Endowus just launched a new product/portfolio called Fund Smart which allows an investor to decide and select what they want for his/her portfolio. One of the pro/con (depending on how you look at it) of robo-advisors is the lack of control to decide how/what you would like to invest in and Endowus has stepped up to fill this gap by being the first in the market to provide an option.

The product is so new that there is no landing page but it can be accessed easily by adding a new goal/portfolio.

No surprise here. This is why till now robo-advisors did not provide something like this. Typically, a portfolio is recommended based on an individual's risk profile. By building/selecting your own fund, there is the possibility of taking more risk than one is comfortable. Hence, the need for such acknowledgment. Basically, you are on your own ("

I will accept full responsibility...").

The Fund Smart portfolio allows one to select your Goal Type and Funding Source. Depending on what you select, the funds that are made available for you to select/invest will be different. You can take a look at all the funds that are available here -

Investments / Fund Smart FAQ under Fund Rationales.

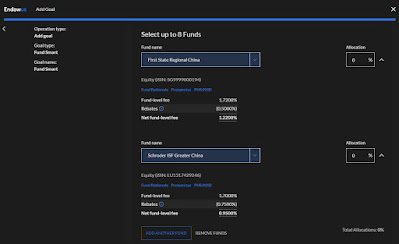

Once you select a fund, you will even be able to see the breakdown of the fees - fund-level fees - Endowus rebates. Note that this does not include Endowus access fee (0.25% - 0.6% depending on product/funding source). You can select up to 8 funds and allocate a certain percentage to it.

No Dimensional funds for CPF OA investment. The Infinity US500 Stock Index Fund has the lowest fee which is comparable to the Dimensional fund above. I have also selected another fund (FF-Global Dividend Fund) that has the highest fee as a comparison.

All these are available at no additional cost/fee. The fees remain the same where SRS/CPF is a flat 0.4% while cash investment will be tiered (0.25%-0.6%). Similar to my previous

Endowus CPF/SRS Review, I still believe that Endowus provides the best platform to invest your SRS/CPF. Anyway, there is a

Fund Smart FAQ section and you can read through them if you are interested.

In my opinion, the Endowus Fund Smart portfolio is more suitable for the more savvy investors that know what they are getting into and would like to have more control over their investment. One of the best things about robo-advisors is that it provides a hassle-free way to invest based on your risk profile. You do not need to spend time to research and decide on the underlying investment or make any decision to sell/rebalance the portfolio. By investing through Fund Smart, you will be giving that benefit up. To be honest, I'm not sure which part is smart, maybe the investor?

As an example, I do not believe Trump will make the USA great again and would like to invest in China. Which fund should I choose? What is the difference?

Anyway, with this Fund Smart portfolio, I might consider investing my CPF OA as I didn't really like what was offered previously. Going to do some research on the China funds. lol.

If you are interested in Endowus, do use our referral link for our readers! You will get S$10,000 managed free for 6 months ($20 equivalent) and we will get $20 too!

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

No comments:

Post a Comment