After the "Great Depeg" of UST and the collapse of Terra LUNA, we received lots of messages, emails and comments. Usually, I would try to reply to all of them but I really didn't have the mood to do anything then. Now that both of us are sort of in the final stage of grief (acceptance), I have decided to document what happened and some of our very painful lessons so that hopefully, it wouldn't ever happen to any of our readers.

|

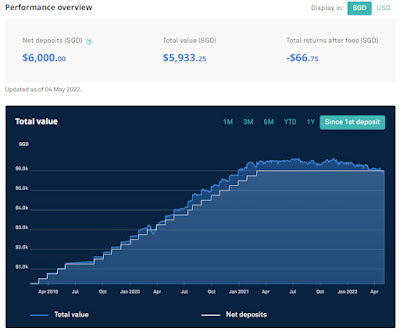

| What's left of our crypto portfolio |

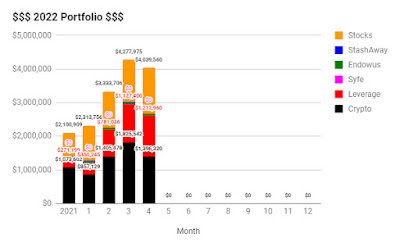

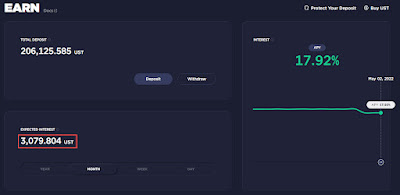

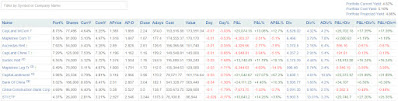

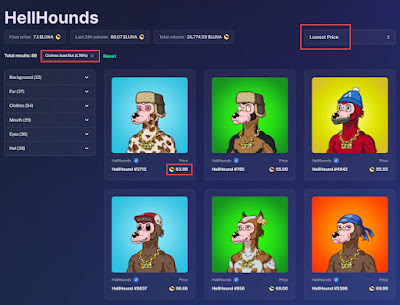

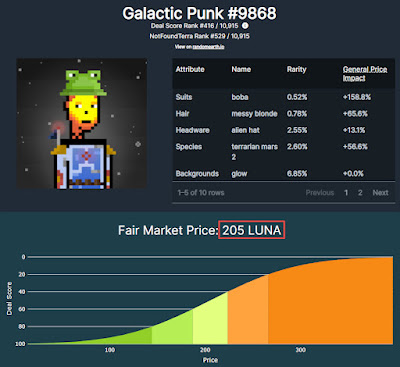

At its peak (Portfolio - March 2022), we had a crypto portfolio worth 2.4m SGD with 597k SGD debt from Anchor Borrow and ~100k SGD worth of NFTs. Not forgetting, I had a crypto business with 2 other friends that was built on Terra and we had a bunch of aUST and 5 digits LUNA before the depeg happened. All that is left now is around 28k SGD. A loss of >2 million SGD.

The past week was probably one of the longest and toughest weeks for us. We cried multiple times whenever we think of the amount we lost and the chance/opportunity to give Baby Ong a better life. We had grand plans - buying a property that is near good schools, decoupling and buying a second property for CZM to generate more passive income. Everything vanished just like that. I blame myself for being too greedy and overleveraging while CZM blames herself for not holding me back more which definitely wasn't her fault. The fault is all mine because she wouldn't have been able to stop me. After losing her Anchor passive income, she's feeling extremely insecure and even wants to return to the workforce although I kept reassuring her that we will be fine (estimated 6-7k SGD passive income from stocks).

For those that are still grieving, do take a look at this comic by The Woke Salaryman (CZM cried while reading this). It wouldn't cheer you up but will help to put things in perspective. No matter what has happened, life goes on. Always remember that money/wealth is merely just one aspect of life and there are more important things in life such as health, family and friends.

