After the "Great Depeg" of UST and the collapse of Terra LUNA, we received lots of messages, emails and comments. Usually, I would try to reply to all of them but I really didn't have the mood to do anything then. Now that both of us are sort of in the final stage of grief (acceptance), I have decided to document what happened and some of our very painful lessons so that hopefully, it wouldn't ever happen to any of our readers.

|

| What's left of our crypto portfolio |

At its peak (Portfolio - March 2022), we had a crypto portfolio worth 2.4m SGD with 597k SGD debt from Anchor Borrow and ~100k SGD worth of NFTs. Not forgetting, I had a crypto business with 2 other friends that was built on Terra and we had a bunch of aUST and 5 digits LUNA before the depeg happened. All that is left now is around 28k SGD. A loss of >2 million SGD.

The past week was probably one of the longest and toughest weeks for us. We cried multiple times whenever we think of the amount we lost and the chance/opportunity to give Baby Ong a better life. We had grand plans - buying a property that is near good schools, decoupling and buying a second property for CZM to generate more passive income. Everything vanished just like that. I blame myself for being too greedy and overleveraging while CZM blames herself for not holding me back more which definitely wasn't her fault. The fault is all mine because she wouldn't have been able to stop me. After losing her Anchor passive income, she's feeling extremely insecure and even wants to return to the workforce although I kept reassuring her that we will be fine (estimated 6-7k SGD passive income from stocks).

For those that are still grieving, do take a look at this comic by The Woke Salaryman (CZM cried while reading this). It wouldn't cheer you up but will help to put things in perspective. No matter what has happened, life goes on. Always remember that money/wealth is merely just one aspect of life and there are more important things in life such as health, family and friends.

Long story short, LUNA price was falling and I had to avoid liquidation by repaying the loan. So I kept borrowing/taking the UST from CZM's Anchor retirement fund to repay my loan. Eventually, I emptied her account but could not fully repay the loan. In the end, we ran out of funds and there was nothing else I could do besides watching everything get liquidated. We were devastated at that point in time but I was still somewhat hopeful that the peg will be regained and consoled myself that we still have about 3-4k LUNA safely staked. Before I knew it, LUNA went into hyperinflationary mode rendering all existing LUNA worthless. I never knew this could happen and was under the impression that there is a cap of 1 billion LUNA. There are 6.9 trillion LUNA now -.-

Lessons

1. Always take profits. I hardly thought of taking profits because I had so much conviction that UST will eventually become the top stablecoin. Why should I take profit now when LUNA is going to be a few hundred dollars by end of the year? After all, those that made huge profits are those that held on for many years right (e.g. Google, Apple, Amazon, BTC, ETH, etc.)? I am just glad that we managed to walk away with some profits at the end of the day.

2. Diversify. As of last month, we had 53% of our net worth in crypto or specifically in 1 coin and we just lost almost all of it. Had I diversified some of them to other coins or off-ramp it, we wouldn't have lost so much.

3. Do not overleverage and ensure that you have the sufficient fund to repay them when necessary. I did not have enough UST to repay my Anchor borrow debt and ended up liquidated.

4. Do not borrow fiat to invest in crypto. At one point in time, I was borrowing 30k USD from SCB and putting that money into Anchor to earn the difference. Eventually, I decided that it is too risky and reversed/repaid everything. I am so glad that I am not in any debt because I lost money in crypto.

5. Algorithmic stablecoin just isn't going to work. Interestingly, this was what I had believed in before I discovered UST/LUNA. You can see my preference for USDC/GUSD in my earlier crypto articles. Eventually, I was convinced that UST will work because the algorithmic stablecoin is built into a network instead of just a dapp. There's so much utility for LUNA and an excellent L1 instead of just a farm and dump coin (e.g. TITAN). If this has failed so miserably, nothing probably will ever work...

