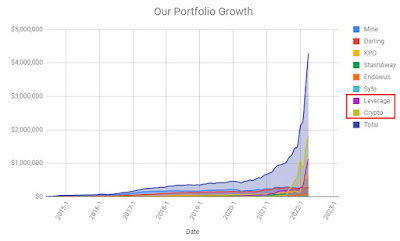

Our portfolio is performing well with LUNA at an all-time high again but our health was not so great last month. All 3 of us fell sick/got injured and had to see different specialists -.-" Baby Ong was having fever, coughing with lots of phlegm and we went to see a PD. CZM had an eye infection after Baby Ong accidentally poked her eyes and we went to see an eyes specialist. I have been having headaches daily for the last 3-4 weeks (even until now) due to scalp boils and had to see a dermatologist. We probably spent more than 1k seeing doctors in just a month.

Leverage/Debt: $1,127,400

Gearing: 35.78%

Yes, it went up by another million and it is getting unbelievable/crazy. With our portfolio growing bigger, access to leverage becomes cheaper and easier. I am now an accredited investor and my wealth lending interest got lowered. lol. The next goal is to get a priority private banking relationship (SG$1.5 m) with SCB so that the interest can be lowered further.

Anyway, I can only attribute these to crypto and the use of leverage. I guess I am not the average financial blogger because most would stay away from both but we actually manage to build our wealth and plan our retirement using both. In my opinion, these are tools available at everyone's disposal and one should not dismiss them without spending the time and effort to understand them first. Having said that, I do acknowledge whatever we are doing is definitely much riskier and all roads lead to Rome so just do whatever you are most comfortable with.

Estimated iInterest for this month: US$4,911.28 (~SSG$6,663.13)

Total interest collected for 2022: $17,060.13

Average interest per month for 2022: $5,686.71

Total passive income for this month: $16,466.53

Total passive income collected for 2022: $30,850.06

Average passive income per month for 2022: $10,283.35

The best part is these are all tax-free :) Technically, our passive income is much higher but I excluded staking yields and LP rewards because they are much harder to track and I have been using staking yields for buying NFTs. lol.

Stocks

So we off-ramp another 100k USD and were lucky to scoop some iShares HK Tech ETF near the all-time low which was the day before the China govt intervened with some good news. We also bought some China banks because the rising interest rate will be good for the banks but our SG banks are at an all-time high so the China banks seem more attractive.

The rest of the stocks were purchased using leverage:

- CapitalandInvest - They declared dividends and we decided to accumulate more

- Frasers Centrepoint Trust - We have a lot of CICT and Mapletree Commercial and wanted to diversify

- Suntec REIT - This was still relatively cheap/undervalued compared to the pre-COVID period

- ICBC - We wanted to diversify away from CCB and BOC

- The remaining should be averaging down our existing holding

The idea of using leverage is simple, borrow the money, buy a good/excellent REIT/stock, use the dividends to pay the interests, and keep the difference while ensuring that we will never get a margin call/trigger. Once again, leverage has its risk and is definitely not for everyone. We see it as our way of buying a second property without incurring any of those taxes (ABSD, rental income tax, etc.). You can take a look at this - Leverage Performance 2020.

Total: $1,782,313.49

Leverage/Debt: $529,566.68

Leverage/Debt: $529,566.68

If you are interested in the smart portfolio tracker (StocksCafe) which I am using as shown above, sign up using my link for a longer trial period :) Refer to our Referrals page for more information.

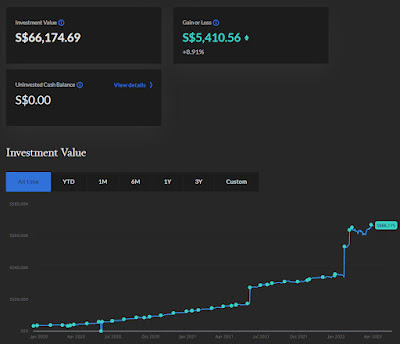

Endowus

Endowus

Capital: $60,764.13

Current: $66,174.69

Current: $66,174.69

I decided to invest my CPF OA last year and blog about it here - Investing CPF OA Through Endowus.

If you are interested in Endowus, do use our referral link for our readers! You will get S$10,000 managed free for 6 months ($20 equivalent) and we will get $20 too! This access fee has no expiry date.

StashAway

Current: $6,111.11

Crypto

The only remaining portfolio with StashAway is CZM's SRS. No plan of doing anything at the moment.

If you are interested in StashAway, do use our referral link. You get $10,000 free management fees for 6 months and we will get $16!

