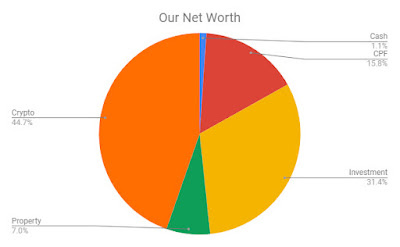

We dabbled in crypto in early 2021 with the plan to allocate just a tiny

1% of our net worth into it. However, I fell deep into the rabbit hole, discovered LUNA/Terra and eventually persuaded/convinced CZM to screw/ignore the 1% allocation. lol. Now it is taking up close to 50% of our net worth.

|

| Our WhatsApp group chat |

In addition, I started exploring DeFi with my friends (some of you can probably tell why it was named that way. Hint: BSC. lol) and eventually we started a crypto business with just US$3k capital. It is currently generating conservatively a few thousand dollars of passive income monthly (probably not that passive for my friends because they are doing the heavy lifting/coding. lol). It is a crazy amount for us because this was achieved in months as compared to our dividends portfolio which we spent years building.

Besides crypto, another factor that contributed to the growth of our wealth is the use of leverage.

Debt/leverage breakdown:

Stocks - SG$271,199

Crypto - US$75,269 (~SG$101,433)

House - SG$350,538

Total: ~SG$723,170

I believe the amount of debt we have taken might make some of you sleepless but it isn't really that much. If you think about it, anyone buying a private property without investing would have taken on much more debt but grow their wealth much slower (just my opinion). Anyway, we borrowed ~SG$372k to invest and it has exceeded our mortgage of ~SG$350k. Once again, leverage isn't for everyone and most importantly, never put yourself in a position where there is a high chance of being liquidated/margin call.

Let me introduce the concept of net worth and its importance once again for the new readers.

Net worth can be calculated by taking all the assets and subtracting away all the debts/liabilities. This is the classic comic where everyone is actually poorer than the beggar who has a net worth of $2.73. Your friends/colleagues may be living in a huge condominium, driving some fancy car but it could all be financed by debts. There is absolutely nothing wrong with that as long as their income allows so but anything can happen! Do not be the The "Poor" Pilot With Multiple Properties. You can refer to the following article on the importance of net worth by InvestmentMoats - Don’t Track Your Expenses or Budget First. Plot Your Net Worth Instead.

CashThis is all the money we have in our savings accounts. Regular readers will know we are investing aggressively that we hardly keep/hold onto cash. No emergency fund as well which I do not recommend since it is personal finance 101. We felt that there's no need for it at the moment, will probably work start saving when CZM retires?

Our Cash:

~ $25,000CPFEvery month, I will try to show CZM her net worth in order to motivate her to work harder towards financial freedom. However, she would always say I inflate her net worth because I included CPF. lol. I am sure some of you may have the same mentality but like I always tell her, CPF is our money and should be included as our retirement planning.

Our CPF:

~ $380,000 (OA + SA + MA)

Investment - Stocks/TradFi

The return through the use of leverage is not being captured and should be higher. Anyway, our overall time-weighted return is

18.01% and XIRR is

6.99%. The majority of our portfolio is tracked using StocksCafe except for Endowus which is about 35k and we have about 271k of leverage/debt. You can refer to

Portfolio - December 2021 for the detailed breakdown.

|

| The screenshot was taken after 2021 so numbers will not tally |

If you are interested in the smart portfolio tracker (

StocksCafe) which I am using as shown above, sign up using my link for a longer trial period :) Refer to our

Referrals page for more information.

Our Investment: ~$756,000

Investment - Crypto/DeFi

What's excluded:

- Crypto Business

I minted/purchased our first NFTs last year

September. It costs about 3 LUNA or US$123 then. I

sold one for 118 LUNA (~US$4,838 then or ~US$9k now) and kept the remaining 2. One of them (#10902) has a silver crown with a

floor price of 250 LUNA or ~US$20k and the other (#9868) is a top 5% glitch punk. Both of them are much rarer than what the floor is trading at but conservatively, they could be sold/valued at a minimum of ~US$40k in total. Of course, the most conservative valuation is 0 which is why they were excluded :)

Our Investment: ~$1,073,000

Property

I believe that property should be included in the computation of net worth. If one excludes the value of the property, the money (cash/CPF) you use to pay for the loan/mortgage will be no different as disappearing into the thin air or throwing it into the sea. Hence, I will be valuing the property based on the total payment (interest + renovation cost) till date. This ensures that our money will not "disappear" and act as a floor/minimum amount (total payment + remaining loan + markup/profit) to sell in the future.

I can imagine people selling their house at market value + markup, thinking that they made money from the sale but it is totally possible that market price + markup < total payment + remaining loan. Does this make sense or is it too confusing? lol.

Anyway, the cost of our HDB + the payment made so far is ~520k and the current outstanding loan is 351k.

Our Property: ~$168,000

Total

Our Net Worth: ~$2,404,000

Here you go! Our net worth pie chart, it looks pretty yummy to me :)

Oh, we also have about 465k miles which are just as valuable/useful as our NFTs at the moment and are valued at 0 dollars as well. lol.

Are you tracking your net worth?

On a side note, Futu's moomoo app free AAPL share sign-up promotion is back for this month. Do read the T&C

here for more information. If you have yet to open an account, you can do so using our

referral link :)

You might be interested in these blog posts too:

-

2017 Net Worth: ~

$510,000-

2018 Net Worth: ~

$640,000-

2019 Net Worth: ~

$886,000Do like any of the following for the latest update/post!

1. FB Page -

KPO and CZM2. Twitter -

KPO and CZM3. Click

here to subscribe using email :)

4. Instagram -

KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

What are your thoughts about the dwindling yield reserves on ANC? Seems like its not sustainable at the rate the reserves are dropping.

ReplyDeleteHi Steve,

DeleteTo be honest, I am not too concerned about it. The thing is Anchor has never promised a fixed 19% interest and the falling yield reserves is just because the interest rate is still being kept at 19%. I am expecting the interest to drop eventually but even at 15%, it is still way higher than banks and I will definitely continue to use it :)

well done!

ReplyDeleteThanks HK!

DeleteWhoa congrats man! Can slack at work liao lol.

ReplyDeleteHahaha. No point slacking, might as well just quit and retire like CZM.

DeleteAnyway, I still need the job for whatever plans we have few years down the road - decoupling and buying multiple properties being the main one. The best part is there is no need to compete/feel stress in the rat race. I think I will be quite indifferent with my increment/bonus going forward as compared to previous years. We shall see :)

hi ! which s&p 500 would you recommend for cash fund. thank you so much.

ReplyDeleteHi JAC,

DeleteI do not understand the question. Do you mean which S&P500 ETF to invest in? I would get the one with the lowest expense ratio and least tracking error. Probably the one by Vanguard...

Thanks for the reply, sorry for the uncomplete question, hahaha.... I'm a novice when it comes to investing.

ReplyDeleteRead More

ReplyDelete