Last month was another crazy month. Baby Ong's infant care had COVID cases and we had to keep her home for slightly more than a week. We tried to look after her while working from home but it was simply not possible as she demands a lot of our attention. In the end, we had to send her to my parents' place while the grandparents look after her for the week. Looking at how things are and seeing our friends/relatives getting COVID, we can't help feeling that it is simply going to be a matter of time before we got it too although we are hoping that it wouldn't happen especially for Baby Ong.

We also got our annual compensation last month. One of us is happy, the other isn't. The unhappy one is retiring. lol. Shall blog more about this separately.

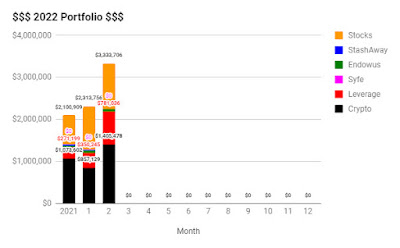

Portfolio

Leverage/Debt: $781,036

Stocks

Gearing: 30.60%

There is a huge jump because of 2 reasons:

1. LUNA price has recovered to an almost all-time high.

2. I have included the leverage I am using on crypto. CZM flagged out the inconsistency in my tracking as I included the leverage for stocks but not crypto.

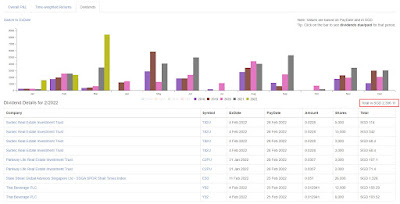

Our Passive Income - Dividends

Our Passive Income - Anchor Earn

Dividends for this month: $2,356.11

Total dividends collected for 2022: $3,986.53

Average dividends per month for 2022: $1,993.26

Estimated iInterest for this month: US$4,096 (~SSG$5,557)

Total interest collected for 2022: $10,397

Average interest per month for 2022: $5,198.50

Total passive income for this month: $7,913.11

Total passive income collected for 2022: $14,383.53

Average passive income per month for 2022: $7,191.76

The best part is these are all tax-free :)

Stocks

Did not buy any stocks for Feb. You can find our top 5 holdings below:

If you are interested in the smart portfolio tracker (StocksCafe) which I am using as shown above, sign up using my link for a longer trial period :) Refer to our Referrals page for more information.

Endowus

Endowus

Capital: $59,240.00

Current: $63,149.31

Current: $63,149.31

I decided to invest my CPF OA last year and blog about it here - Investing CPF OA Through Endowus.

If you are interested in Endowus, do use our referral link for our readers! You will get S$10,000 managed free for 6 months ($20 equivalent) and we will get $20 too! This access fee has no expiry date.

StashAway

Current: $6,295.07

Crypto

The only remaining portfolio with StashAway is CZM's SRS. No plan of doing anything at the moment.

If you are interested in StashAway, do use our referral link. You get $10,000 free management fees for 6 months and we will get $16!

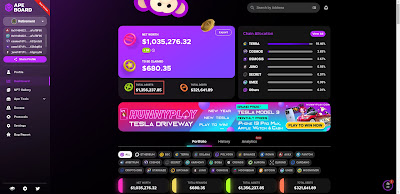

Crypto

The first time LUNA ran up to 3 digits, I was too conservative with using Anchor Borrow. Every time LUNA price went up, I would simply withdraw the bLUNA in order to get the staking yield. This time round, I kept borrowing more and more when the price went up. I would take the borrowed UST to buy LUNA and swap for more bLUNA which I will repledge/provide as collateral in order to borrow more. lol. That's how we bought more LUNA without the need for new capital.

In my opinion, PRISM has the best tokenomics for all of Terra's altcoins. They built their own DEX so people will have to trade through it in order to take a portion of the fees to redistribute to the PRISM stakers. During the launch, there was a lot of debates on whether pLUNA or yLUNA should be worth more and assuming the market is efficient, we now know which one is the winner. The strategy if one is interested in refactoring is to sell pLUNA and buy more yLUNA. In addition, with AMPS, one can further increase yluna staking yield *mindblowing*. On the other hand, I would recommend staying away from White Whale because they will not be able to deliver what they had promised previously. Basically, their arb bots have a very low success rate. You can go find out more in their discord.

