I started DeFi about a month ago and I got addicted to it fast. Haha. As I got more comfortable/familiar with how things work through Binance Smart Chain (BSC), I began to explore other networks that claim to be cheaper and better than BSC. As a result, I now have money in BSC, Polygon, Fantom and Harmony ONE. I am sure you are already aware that the crypto world is full of scams, meme/shit coins but I have finally found a place where I am comfortable putting more money in 5 or even 6 digits. Even when I was in BSC, I have not considered putting more money in because it just didn't feel right/safe given that a lot of the projects are being built/developed by anonymous people.

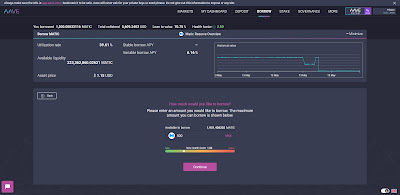

Introducing Aave - an Open Source and Non-Custodial protocol to earn interest on deposits and borrow assets. Yes, you read that right, one can actually earn interest by borrowing from the protocol. If you looked at the screenshot above, you will see 2 different percentages for both deposit and borrow. The larger font one is the interest one will get in the same asset while the percentage in the smaller font is the yield one will get in the form of WMATIC for participating (both deposit and borrow) in the market. WMATIC is simply wrapped MATIC for usage on other networks which can be easily converted to MATIC which is the currency/fee one has to pay for transacting on the Polygon network. If you are on BSC, MATIC will be the BNB equivalent.

For example, if I were to deposit MATIC, my interest will be 1.83% + 6% = 7.83%. However, if I were to borrow MATIC, the loan interest will be 5.97% but I am also getting paid 15.63% by participating in the borrowing market. Hence, the net return is actually -5.97% + 15.63% = 9.66%. On the other hand, if I were to borrow DAI, you will see that the net return is -0.6%. Pick your battle wisely. lol.

Let me also share why I find Aave to be safer as compared to the other platforms in DeFi. Aave isn't new, it has been around since 2017 on the Ethereum network and is one of the top platforms with US$11 billion locked according to DeFi Pulse. Most importantly, we know who the founders/team members are. In my opinion, if one is genuine in working/building something that works, there is really no reason not to show their face/name and put their reputation on the line. Anyway, Aave launched on Polygon just last month but have already gathered US$4.8 billion in such a short time span which I guess shows a lot on the confidence others have on the platform too.

To get started, simply deposit some of your existing crypto assets. I transferred my ETH from crypto.com to my Metamask wallet address on the Ethereum network before bridging over to Polygon.

This is what I meant when I said the fees are high/expensive on the Ethereum network. One simple transaction/transfer of asset cost US$35.70 (~SG$47.55). Hence, it is not recommended to bridge from the Ethereum network. Instead, try bridging DAI, USDC or USDT from BSC instead using xpollinate.io which will cost less than a dollar. When you bridge over using xpollinate.io, 0.001 MATIC will be sent to your wallet which is more than enough for you to convert your stablecoins to more MATIC. Alternatively, head over to matic.supply to claim the 0.001 MATIC for free too :)

Once you have some deposit, you will be able to borrow because some of your deposit (in fact all except USDT) will act as collateral besides earning interest. Click on "Borrow" on the top.

My health factor has increased to 2.50. So what's next? Let's borrow more!

It was a lot of trial and error at the start but I have created a spreadsheet to do that now.

Before depositing what I borrowed.

On a side note, CZM finds DeFi interesting too and has given me SG$3k to farm/invest for her (surprise surprise). Similarly, I have decided to invest her money into a liquidity pool by QuickSwap because it is the biggest DEX in Polygon and the founders/developers are known - not some anonymous food-coin fork. lol. If you are on BSC, QuickSwap is the PancakeSwap equivalent.

In addition, I am using AdamantVault, a yield optimizer that will auto compound the rewards from providing liquidity + their own governance token to further increase the return. The initial plan was to simply farm at QuickSwap but I saw an "endorsement" from QuickSwap so I believe it should be relatively safe to use AdamantVault too.

Anyway, I have blogged about different ways to leverage crypto to build wealth for people with different risk appetites:

The safer approach using stablecoins

Risky approach but more hassle-free

Highest risk and you are on your own

- DeFi apps on Binance Smart Chain (BSC) such as PancakeSwap and PancakeBunny

- DeFi - Aave, QuickSwap and Adamant on Polygon (Matic Network)

On a side note, Futu's moomoo app attractive sign-up bonus (one free Apple Share besides other benefits) has been extended to 31st May 2021 (1500hr SGT)! Take a look at the latest benefits here.