I honestly never thought the death spiral could actually happen. Although I often said that I am simply blogging about what we are doing and asked people to do their own research before investing, if you read our blog and it had influenced your decisions, I’m really sorry. At this point in time, I have sort of accepted the loss but I can't get rid of the guilt that I have been feeling for others. I had so much faith in it that I recommended it to friends and families and they are now all hurt financially. We tried to compensate our siblings' losses but none of them took it :(

|

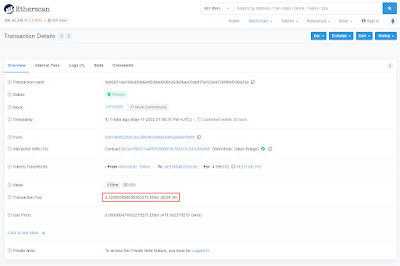

| ~US$300 of gas fee to receive bETH |

Am I going to stay away from DeFi after this? Probably not, I do believe in its potential but I will probably not put in fresh funds for the time being. Highly doubt I will ever have this kind of conviction anymore. I have tried Ethereum, BSC, Polygon, Fantom, Avalanche, Harmony, Cosmos (Osmosis, Juno and Secret) and Thorchain but none of them impressed me like Terra did. Ethereum is the worst with ridiculous gas fees for simple transactions (yes, the gwei was high but it just isn't intuitive/user friendly. I should be able to transact at any time at my convenience and pay roughly the same fees) while the rest of the EVM chains are full of forked projects with more scams than legitimate projects. Terra did not have any of those issues and I would argue probably the closest in bringing real-world use cases/adoption with apps/teams like Alice, Kado, etc. Having said that, it seems ETH is the only truly deflationary coin out there and I will be keeping whatever that is remaining. Going forward, we will possibly just accumulate the "blue chip" BTC and ETH as the bulk of our crypto portfolio.

Lastly, I have been wanting to take a break from blogging for a while but I continued because once in a while I get encouraging messages/emails telling me how we have inspired them to start their investing journey early but I guess this is it. Not sure how long the break will be, could even be indefinitely. Besides, you probably shouldn't read/learn from someone that has lost so much money going forward. lol. Take care everyone and till next time or not :'(

P.S. Our blog ended up in a police report and we were quite amused by it. Honestly, whoever that reported it should probably spend more time and effort looking for a job and not waste the police resources.

long time reader, first time poster; just wanted to wish you well! it's been great seeing your growth over time through this blog, sad to see you go.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteHi there. Dont let the loss be your stumbling block. Been there and know the feelings. Learn from it and move on. You will be a better investor/trader.

ReplyDeleteso sorry to hear about this - look on the bright side, i also lost quite a bit of money and i put it in only on Sunday.....after reading your post. life is full of ups and down and you are still doing better than most people; there'll always be a rainbow after a downfall/rain - look out for it :)

ReplyDeleteHi FutureValue,

DeleteSorry to hear about your loss as well. I know you are definitely one of them that was influenced by my articles to invest/try out defi. Please take care and look on the bright side too!

dude, no issue - i fully understand the need to do my due diligent when investing. let me know if you have new lobangs on any crypto stuff.. frankly, i think this space still have a lot of potential, and continue posting when you are ready. i will be your avid reader.

DeleteI think i will still be crying now if i lost 2m SGD! It happens to most of us, not many will have the discipline to pull the trigger to lock in the profit. Well, it is crypto, if it went up 5x, what stops it from going another 10x, 100x isnt it? I had similar experience back in the crypto bull run in late 2017. My portfolio was at 10x, but i didnt sell. Then it went all the way down to 0.01x. However, the order of magnitude isnt as big as yours. In any case, i am also a supporter of margin, but only in shares. All the best! You and your wife are still very young and already have an impressive portfolio.

ReplyDeleteThey didn't lost 2m. They lost the chance to get 2m of profits. Its 2 totally different things. Losing the opportunity to be profitable isn't a real tangible loss; loss is when you lost part or all of your capital leh.

DeleteTechnically this is correct but not many can be so logical at times like this. In anycase, they had a leverage of 600k in their crypto portfolio. I am not sure how crypto leverage works, but i assume they have a 600k debt to pay now. Not sure.