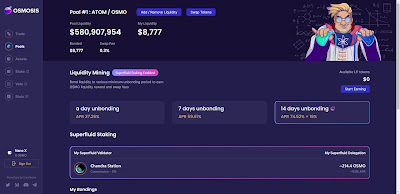

I used some of the borrowed funds and IBC to Cosmos and bought some ATOM, JUNO, SCRT and UMEE (mostly being staked). Osmosis has also recently launched Superfluid Staking which is extremely innovative. One can now provide liquidity on Osmosis and 50% of the OSMO (25% of the LP value) can then be staked, hence increasing the yield.

You might be interested in these blog posts too:

- 2021 Net Worth

You can refer to our crypto portfolio (except for CZM's retirement Anchor) on Ape Board for a more detailed breakdown.

Anyway, I have blogged about different ways to leverage crypto to build wealth for people with different risk appetites:

The safer approach using stablecoins

Risky approach but more hassle-free

Highest risk and you are on your own

- DeFi apps on Binance Smart Chain (BSC) such as PancakeSwap and PancakeBunny

If you are interested in the platform I am using, do sign up using our referral links for some bonus :)

BlockFi: Deposits US$100 or more into your BlockFi Interest Account (BIA), you will earn US$10 in BTC and we will earn US$10 in BTC too.

BlockFi: Deposits US$100 or more into your BlockFi Interest Account (BIA), you will earn US$10 in BTC and we will earn US$10 in BTC too.

Celsius Network: Earn US$50 in BTC with your first transfer of US$400 or more and we will earn US$50 in BTC too.

CakeDeFi - Deposits US$50 or more into your CakeDeFi account, you will earn US$30 in DFI and we will earn US$10 in DFI too.

Gemini: We will both receive US$10 of bitcoin after you buy or sell US$100.

Crypto.com: Sign up using our link, stake SG$500 worth of CRO and we both get US$25 in CRO

FTX: We will receive 25.00% of your trading fees and you will receive a 5.00% fee discount on all of your trades.

On a side note, Futu's moomoo app is giving free SEA share for their sign-up promotion. Do read the T&C here for more information. If you have yet to open an account, you can do so using our referral link :)

Accidentally clicked on the annoying ads? Let me thank you in advance as you are indirectly doing good as we will be Donating 100% Ads Revenue Going Forward!

- 2021 Net Worth

- Our CPF 2021

- Portfolio - December 2021 - $2,100,909

- Portfolio - January 2021 - $2,307,446

- Portfolio - February 2022 - $3,333,706

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

wow, $1m jump in portfolio.

ReplyDeleteHi HK,

DeleteTechnically, it isn't a $1m jump. I just under reported in the previous months by excluding the crypto leverage which was around US$200-300k (SG$270-400k) in size. The rest can be attributed to LUNA price increase which is close to 100% compared to last month.

Nothing magical, just concentrated bet/pick on LUNA and I am expecting more jump in the next few months :)

Hi KPO, what are your thoughts on putting LUNA - UST into Astroport instead of collaterising LUNA in Anchor to borrow UST against it? Want to know what your considerations are.

ReplyDeleteHi Steve,

DeleteLUNA-UST LP will have impermanent loss which I would rather avoid especially when I am very bullish on LUNA. Hence, I only have some in LUNA-BLUNA LP or would rather borrow against it.

Hi KPO, thanks very much for your sharing. May I enquire what might be the most cost-efficient way to off-ramp UST (e.g withdraw USD to local SG bank account)? Thank you.

ReplyDeleteHi B,

DeleteIt depends on how much you are trying to off-ramp. If more than 10k UST, send it to FTX then sell for USD and withdraw the USD back to local bank.

If it is less then 10k UST then IBC it to Osmosis, swap for CRO, withdraw to crypto.org chain and transfer to your crypto.com wallet. From there, you can sell the CRO and withdraw the SGD using StraitsX/Xfers or just spend on the card.