Insurance is all about transferring risk to another party. Our recent experience tells us again that it is simply better to self insure...

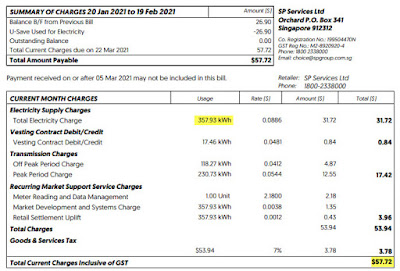

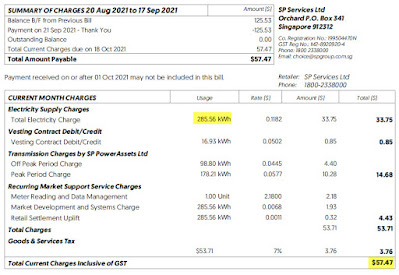

In our previous posts - 1 Month as a Parent and Mount Alvernia Delivery & Phototherapy Charges, we mentioned that our baby had severe jaundice (290+ level) and had to be admitted for phototherapy 6 days after she was born.

Long story short, we tried to claim the phototherapy treatment from the ReadyMummy policy but was rejected. To be honest, the amount that can be claimed was supposedly just $100 which is a relatively small amount considering the phototherapy treatment cost $967.92 while the ReadyMummy premium cost $798.00. What really pisses me off was the lack of transparency in the way Manulife promotes/markets ReadyMummy and the lack of product knowledge from this agent.

One fine day, I received the rejected claim letter. The agent is so cui (lousy) that he made no effort in communicating the result of the claim to me. I had to find out from the slow mail while he would have received an email. The reason for rejecting it was ridiculous! Apparently, it was not severe enough because Baby Ong was admitted for less than 3 days. Why would the severity be determined by the number of days admitted? Regardless, I went to their website, brochure and even the documents (e.g. product summary) my agent sent me previously but I did not find the minimum 3 days being stated/mentioned anywhere.

He responded that he will appeal only after I confronted him. Shouldn't the approach be him informing me that the claim has been rejected and proceeding to appeal for me?

When we buy insurance, we do not want to find out how good the policy is or to make any claim. To be fair, the Manulife ReadyMummy plan has many other coverages too (on paper and maybe possibly other hidden T&Cs) and it is not right for us to say that it is a bad policy simply based on the above but it was really a bad experience we had to go through. Will we buy this policy if we were to have a second child or any Manulife policy? Definitely not. Is it fair to expect the agent to be well versed in the product he/she is selling? I certainly think so.

End of the day, is it agent cui or policy cui? ¯\_(ツ)_/¯

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)