition, with the significant drop in NAV, without oversubscribing the rights issue, I would end up buying the shares at a premium or much more than the initial 0.615 PB. As you can see, the calculator is simply screaming bad deal everywhere.

I would also like to point out that the above calculations did not take into account the convertible bonds. To put it simply, it means that the bonds can be converted into shares which means more dilution in the future...

Last but not least, if we were to look into the purpose of the cash call, unlike REITs, SIA is not expanding the business or buying more property, the cash is used for their operating expenses and to repay other debts. If the coronavirus (COVID-19) pandemic does not end soon, with fixed operating cost and no way to generate revenue, will history repeats itself (more rights issue)? Sorry to dash some of your hopes but SIA has been trading around its NAV historically, hence it will never go back to $10 or anywhere near it anymore with this rights issue.

Yes, we love playing the miles game to take SIA First/Suite/Business flight but definitely not as a shareholder. Personally, I would rather put my precious cash in REITs now. On the bright side, this is a renounceable rights issue which means you can sell the rights or sell the shares now.

All the best to the shareholders!

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)