DeleteAnyway, just on a side note to kpo and czm, you cant decouple a HDB house. I assume you are still holding on to your BTO since you just took the key recently. "The past week was probably one of the longest and toughest weeks for us. We cried multiple times whenever we think of the amount we lost and the chance/opportunity to give Baby Ong a better life. We had grand plans - buying a property that is near good schools, decoupling and buying a second property for CZM to generate more passive income. "

Deleteyour words as cheap as your name

Deletesuggest you open your eyes and re-read his sentence, pretty sure he meant upgrading to a private property near schools, decoupling it in the future to buy a 2nd property lol. but then again, the poor you wouldn't have thought of this because its not within your capability so all you think of is decoupling for HDB

DeleteHahahaha. This is funny. Thanks Shane. I should have indicated it clearer. We were indeed planning to buy 2 private properties.

DeleteFelt bad that my comment was hijacked and turned into other things. In anycase, the reason why I pointed out the decoupling thing is because if kpo is buying 2 private properties , then why don't just buy it using one name right from start instead of buying using 2 names, then decouple, then buy another one. At the same time, I didn't think that he wouldn't know hdb cannot be decoupled. In anycase, he has clarified. When you feel like blogging again, perhaps you can share your thoughts on why not just buy using single name right from the start.

DeleteHi Happy Reit Investor,

DeleteI sure hope Philip wouldn't hijack it again after embarrassing himself. We never thought we would be able to afford buying 2 private properties one day so that was never part of our plan until last year. Hence, when we apply for the current BTO/house many years, we used both our names.

Hello to you and your wife, I've been following this blog since you've started from your grandfather's inheritance to build your stock portfolio past 1 mil. It has inspired me and my wife too to do the same and track our journey. It was also because of this blog that we've pushed for a 6 figure portfolio in our 20s. Just want to thank you for all that you've shared so far with the readers. May God continue to shine upon you and your family.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteI was never in crypto, but followed your blog closely as I was impressed with the high risk strategy. In the big scheme of things you still have a higher networth than most people even after the crash and you and your family are healthy. This is the most important. I am very impressed that you published this blog article after the crash, it takes guts to reflect like that.

ReplyDeleteHey man hope you cheer up after your grieving. I took a 5 digit loss as well, consider myself lucky as I ran during the 1st recovery.

ReplyDeleteKeep blogging you inspire a lot of people to venture into investment

This is not the place for you to troll, if you are mature enough please leave. Profits not taken are still profits.

DeleteLol phillip what's your deal? Are you trash talking here to compensate for the pathetic life that you're currently leading? Sour because someone lost the chance to get 2m of profits but still richer than you? Grow up. If you have nothing nice to say, leave.

DeleteJust wanted to say you should continue to blog. Take a break but continue to blog.

ReplyDeleteThe best only arise only after failure. I am confident your blog will now be better than ever.

When you look back, you will see that you had a lot of success picking the right investments actually. Take the needed break . But Fear not failure, Fear the success in things that dont really matter much.

camping for the next blog update

DeletePlease stay strong and I hope you can take the time to heal :(( you sound so sad, but pls don't blame yourselves too!!! :(( Hugs ♥️♥️

ReplyDeleteLove reading your blog and your investment journey has inspired me. Take and break if you need to and hope that you will write again soon

ReplyDeleteHello kpo and czm. Please stay strong. I believe you'll become an even better investor after this ordeal. Not sure why there's so many sour and salty comments here but do ignore all of them as they hold no value/weight. Got to know of your blog only recently but already sad to see you go. Hope you'll continue writing soon! Come back stronger and better :)

ReplyDeleteThank you everyone for your kind words and encouragement! Haters gonna hate and there is no need to defend us or engage them. If being evil or trolling here makes them happy and satisfied with their lives, so be it, we are not affected by them at all. I can delete all their comments but I believe they will probably just create more accounts to spam, so I will just leave them as it is. Take care everyone!

ReplyDeleteI am not going to waste any more of my time responding to trolls/keyword warriors and will be deleting all of their messages. You guys are disturbing my break. lol.

DeleteIf you have anything negative to say, I suggest you head over to the HWZ forum where all the trolls/keyword warriors who doesn't read our blog or understand how crypto/blockchain works but can spread fake news and make various assumptions will agree with you. All of you can hang out together just like birds of a feather flock together. In this case, people with no empathy/low EQ.

This is my blog and I will not tolerate such nonsense anymore.

