After researching, I realized the cheapest way was to move them to the Harmony ONE network which cost just 0.0008 ONE token. That's 0.0008 x US$0.1094 (at the point of writing) ~ US$0.00008752. lol. No pain at all as compared to transferring BTC or ETH.

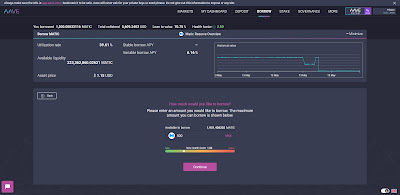

Anyway, I transferred my ETH to my Metamask wallet, bridged over to Polygon and is currently deposited to Aave as collateral. I converted all my CRO to ONE and as usual, I would always send the minimum amount as a test transaction. Initially, I sent it to Binance first before sending it to my Metamask wallet but I realized I can actually just send the ONE token directly to my Metamask wallet. If you are already on Ethereum or BSC network, then you can use this bridge - https://bridge.harmony.one/one. Based on my experience, transferring fund to the Harmony network is extremely easy/smooth.

You can set up your Metamask wallet or configure the network by following the instructions here. The article/guide will also teach one how to get your ONE address using your 0x address.

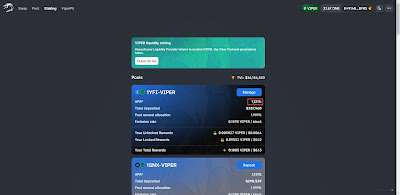

|

| Screenshot taken from https://vfat.tools/harmony/ |

Typically, on PancakeSwap or anywhere else, the crazy high yields are from shitcoin LP but not in Viper. The LP are mostly from reputable projects from Ethereum. Do also note that the returns shown are in APR which means the APY returns are even higher. In addition, the fees are negligible, definitely the lowest amongst all the network I have tried.

Similarly, I decided to try out Fantom with a capital of SG$5k which is another smaller network but unfortunately, I went in when the FTM token was trading around its peak/highest (~US$0.80+) and am suffering a 60% loss with its current price at just US$0.36 as of 27th May. I decided to average down and put in another SG$1k yesterday and the price dropped another 20% to US$0.29 today. Faints @_@"

Under normal circumstances, transferring FTM token can be done through Binance for a very cheap fee (0.01 FTM) but it was extremely painful for me previously when Binance suspended the withdrawal to the network for days/weeks and multichain.xyz were having some issue as well. In the end, I transferred the FTM which I already bought at a high price through the Ethereum network and bridge over using multichain paying a lot more fees (Ethereum gas fee + 80 FTM multichain transfer fee) along the way. The good news is Binance has resumed the withdrawal/transfer to the FTM network directly so it should not be so painful/costly if you are considering trying it out. You can follow the guide here to set up your Metamask.

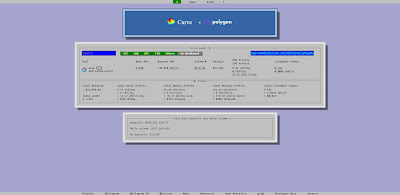

|

| Screenshot taken from https://vfat.tools/fantom/ |

These are the farm I am in - Spooky, Spirit and Waka because they are one of the bigger farms based on TVL according to DefiLlma.

~US$886 with a yield of 233.26% APR based on the current price.

~US$856 with a yield of 311.65% APR based on the current price.

~US$228.52 with a yield of 1,278% APR based on the current price.

Generally, the higher the APR, the lesser I will put in because it generally means higher risk. I do not think I will be exploring other networks (e.g. Avalanche, Solana, etc.) because I do not have much capital to play/throw anymore and after a while, they are more or less the same. Hence, this should be my last DeFi article unless I discover new things.

After exploring/experimenting for a few weeks, my strategy is to just pump more capital/money into Aave and Curve to farm MATIC because they are still relatively safer. All that is left now is to think of a monthly DCA plan to get more BTC, ETH or more stablecoins on Aave and get CZM onboard. lol.

Anyway, I have blogged about different ways to leverage crypto to build wealth for people with different risk appetites:

The safer approach using stablecoins

Risky approach but more hassle-free

Highest risk and you are on your own

- DeFi apps on Binance Smart Chain (BSC) such as PancakeSwap and PancakeBunny

- DeFi - Harmony ONE and Fantom

On a side note, Futu's moomoo app attractive sign-up bonus (one free Apple Share besides other benefits) has been extended to 31st May 2021 (1500hr SGT)! Take a look at the latest benefits here.

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)