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

what about gas fees after you bridge usdc over to matic using xpollinate?

ReplyDeleteHi wenwei,

DeleteGas fees are even cheaper in Polygon compared to BSC. Probably less than 1 cents or 0.1 cents.

For your AAVE position, I hope you know that by borrowing MATIC, you are implicitly shorting MATIC. Your position will get rekt is MATIC goes up like crazy. A health factor of 1.35 is also quite dangerous imo.

ReplyDeleteAs for your Adamant position, it doesn't sound like you know what you're actually investing in. I hope you understand impermanent loss.

Hi KK,

DeleteOf course I do. It depends on how you see it, if I were to convert the borrowed MATIC into other assets then I am definitely shorting it. My plan is simply to borrow and earn higher interest by participating in the market.

Yes, you are right but it is all calculated risk in my opinion. Let's say at a health factor of 1.35, the price of MATIC will need to increase 100% before I get liquidated. MATIC current price is US$1.75 with a market cap of US$10b. A 100% increase will put it at US$21b, in the top 10 coins. Will it happen? Probably but I am guessing not overnight. Having said that, I do agree that 1.35 is dangerous. Typically, I will adjust/move my position to above 1.5 before sleeping/working which gives me a buffer of 150% increase. I am explaining all these since you pointed out. Like I mentioned above, I will write another article to explain more about it. Appreciate if you can share your opinion again :)

As for your statement about my Adamant position, I didn't explain much doesn't mean I do not understand. It is just that I have already blogged about it previously. I hope you have read my other DeFi articles before making such a statement but I guess not.

so what happened to your position after the spike in MATIC?

DeleteHi ymerej,

DeleteNothing happened. Like I said, if you want to play the leverage game, you got to make sure you don't get liquidated/margin call. Anyway, I changed my strategy. You can read more here - https://kpo-and-czm.blogspot.com/2021/05/defi-farming-matic-using-aave-curve.html

How do I transfer MATIC from Binance to the Matic network?

ReplyDeleteHi Yeo,

DeleteAh right. I forgot to mention that in my article, it was at the back of my mind. lol.

2 "free" ways:

1. When you bridge stablecoin from xpollinate.io, 0.001 MATIC will be sent to your wallet

2. Go to https://matic.supply/ and claim the 0.001 MATIC

The 0.001 MATIC will be enough to last you multiple transactions. Just convert some stablecoins to MATIC at QuickSwap.

I enjoyed your earlier posts on Celsius. For this particular posts, the title and content look a bit desync because the bulk of it is talking about Aave, only the last bits are talking about QuickSwap and Adamant and the jump in narrative is bit sudden. It would be more reader friendly to have a dedicated post on each product.

ReplyDeleteHi Kh,

DeleteHaha. Thanks and understand your point. That's because Aave is relatively newer while QuickSwap and Adamant are pretty similar to what I blogged about previously on - https://kpo-and-czm.blogspot.com/2021/04/pancakeswap-and-pancakebunny-our-experience-with-defi.html

They are essentially the same (QuickSwap=Pancakswap while Adamant=PancakeBunny) just different name/dapp on different network so I just briefly covered them. Feedback taken :)

What is your motivation for earning interestor yield in MATIC, given that it is not a stablecoin? Also what are the withdrawal fees if one wishes to withdraw the holdings from Aave platform back to your own wallet or eg. Binance /Gemini account ? What the risks with the Aave platform that beginners should take note of ? Appreciate if you can enlighten.

ReplyDeleteThe thing with stablecoin is that we minimize the risk/downside but at the same time, there will be no upside. I am farming MATIC because I believe it has some upside. E.g. I farm 1,000 MATIC now at $2 each but few years later, it might become $10? Of course, it can become 20 cents too. Who knows. lol.

DeleteYes, I gave it some thought but not planning to execute it anytime soon. The initial plan is AAVE/Curve(Polygon) -- xpollinate.io --> Metamask(BSC) --> Binance --30 USD for wire transfer--> Bank but the xpollinate bridge is down. I know can still go bridge from xDai but I have yet to try it. If you really want to cash out now, then probably will have to go through the ETH bridge/route then to Gemini. On the bright side, there is no withdrawal fee from Gemini.

Risks of Aave - https://medium.com/aave/understanding-the-risks-of-aave-43334dbfc6d0