Thanks for sharing valuable lessons learned, KPO. Crypto has been very tempting but too risky for retiree like me. Thank God I was not tempted by crypto greed.

ReplyDeleteYou are the most transparent blogger that I know by sharing all the crypto and stock investments in ApeBoard and blog. You have shared your leverage strategies also in twitter. Although I find it very risky move but it does open my eyes on how leveraging works. With the terra crash, it makes me do self reflection and think wiser now that crypto is really a speculative or trading only. We cannot really treat it as asset yet especially when we have leverage: the double edge sword.

ReplyDeleteGoing forward, I will not put more than 10% into crypto as the crash is real and damaging to our mental/health.

All the best bro. Stay strong, stay healthy and please continue your blog in the future. Maybe can talk about stocks, finance, high interest savings account, SSB and others. Waiting for your come back soon.

No worry, u will be fine, I loss 30K but that is just 6% of the total i invest in shit coin, Most of my vestment in coin are on btc and eth, they are 80% of my crypto portfolio.

ReplyDeleteWhat make u invest all in on just one coin? Is this true? I hope it is not.

Even no matter how good it look, it still can go wrong. Like Hyflux, noble and many more,

Wish u a fast recovery, at least u are not so emotional; stable and still able to write this article show u have great character. I see u doing well going forward.

God bless u. May u be well and happy always.

victor

I read too quickly. it is 53% of yr total investment on just one coin luna. U shd have divert that half amongst several coin like i did. Nvr mind, stock will come back strong, Inflation favor stock because this is where u can beat a inflation of 7% to 8%, money iwll be back soon after rate scare is taken as norm.

ReplyDeletevictor

Thank-you for frank sharing. Wishing you well and take care. We will survive and bounce back.

ReplyDeleteNvr mind, dont feel pain,mkt is forward looking so must be life, the past is over, there is nothing we can do about it. What is most important in the "now", what u have now is all the matter.

ReplyDeleteJust dont "mau"all in into one stock or any vestment, I hear one guy put all into TLSA and tell other he have high conviction for this stock, now look what happen?

There was this chicken genius youtuber also call other to vest into TSLA alone.

Diversification nvr fail, failure come to those who did not diversify.

Hi sir, is it safe to still invest in crypto?

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteSorry i am not the owner of this blog but i love to answer yr question, My apology to the owner too.

ReplyDeleteYes, of course, crypto is still the best investment imo. but i suggest u buy 70% on btc n eth which are the safest, then 30% diversify across all top mkt cap shit coin like BNB ADA SOL DOT AVAX and of course read up before u invest know what u are buying, at least if dies u dies happily and not so heavy since u diversify.

Why 30% ?? that 30% could give u more than 70% of the profit. becuase shit coin run the fastest,

cheongwee

This comment has been removed by the author.

DeleteI think 20% to 30% is reasonable risk i am willing to put into, jmo

Deletecheongwee

Hi everyone! Hope you are all fine. I am wondering to see the what is luna coin because I want to upgrade my content on Google. I can read it and I get a little bit worthy info from your post. So, be sure to checkout my post and tell me the mistakes. Follow post linkWhen will Luna coin rise again.

ReplyDeleteWhen tide is rising, everyone is an expert. When the tide recedes, we realized that some people are swimming naked.

ReplyDeleteDiversification is the key, if u think a product is good, u can put more into it, but not such that it cause u to worry day to day. If u are looking at it everyday, this means u are over vested in there.

ReplyDeleteI think they are overvested in LUNA . that is unfortunate, and please be sensitive to what u said to cause further suffering to other,

ReplyDeleteHOW TO RECOVER STOLEN BITCOIN/USDT 2024 ?

