We attended KKH Antenatal Programme (1 day intensive course) last weekend which cost $300 as a KK patient (for non-patient, it will cost $320). You can choose to do it over 4 weeks or a day which cost slightly different too.

Anyway, I found it informational while CZM was slightly disappointed because she already knew almost everything that was taught/shared except for the practical portion. In her free time, she will be reading/watching pregnancy/baby related articles/youtube while I continue to read/track financial stuff + gaming. Let's just say we have different roles and responsibilities. One interesting takeaway is we should not be feeding the baby any water until he/she is old enough for solid food. Try telling that to your parents and see the weird look on their face (totally not convinced) - "You grew up fine drinking water!". lol.

Our Syfe Portfolio

Composition: 100% REITs

Dividend: Reinvest

Monthly Investment: $1,000

Composition: 100% Equities

Dividend: Reinvest

Monthly Investment: $500

Account Statement (Lifetime)

Our current tier is Blue (<$20,000). This is determined by the size of the portfolio (currently $6,260.30) which in turn determines the fees to be charged. The statement lifetime return is $1060.30 which includes a $800 referral bonus. The actual lifetime return would be $260.30. Thanks to our readers for using our code!

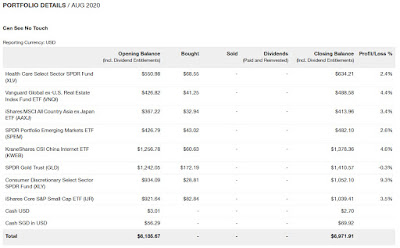

Account Statement (August 2020)

The return for the month is $187.62 which includes a $110 referral bonus. This means our actual return for the month is $77.62.

As of 10 September 2020, this is our portfolio performance:

Capital: $4,000.00

Current: $5,036.83 (16.84% - return is skewed due to referrals)

New UI worth mentioning! Syfe has introduced a projection of the REIT+ portfolio based on different years and invested amount. Do click and play around with the forecast. This is not available on the Equity100 portfolio

Capital: $1,200.00

Current: $1,343.29 (14.47% - return is skewed due to referrals)

Transaction Breakdown

There are too many so I will just share a snippet. Anyway, if you want to extract the transaction information from Syfe, do take a look at this article -

Syfe Transactions Parser. Anyway, the parser will not work for the Equity100 and Global ARI portfolio when there are small transactions (<0.01). You can refer to this for more information -

Syfe - July 2020. The parser will work if Syfe is willing to change its UI and display more decimal places...

|

REIT+ Portfolio

|

After parsing them into a csv file, I pivoted the data to get the following view.

Management Fee

The management fee can be obtained by $5,125.71 x 0.65% / 366 * 31 ~ $2.78.

StocksCafe

In my opinion, the return captured by StocksCafe will be a more accurate representation of our portfolio return as the referral bonuses are treated as capital. Having said that, I can also understand why Syfe treats them as a return instead of a deposit too. Just a different perspective.

Anyway, looking at the time-weighted return (

13.79%) for this year, we can see that Syfe REIT+ 100% is outperforming STI ETF (including fees). In addition, if we were to look at the projected dividends till the end of the year based on the existing investment, we can expect $103.82 of dividends or $8.65 per month. Since the dividends >> fees, this is a pretty sustainable portfolio assuming if there's no capital loss.

If you are interested in signing up, do use our referral code (

KPOBONUS) for some cash incentive! Invests $500 and more and we will receive a $10 bonus each. Invests $10,000 and more and we will receive a $50 bonus each. Invests $20,000 and more, we will receive a $100 bonus each!

If you are interested in the smart portfolio tracker (

StocksCafe) which I am using as shown above, sign up using my link for a longer trial period :) Refer to our

Referrals page for more information.

You might be interested in previous months update too:

-

Syfe REIT+ (100%) Review-

Syfe - May 2020 - $1,135.43

-

Syfe - June 2020 - $2,558.58

-

Syfe - July 2020 - $3,872.68

- Syfe - August 2020 - $6,260.30

Do like any of the following for the latest update/post!

1. FB Page -

KPO and CZM2. Twitter -

KPO and CZM3. Click

here to subscribe using email :)

4. Instagram -

KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)