We have decided to withdraw and stop the monthly investment for one of our StashAway portfolios (Cash - StashAway Risk Index 22%) for the following reasons:

- Better yield/return in crypto

- Get access to more leverage

I think once one is exposed to DeFi, it will be very difficult to go back to buying stocks or options because the yield/return are simply much higher. Of course, so is the risk but who says stocks can't go to zero? I have a couple - Eagle Hospitality Trust and Ezion (I got out of this immediately after it was suspended for about a year with a 64% capital loss before it got suspended again).

In my opinion, crypto is here to stay and this is evident in the stance/actions the banks/companies are taking. Just to share a few:

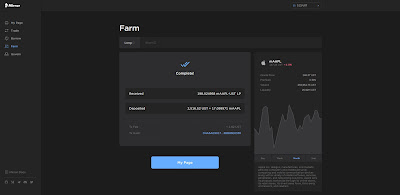

Anyway, I can get access to a USD savings account equivalent with 20% interest through Anchor Protocol or 30-50% yield using delta-neutral strategies through Mirror Protocol. Not forgetting the capital gain (currently close to 100% and I am expecting more upside) from my LUNA stash too.

The other reason is very similar to why I stop investing through Syfe too which I blogged about here - Bye Bye Syfe! The invested money isn't working hard enough because I lose the ability to leverage using them. For every 10k invested and pledged as collateral in SCB, I will get access to another 7k to leverage assuming LTV of 70%.

I will not be so extreme (I might be if I am not married/have a baby. lol) and start selling all the stocks and move them to crypto but going forward, I will be putting most of my money into crypto (specifically just Terra) and the plan is to utilize leverage or let CZM buy stocks. Having said that, I will continue use StashAway for my SRS and Baby Ong's investment.

Alright. Let's take a look at the withdrawal process!

Start by selecting the portfolio you would like to withdraw.

Next, select a reason for withdrawal. I selected "not satisfied with the returns". lol.

Select the type of withdrawal.

The good thing was the withdrawal took only 1 business day. I initiated the withdrawal on 24th August and I see the fund in my bank account on the 25th August.

I had to reach out to support to get those transactions exported before I could update StocksCafe. To be honest, XIRR of 9.59% is still quite decent. If crypto is not your cup of tea and you are not familiar with stocks, robo will be your next best alternative as compared to savings/insurance products.

A more detailed breakdown of when the sell/closed transactions happened and the realized P&L. Given that this is my first withdrawal after 3/4 years, that means none of the above sell transactions was triggered by me and it seems like there is at least 1 re-optimization each year (usually at a profit).

Anyway, if you are interested in signing up for StashAway, do use our referral link - KPO and CZM Referral Link. You will get $10,000 free management fees for 6 months and we will get $16!

If you want to extract those transactions information from StashAway, do take a look at this article - StashAway Transactions Parser.

If you are interested in the smart portfolio tracker (StocksCafe) which I am using as shown above, sign up using my link for a longer trial period :) Refer to our Referrals page for more information.

On a side note, Futu's moomoo app sign-up promotion is now slightly different (Pfizer and Haidilao shares are given with deposit and 3 trades each on US and HK markets. T&C here) and has been extended to 19:59 hrs SGT, 31st August 2021! As part of the collaboration, I will be giving away 5 moomoo 'neck-fix and chill' pillow (not for sale but can be redeemed in the app) to 5 randomly chosen readers who signed up through our referral link for this month! More information can be found here - Futu's moomoo August Campaign + Merchandise Giveaway!

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

If you want to extract those transactions information from StashAway, do take a look at this article - StashAway Transactions Parser.

If you are interested in the smart portfolio tracker (StocksCafe) which I am using as shown above, sign up using my link for a longer trial period :) Refer to our Referrals page for more information.

On a side note, Futu's moomoo app sign-up promotion is now slightly different (Pfizer and Haidilao shares are given with deposit and 3 trades each on US and HK markets. T&C here) and has been extended to 19:59 hrs SGT, 31st August 2021! As part of the collaboration, I will be giving away 5 moomoo 'neck-fix and chill' pillow (not for sale but can be redeemed in the app) to 5 randomly chosen readers who signed up through our referral link for this month! More information can be found here - Futu's moomoo August Campaign + Merchandise Giveaway!

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)