EthicsRefinance hackers were invaluable in helping me recover my stolen bitcoin worth $234,000. Their exceptional skills and ethical approach ensured a successful retrieval. I highly recommend their services for similar situations. With their extensive knowledge and experience in cybersecurity, EthicsRefinance hackers consistently prove their ability to handle complex cases. I am grateful for their assistance and wholeheartedly recommend their trustworthy and efficient services. They go above and beyond to safeguard and restore their clients' assets. Their track record speaks for itself, making them the top choice for bitcoin recovery. Reach out to EthicsRefinance hackers today and reclaim what is rightfully yours

EMAIL VIA: ethicsrefinance @ gmail .com

TELEGRAM: @ethicsrefinance

I'm just so happy for recovering what i lost to scam mers some months ago, i was introduced to a recovery agent by an old friend whom i met at Mcdonalds last week. I told her about the issue and how i lost all my pension to investment scams which operated under the name finance block. The recovery agent asked me for some proofs and transaction histories, we had other few briefings through the recovery until we recovered everything i lost under 13 hours, took another 4 hours to get deposited into my personal wallet. It is a very nice feeling to be back on track with the new year.

ReplyDeleteI will drop the agents contact just incase anyone here find themselves in similar situation now or tomorrow.

E mail: refunddpolici(at) gmail (dot) com

Whats app and Tel : +1 ( 9 7 2) 9 9 8‑2 7 5 5

Thank You.

Facebook,Internet and Telegram are wild places and full of scammers, i was a victim of cryptocurrency scammers and i lost a considerable amount of money.I lost cumulatively Usd430,000 of my pension,housing and life savings.I was so hopeless,depressed,worried and believed that my stolen fortunes were forever gone. I became very concerned and talked to my friend whom i met at Walmart about my misfortune and bad experience, that's when I found out about Refund Policy Recovery. I also read some evaluations of their service afterwards and how useful they had been for many individuals who had lost their money. I contacted them right away to ask for their help and intervention. Though I was having a doubt when the team informed me that they could retrieve back my stolen bitcoins, but i must confess that it was the best decision that I made because my stolen Bitcoin was successfully returned to me, Something I thought would never happen. So for those who are victims, don't let those unfortunate scamm ers get away with your hard earned money. You can rely on the expertise of Refund Policy to get back whatever you may have lost due to fake investment trading through the means below

ReplyDeleteEmail:Refunddpolici @ gmail.com

Whatsap:+1 (972) 998‑2755

Hello there, as a newbie to crypto currency trading, I lost a lot of money trying to navigate the market on my own. In my search for a genuine and trusted trader, I came across Carlos Ellison who guided and helped me make so much profit up to the tune of $40,000. I made my first investment with $1,000 and got a ROI of $9,400 in less than 8 days. You can contact this expert trader via email carlose78910@gmail.com or Via Telegram: +12166263236 and be ready to share your own testimony

ReplyDelete"This blog is a gem! It's incredibly well-researched and presents such a unique perspective on the topic. Kudos to the author for their insightful analysis!"

ReplyDeletehttps://www.discountdrift.com/

Moonbag is your safest coin meme to invest in 2024. it will be replacing doge coin behind.

ReplyDeleteInteresting read! Also, take a look at retirement planning tips.

ReplyDeleteI really benefited from this article on building a budget.

ReplyDeleteBOTNET CRYPTO RECOVERY is a global leader in cross-border crypto asset recovery, specializing in helping victims of fraud. With a vast network of partners—including major exchanges, regulatory agencies, and cybersecurity firms across North America, Europe, and Asia—they can quickly freeze stolen assets across multiple jurisdictions, preventing fraudsters from moving funds internationally. Their team has deep expertise in the legal and regulatory complexities of cryptocurrency recovery, enabling swift action even in offshore and multi-country cases. Using advanced forensic techniques, they identify and trace stolen funds, working closely with law enforcement and financial institutions to maximize recovery chances. Whether dealing with fake investment schemes, ransomware, or phishing scams, BOTNET CRYPTO RECOVERY provides effective solutions to reclaim lost assets. Contact them at botnetcryptorecovery@groupmail.com or visit https://botnetcryptorecovery.com to start your recovery process.

ReplyDeleteDiscover how to buy crypto on Tangem Wallet securely and easily. Learn about features, supported coins, limitations, and expert tips in this complete guide.

ReplyDeleteMy digital recovery story...

ReplyDeleteI lost a significant amount of crypto to a fake investment platform and was close to giving up. A friend referred me to a trusted recovery team who helped me recover my assets including BTC, ETH, and USDT in just a few days. They kept me updated throughout the process, which showed real transparency and professionalism. They recover digital assets no matter how long ago you lost them.

