I have closed off all our Syfe portfolio and blogged about the rationale here - Bye Bye Syfe! To be honest, closing off StashAway crossed my mind too ever since I discovered the possibility of DeFi farming using stablecoin which I have blogged about here - DeFi - Farming MATIC using Aave + Curve. The strategy will give us about 30-40% yield (depending on the price of MATIC as well as the fluctuating yield of Aave and Curve) and with just US$30k, I could generate a monthly cashflow of ~US$800 or SG$1k. To generate that kind of cashflow traditionally assuming a 5% dividend portfolio requires a capital of SG$240k. However, it is not without risk and given that I am still fairly new to it, I will be observing for the next few months before deciding if I should move more cash over.

Investment for this month:

KPO and CZM Cash - StashAway Risk Index 22% - $1,000

Baby Ong Cash - StashAway Risk Index 36% - $100

KPO and CZM Cash - StashAway Risk Index 22% - $1,000

Baby Ong Cash - StashAway Risk Index 36% - $100

KPO SRS - StashAway Risk Index 36% - $638

Total: $1,738

1. PORTFOLIO SUMMARY (as of the last day of the month)

|

| KPO |

|

| CZM |

Based on the statement (30 April 2021), our total investment is $67,210.58! KPO gains $765.51 and CZM gains $85.35 for the month.

As of 21 May 2021, these are our portfolio performance:

As of 21 May 2021, these are our portfolio performance:

KPO SRS - StashAway Risk Index 36%: $16,243.49 (44.50% - Capital: $13,702)

CZM SRS - StashAway Risk Index 22%: $6,496.80 (24.74% - Capital: $6,000)

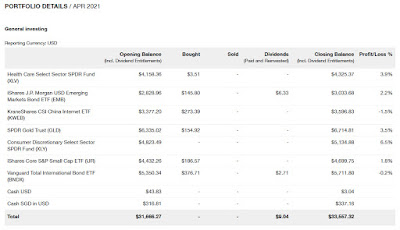

2. PORTFOLIO DETAILS

Note that these are reported in USD.

Note that these are reported in USD.

|

| KPO and CZM Cash - StashAway Risk Index 22% |

|

| Baby Ong Cash - StashAway Risk Index 36% |

|

| KPO SRS - StashAway Risk Index 36% |

|

| CZM SRS - StashAway Risk Index 22% |

3. FEE CALCULATIONS

The fee stated is based on the monthly-average assets SGD ($25,000.00 x 0.8% + $25,000.00 x 0.7% + $9,656.83 x 0.6%) / 365 days * 30 days = $35.58.

The fee stated is based on the monthly-average assets SGD $6,496.72 x 0.8% / 365 days * 31 days = $4.27.

StocksCafeEvan (founder of StocksCafe) made an improvement where one can now benchmark their portfolio against multiple indexes/ETFs. Looking at the time-weighted return (4.21%) for the year 2021, we can see that StashAway Risk Index 22% is underperforming all of our benchmarks.

If we compare across the years, StashAway's portfolio is winning by a huge margin (43.01%) except losing to SPY (68.60%) and IWDA (58.32%). In addition, it has the lowest volatility and max drawdown. This is what StashAway meant by reducing risk and maximizing the return.

The annualized return/XIRR of the portfolio is very impressive too at 12.29%. Using the Rule of 72, it means that the StashAway portfolio will double our money in 72 / 12.29 ~ 5.85 years. In comparison, the same money if left in the bank account at 2% interest rate will take 72 / 2 ~ 36 years to double.

As for StashAway Risk Index 36%, the portfolio currently has a higher time-weighted return (45.31%) when compared against all the indexes (STI, SPY, and IWDA) but it is also clear that it is riskier in the sense that both its volatility/max drawdown are much higher when you compare against the benchmark and StashAway Risk Index 22% portfolio. The XIRR is 20.00%. Using the same rule, our money will double in 72 / 20.00 ~ 3.60 years.

Anyway, if you are interested in signing up for StashAway, do use our referral link - KPO and CZM Referral Link. You will get $10,000 free management fees for 6 months and we will get $16!

If you want to extract those transactions information from StashAway, do take a look at this article - StashAway Transactions Parser.

If you are interested in the smart portfolio tracker (StocksCafe) which I am using as shown above, sign up using my link for a longer trial period :) Refer to our Referrals page for more information.

On a side note, Futu's moomoo app attractive sign-up bonus (one free Apple Share besides other benefits) has been extended to 31st May 2021 (1500hr SGT)! Take a look at the latest benefits here.

You might be interested in previous months update too:

- StashAway - December 2020 - $56,721.26

- StashAway - January 2021 - $59,991.38

- StashAway - February 2021 - $61,608.72

- StashAway - March 2021 - $64,759.72

- StashAway - April 2021 - $67,210.58

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

No comments:

Post a Comment