Long story short, LUNA price was falling and I had to avoid liquidation by repaying the loan. So I kept borrowing/taking the UST from CZM's Anchor retirement fund to repay my loan. Eventually, I emptied her account but could not fully repay the loan. In the end, we ran out of funds and there was nothing else I could do besides watching everything get liquidated. We were devastated at that point in time but I was still somewhat hopeful that the peg will be regained and consoled myself that we still have about 3-4k LUNA safely staked. Before I knew it, LUNA went into hyperinflationary mode rendering all existing LUNA worthless. I never knew this could happen and was under the impression that there is a cap of 1 billion LUNA. There are 6.9 trillion LUNA now -.-

Lessons

1. Always take profits. I hardly thought of taking profits because I had so much conviction that UST will eventually become the top stablecoin. Why should I take profit now when LUNA is going to be a few hundred dollars by end of the year? After all, those that made huge profits are those that held on for many years right (e.g. Google, Apple, Amazon, BTC, ETH, etc.)? I am just glad that we managed to walk away with some profits at the end of the day.

2. Diversify. As of last month, we had 53% of our net worth in crypto or specifically in 1 coin and we just lost almost all of it. Had I diversified some of them to other coins or off-ramp it, we wouldn't have lost so much.

3. Do not overleverage and ensure that you have the sufficient fund to repay them when necessary. I did not have enough UST to repay my Anchor borrow debt and ended up liquidated.

4. Do not borrow fiat to invest in crypto. At one point in time, I was borrowing 30k USD from SCB and putting that money into Anchor to earn the difference. Eventually, I decided that it is too risky and reversed/repaid everything. I am so glad that I am not in any debt because I lost money in crypto.

5. Algorithmic stablecoin just isn't going to work. Interestingly, this was what I had believed in before I discovered UST/LUNA. You can see my preference for USDC/GUSD in my earlier crypto articles. Eventually, I was convinced that UST will work because the algorithmic stablecoin is built into a network instead of just a dapp. There's so much utility for LUNA and an excellent L1 instead of just a farm and dump coin (e.g. TITAN). If this has failed so miserably, nothing probably will ever work...

I honestly never thought the death spiral could actually happen. Although I often said that I am simply blogging about what we are doing and asked people to do their own research before investing, if you read our blog and it had influenced your decisions, I’m really sorry. At this point in time, I have sort of accepted the loss but I can't get rid of the guilt that I have been feeling for others. I had so much faith in it that I recommended it to friends and families and they are now all hurt financially. We tried to compensate our siblings' losses but none of them took it :(

|

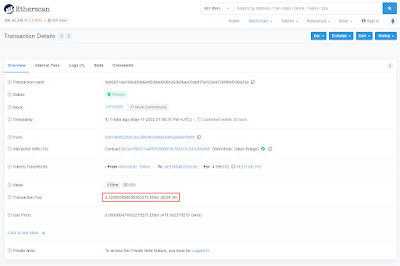

| ~US$300 of gas fee to receive bETH |

Am I going to stay away from DeFi after this? Probably not, I do believe in its potential but I will probably not put in fresh funds for the time being. Highly doubt I will ever have this kind of conviction anymore. I have tried Ethereum, BSC, Polygon, Fantom, Avalanche, Harmony, Cosmos (Osmosis, Juno and Secret) and Thorchain but none of them impressed me like Terra did. Ethereum is the worst with ridiculous gas fees for simple transactions (yes, the gwei was high but it just isn't intuitive/user friendly. I should be able to transact at any time at my convenience and pay roughly the same fees) while the rest of the EVM chains are full of forked projects with more scams than legitimate projects. Terra did not have any of those issues and I would argue probably the closest in bringing real-world use cases/adoption with apps/teams like Alice, Kado, etc. Having said that, it seems ETH is the only truly deflationary coin out there and I will be keeping whatever that is remaining. Going forward, we will possibly just accumulate the "blue chip" BTC and ETH as the bulk of our crypto portfolio.

Lastly, I have been wanting to take a break from blogging for a while but I continued because once in a while I get encouraging messages/emails telling me how we have inspired them to start their investing journey early but I guess this is it. Not sure how long the break will be, could even be indefinitely. Besides, you probably shouldn't read/learn from someone that has lost so much money going forward. lol. Take care everyone and till next time or not :'(

P.S. Our blog ended up in a police report and we were quite amused by it. Honestly, whoever that reported it should probably spend more time and effort looking for a job and not waste the police resources.

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)