March has been a pretty exciting month. It was one of the worst market performance since we started investing in 2014 and we just kept buying as the prices fall. Unfortunately, when it was at its lowest, we have already run out of money. We even decided to make use of our overdraft/leverage account - Biggest Losses in a Day + Start of Leverage which was opened 2 years ago - Leverage - A Double-Edged Sword. At one point in time, our portfolio lost more than $100k year to date but like I always say - life goes on!

Will the market fall lower? Maybe? All I know is a few years down the road, we will be glad of the actions we took today instead of holding cash worrying that it will fall more. Fall more buy more! Anyway, we have some good news to share too but let's keep that to next month instead :)

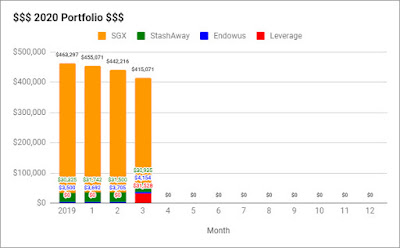

Our portfolio decreases by 6.14% to $415,071 - $63,904.86 of capital injection (including $31,528 of leverage) and $91,049.96 of capital loss.

Will the market fall lower? Maybe? All I know is a few years down the road, we will be glad of the actions we took today instead of holding cash worrying that it will fall more. Fall more buy more! Anyway, we have some good news to share too but let's keep that to next month instead :)

Our portfolio decreases by 6.14% to $415,071 - $63,904.86 of capital injection (including $31,528 of leverage) and $91,049.96 of capital loss.

If you prefer to look at numbers, this is the raw data used to generate the above bar graph. These numbers are as of the last day of the month.

"Cash Flow" is the amount of money being injected/withdrawn from the portfolio (buying stocks = +ve cash flow while selling stocks and collecting dividends = -ve cash flow)

SOLD

None

BOUGHT

- STI ETF (4 x 1,000 units) @ $2.85, $2.68, $2.58 and $2.42

- Capitaland 1,000 units @ $2.95

- DBS 100 units @ $20.40

- Frasers Commercial Trust 1,500 units @ $1.36

- Mapletree NAC Trust 5,000 units @ $0.84

- Soilbuild Business REIT 9,000 units @ $0.31

- CapitaRetail China Trust (5,000 and 2,000 units) @ $1.36 and $1.19

- Cromwell REIT EUR 10,000 units @ EUR$0.44

- OCBC 900 units @ $8.88

- Frasers Hospitality Trust 4,000 units @ $0.485

- AIMS APAC REIT 1,600 units @ $1.21

- Starhill Global REIT 3,600 units @ $0.555

- ARA Hospitality Trust 2,700 units @ $0.48

- CDL Hospitality Trust 1,800 units @ $1.07

- CapitaMall Trust 2,800 units @ $1.76

- IWDA (14 and 15 units) @ US$54.71 and US$49.88

Most of the purchases were to average down for existing investments. The newer stocks were purchased using leverage to earn the difference (e.g. 8% dividend yield - 2% interest) and the key is to prevent/avoid a margin call. We have been pretty conservative in using it and the pledged stocks will have to fall another 80% as of now to trigger the first call.

Buying STI ETF has always been part of our plan but we stopped when the price got too high. Seeing it drop, we decided to start buying again.

Apart from our regular monthly investment into StashAway and Endowus, we have decided to invest SGD $2,000 every month into IWDA (iShares Core MSCI World UCITS ETF) which is an accumulating (does not distribute dividends) world ETF managed passively by iShares. This has multiple purposes:

1. Capital Growth - Determine if simply buying a diversified world ETF will outperform StashAway/Endowus

2. Leverage Collateral - It has 70% LTV which will increase eventually increase our ability to borrow more or prevent a margin call

Anyway, IWDA is highly recommended by ShinyThings from HWZ. You can refer to this summarized version here.

Dividends

The total dividends collected this month is $663.23. The breakdown is as follows:

| Company | PayDate | Shares | Total |

| SSB Sep 2018 | 1-Mar-20 | 500 | $5.05 |

| Keppel DC REIT | 3-Mar-20 | 4,900 | $95.55 |

| Mapletree North Asia Commercial Trust | 10-Mar-20 | 5,000 | $83.55 |

| First Real Estate Investment Trust | 13-Mar-20 | 11,009 | $236.68 |

| Far East Hospitality Trust | 27-Mar-20 | 10,316 | $98.00 |

| CapitaLand Retail China Trust | 30-Mar-20 | 4,000 | $144.40 |

Total dividends collected for 2020: $3,495.35

Average dividends per month for 2020: $1,165.11

StashAway

|

| KPO |

|

| CZM |

Capital: $30,750.00

Current: $30,995.84

Endowus

Capital: $5,000

Current: $4,154

On a side note, Endowus has reached out and offered a masked referral link for our readers! You will get S$10,000 managed free for 6 months ($20 equivalent) and we will get $20 too! Shall start doing monthly statement updates for it soon too!

You might be interested in these blog posts too:

- Portfolio Performance in 2019

- 2019 Net Worth

- Portfolio - December 2019 - $463,297

- Portfolio - January 2020 - $455,071

- Portfolio - February 2020 - $442,216

- Portfolio - March 2020 - $415,071

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

"Anyway, we have some good news to share too but let's keep that to next month instead :)"

ReplyDeleteLemme guess. Someone going to be a father soon?

If so, gxgx!

You shouldn't be UN but IN. Hahahaha.

Delete