Facebook reminded me earlier that 75 people that liked our page have not heard from us in a while (about one week ago only!). Sorry for disappointing everyone as I have been busy playing Monster Hunter World! Hahahaha.

This is for all DBS Multiplier Account holders! CZM and I changed our bank account from OCBC 360 to DBS Multiplier Account last year December when DBS revamped the product. There are many reviews and comparisons done for all the different bank accounts (e.g. Seedly Cheat Sheet: Best Savings Accounts For Working Adults 2018?) so I will not go into that.

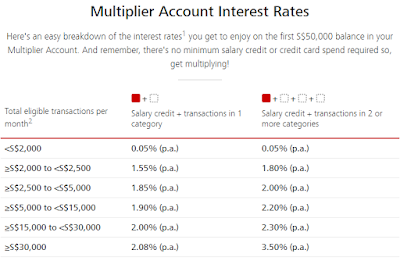

What we like about the Multiplier Account is that it is hassle-free and does not encourage/force spending (minimum spend of $X amount on credit card). One simply has to credit their salary to the account + credit card spend of any amount ($1 also can!) or any of the 3 other categories (home loan, insurance or investment).

Back to the free money! DBS has launched/created a closed group on Facebook called The Burrow. In order to get the free $5, you need to do the following 2 things:

1. Own a DBS Multiplier Account

2. Join The Burrow

Once you have done that, you will have to fill up a form by DBS - "Help us identify you as a DBS Multiplier account holder in The Burrow". Free money! The good news is that there is no limit on the number of $5 that will be given out and the qualifying period is from 1st Jan 2018 to 30th June 2018, lots of time for you to decide if you want to sign up for the account and then participate to get the free $5.

Terms and Conditions apply :) Back to Monster Hunter World!

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)