If you need help, contact them at

primewebcyberteam@gmail.com

Don’t miss these smart money saving tips.

ReplyDeleteThis platform really helped my financial discipline.

ReplyDeleteThe time for MoonBag is gone. I think for 2025 the best coin is troller cat.

ReplyDeleteDO YOU KNOW THAT YOU CAN RECOVER YOUR LOST CRYPTO?Yes you can. I was utterly depressed because i was scammed of my Bitcoin and Ethereum that is worth $64,000 I contacted law enforcement but no positive answer, so i thought i have lost it all until i saw a comment about DAREK RECOVERY, Guess what guys, 100% of my crypto was refunded back to me after contacting them in less than 48 hours. I’m not the type that write comments, I'm glad to share my own experience here, If you ever lost your BTC, Eth etc, contact recoverydarek@gmail.com .

ReplyDeleteAfter what felt like a nightmare of losing 2 BTC due to a scam, today the marks triumphant moment when those funds were fully recovered and transferred back into my Trust Wallet—all thanks to TROY HACKS CYBER SERVICE When my wallet was hacked, and my cryptocurrency stolen was, I feared that my substantial investment was always. However, TROYHACKS CYBER SERVICE provided a lifeline that restored not just my funds, but my peace of mind.

ReplyDeleteThe recovery process started with a thorough assessment of my case. After I explained how my wallet had had compromised, TROY HACKS CYBER SERVICE team immediately got to work. They used advanced blockchain tracking technologies to follow the trail of my stolen my Bitcoin through various exchanges and accounts. This level of expertise in tracing digital complex footprints was crucial in pinpointing the exact location of the stolen assets.

TROYHACKS CYBER SERVICE also leveraged partnerships with key exchanges and used legal methods to freeze and retrieve the stolen BTC. Once they confirmed that the assets were recoverable, they worked swiftly to reroute the 2 BTC back to my Trust Wallet. Throughout the whole ordeal, their communication was excellent, keeping me updated on the every progress step of the way.

Thanks to TROY HACKS CYBER SERVICE , my 2 BTC is now safe back in my possession, and I couldn’t be more reliefd. Their professional effectiveness and make them the go-to experts for anyone dealing with lost, stolen, or hacked cryptocurrency. You can reach at to them via (Troyhacks@cyberservices.com) WhatsApp: +1(260)237-6241

Really helpful post! I’ve been exploring DealPromoX for the latest deals and coupon codes — it’s a solid place to grab discounts on popular brands. Worth a look if you like saving while shopping online!

ReplyDeleteVery informative content — appreciate the effort you put into this. When I shop online, I always try to verify coupons before checking out, and lately I’ve been using DealPromoX for that. They list active promo codes with recent updates, which helps avoid expired or invalid offers. It’s a useful site for anyone who wants to grab extra savings without spending time testing codes one by one.

ReplyDeleteI want to sincerely thank Almighty Professionals Wizard Recovery for their incredible skills; they are truly outstanding individuals and I wish I had gotten in touch with them rather than reaching out to other cybercriminals for help. If you read this comment, you will definitely be able to recover your stolen or restricted cryptocurrency investment. I am posting it for people who have been affected by cryptocurrency mining, trading, Investments and financial scams. Email : professionalwizardrecovery@gmail.com

ReplyDeleteOn the planet, I am the happiest man. My lost Bitcoin was returned to me in less than 72 hours thanks to Professionals Wizard Recovery. I contacted Professionals Wizard Recovery after reading some amazing reviews and telling him that my Bitcoin had been stolen by a fake investment firm and that I needed help getting it back. I didn't realize Professionals Wizard Recovery would work so fast for me because it was so effective. After discovering my situation, he made every effort to retrieve my missing Bitcoin from those thieves. never give up in recovering all your lost cryptocurrency, contact Professionals Wizard Recovery Via;

E-MAIL: (professionalwizardrecovery@programmer.net)

VERIFIED WEBSITE:( https://professionalwizard.wixsite.com/professionals-wizard )

WHATSAPP (+44 7442 684963)