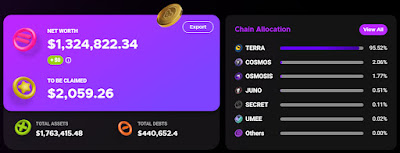

Crypto

Total excluding NFTs: $2,423,375.59

Leverage/Debt: $597,833.11

Leverage/Debt: $597,833.11

Besides buying LUNA, I also bought some RUNE, ASTRO, MARS and PRISM last month. ASTRO is interesting because of the potential Astro war in the future (similar to Curve war) and it is my 3rd biggest bag now. MARS got sold off too heavily and I decided to buy some when it was trading around US$0.69. PRISM is the most interesting Terra altcoin at the moment because of the potential to earn >30% staking yield from LUNA. These Terra applications are far from delivering/launching all the features so I do think they have a lot of potentials.

Didn't do anything new on the Cosmos side. Saw that there was some JUNO drama going on but couldn't really be bothered. I have been collecting the yield and restaking them for most of those coins.

You can refer to our crypto portfolio (except for CZM's retirement Anchor) on Ape Board for a more detailed breakdown of how we DeFi although you wouldn't see all of it because some of my coins are still with the exchanges.

These are the top 10 coins in our portfolio.

My most valuable NFT will be this Galactic Punk that comes with a glitch valued at 200 LUNA (~US$22k). lol. Diamond hands until it reaches 6 digits!

You might be interested in these blog posts too:

- 2021 Net Worth

Anyway, I have blogged about different ways to leverage crypto to build wealth for people with different risk appetites:

The safer approach using stablecoins (I have stopped using this)

Risky approach but more hassle-free (I have stopped using this too)

Highest risk and you are on your own

- DeFi apps on Binance Smart Chain (BSC) such as PancakeSwap and PancakeBunny

If you are interested in the platform I am using, do sign up using our referral links for some bonus :)

BlockFi: Deposits US$100 or more into your BlockFi Interest Account (BIA), you will earn US$10 in BTC and we will earn US$10 in BTC too.

BlockFi: Deposits US$100 or more into your BlockFi Interest Account (BIA), you will earn US$10 in BTC and we will earn US$10 in BTC too.

Celsius Network: Earn US$50 in BTC with your first transfer of US$400 or more and we will earn US$50 in BTC too.

CakeDeFi - Deposits US$50 or more into your CakeDeFi account, you will earn US$30 in DFI and we will earn US$10 in DFI too.

Gemini: We will both receive US$10 of bitcoin after you buy or sell US$100.

Crypto.com: Sign up using our link, stake SG$500 worth of CRO and we both get US$25 in CRO

FTX: We will receive 25.00% of your trading fees and you will receive a 5.00% fee discount on all of your trades.

On a side note, Futu's moomoo app is giving free SEA share for their sign-up promotion. Do read the T&C here for more information. If you have yet to open an account, you can do so using our referral link :)

Accidentally clicked on the annoying ads? Let me thank you in advance as you are indirectly doing good as we will be Donating 100% Ads Revenue Going Forward!

- 2021 Net Worth

- Our CPF 2021

- Portfolio - December 2021 - $2,100,909

- Portfolio - January 2021 - $2,307,446

- Portfolio - February 2022 - $3,333,706

- Portfolio - March 2022 - $4,277,975

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

Hi Ser. What requirements do you have to maintain for your SC Priority account? Need to buy any of the scammy bank products? or just maintain stocks in your investment account? What EIR are you currently enjoying? Thanks for your posts

ReplyDeleteHi sl,

DeleteYou will need at a minimum of S$200,000 in deposits and/or investments for priority account. No need to buy any scammy products and yes, we just hold all our stocks in the trading account. Based on my experience, the EIR can be different for different people. Given that we are now AI, it is definitely lower than what the bank will offer to just priority customer. Even before we got AI, the interest for the leverage account was lower than our mortgage (1.55%) already. Best to just check with the bank or ask your RM :)

Bro, you have outperformed me like crazy since 2 years ago! congrats!

ReplyDeleteI am now inspired by your crypto anchor earn and tested $130 into Anchor... I am still puzzled as i just started today, can I check with you a few questions?

1) Is it better to stake UST at 19% vs. buying luna and convert to Bluna and loan it then stake?

2) For the UST staking at 19%, the rewards are in ANC or UST?

3) Then, would you still recommend cakedefi given its APY is now 30%~?

Thanks in advance.

Hi FutureValue,

DeleteThanks! I guess I got lucky and managed to discover luna relatively early.

1. It is not about which is better but which fits your risk profile more. Depositing UST in Anchor is essentially like a USD high interest savings account. There is no volatility/capital appreciation holding UST, just the 18% interest. Buying luna/bluna means you are fine with the volatility and is looking for capital appreciation/losses. Loan and stake it will be the highest risk where you will be leveraging already.

2. UST. I really wouldn't call it staking. You are simply depositing UST into Anchor Earn and in return, you get aUST. aUST will appreciate at 18% and when you withdraw, you will get your capital + interest in UST.

3. I am not using CakeDeFi anymore. Was using it before I discover Terra/Luna/Anchor. Nowadays, I just recommend Anchor for beginners/people new to crypto because there's no volatility and the concept (USD high interest savings account) is easier to understand/explain.