Anyway, our portfolio reaches another new high! It increased by 14.42% to $1,179,579 - $84,491.51 of capital injection and $64,181.94 of capital gain. This includes $202,372 of leverage/debt (gearing/debt ~20.71%).

"Cash Flow" is the amount of money being injected/withdrawn from the portfolio (buying stocks = +ve cash flow while selling stocks and collecting dividends = -ve cash flow)

SOLD

- IREIT Global (500 units) @ $0.64

- IREIT Global (500 units) @ $0.64

Decided to sell it for a small profit and clean up the portfolio. I bought it in the first place to conduct an experiment to see if there is any way to profit from the right issues by oversubscribing to it. Unfortunately, it is not really worth the effort.

I bought 100 shares which came with 45 rights, bought another 55 rights to make it 1 lot and oversubscribed the rights issues by another 9,900 shares. I was only allocated 300 more shares (~3% allocation).

BOUGHT

- Tencent (100 units) @ HK$429.00- Ping An (500 units) @ HK$69.10

- China Construction Bank (2,000 units) @ HK$5.64

- Ascott Trust (5,000 units) @ $1.01

- DBS (300 units) @ $31.00

- OCBC (600 units) @ $12.37

- Mapletree NAC Trust (5,000 units) @ $1.01

- Mapletree Commercial Trust (5,500 units) @ $2.11

- Keppel REIT (20,000 units) @ $1.09

- Suntec REIT (15,000 units) @ $1.45

Dividends

The total dividends collected this month is $4,016.60. The breakdown is as follows:

Most of the purchases were from using leverage. I used the money from closing our StashAway cash portfolio to repay our USD loan/leverage. As a result, I get access to more SGD which I then borrow to buy more REITs, pledge and repeat to get access to even more capital.

Anyway, the idea of using leverage is simple, borrow the money, buy a good/excellent REIT/stock, use the dividends to pay the interests, and keep the difference while ensuring that we will never get a margin call/trigger. Once again, leverage has its risk and is definitely not for everyone. We see it as our way of buying a second property without incurring any of those taxes (ABSD, rental income tax, etc.). You can take a look at this - Leverage Performance 2020.

Given that it is a brand new year, I have adjusted my SRS contribution to $1,276 per month with the intention of maxing it by year-end. We have also decided to open another StashAway portfolio for Baby Ong. You can read about Our Insurance and Investment Plan for Baby Ong.

Our Monthly DCA for June - $1,376

Our Monthly DCA for June - $1,376

$100 Cash for Baby Ong - StashAway Risk Index 36%

$638 KPO's SRS - StashAway Risk Index 36%

$638 KPO's SRS - Endowus Loss Tolerance -60%Dividends

The total dividends collected this month is $4,016.60. The breakdown is as follows:

Company PayDate Shares Total

Parkway Life REIT 31-Aug-21 5,000 $169.00

Wilmar International Ltd 27-Aug-21 1,000 $100.00

CDL Hospitality Trusts 27-Aug-21 4,800 $58.56

Ascott Residence Trust 27-Aug-21 25,913 $529.92

Suntec REIT 27-Aug-21 11,000 $231.99

IREIT Global 27-Aug-21 500 $11.45

OCBC Ltd 26-Aug-21 1,519 $379.75

DBS Group Holdings Ltd 26-Aug-21 1200 $396.00

SPDR Strait Times Index 25-Aug-21 26,000 $1,118.00

Frasers L&C Trust 24-Aug-21 24,297 $318.28

Singapore Telecommunications Ltd 18-Aug-21 4,000 $96.00

China Construction Bank Corp 5-Aug-21 10,000 HK$3,517.52 (~S$607.65)

Total dividends collected for 2021: $19,299.74

Average dividends per month for 2021: $2,412.46

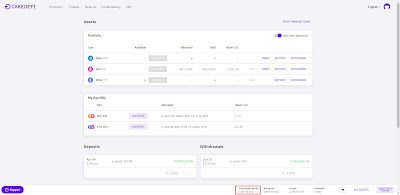

StashAway

Average dividends per month for 2021: $2,412.46

StashAway

|

| KPO |

|

| CZM |

Capital: $22,954.00

Current: $25,618.83

If you are interested in StashAway, do use our referral link. You get $10,000 free management fees for 6 months and we will get $16!

If you want to extract those transactions information from StashAway, do take a look at this article - StashAway Transactions Parser.

Current: $25,618.83

If you are interested in StashAway, do use our referral link. You get $10,000 free management fees for 6 months and we will get $16!

If you want to extract those transactions information from StashAway, do take a look at this article - StashAway Transactions Parser.

Endowus

Capital: $26,252.00

Current: $31,258.53

Current: $31,258.53

I decided to invest my CPF OA last month and blog about it here - Investing CPF OA Through Endowus.

If you are interested in Endowus, do use our referral link for our readers! You will get S$10,000 managed free for 6 months ($20 equivalent) and we will get $20 too! This access fee has no expiry date.

Crypto

Tracking crypto investment becomes very painful when the number of coins increases as well as when I move across to different networks. Hence, to simplify the tracking, I will just be tracking the capital I put in vs the current value at the end of the month.

I exited FTM and BSC at a loss and Polygon and Avalanche at a profit. Huge profit from Avalanche from SG$500 to SG$3.6k. I bought PERI around 30 cents and sold at $2 when an incentive program was launched in Avalanche. If only I put SG$5k in like all the other networks... lol. Personally, I found transferring fund to Avalanche too troublesome where one still have to bridge between the X and C chain and that stopped me from transferring more money into the network.

On a side note, there are still some residue funds left in BSC (~US$600) and Polygon (~US$1k on Adamant and QiDao) which are "staked/locked". I have also sold off all my ADA (Cardano) and BTC to buy more LUNA. Cardano on paper/in theory looks good but once you dive into DeFi, you will start to wonder how it deserves the current valuation without any smart contract functionality. I sold BTC because I can probably 2 or 3x the money while LUNA has a lot more upside. In addition, with the huge profit from ADA, I bought some RUNE and kept the rest to margin trade which I will be buying and taking profit on LUNA.

Capital: SG$130,240.05 + US$3,125.22 (leverage) ~ SG$134,434.56

Current: SG$221,793.30 + US$3,125.22 (leverage) ~ SG$225,987.81

Current: SG$221,793.30 + US$3,125.22 (leverage) ~ SG$225,987.81

Crypto - Binance

Crypto - CakeDeFi

CakeDeFi - Deposits US$50 or more into your CakeDeFi account, you will earn US$30 in DFI and we will earn US$10 in DFI too.

Crypto DeFi - Terra

I blogged about it previously - DeFi - Terra (LUNA & UST) & Anchor Protocol (20% Interest) and DeFi - Terra Mirror Protocol Delta-Neutral Strategies. I have moved most of my money to Terra including CZM's initial investment because this is my high conviction crypto pick. lol. In my opinion, LUNA can easily go to 3 digits because it is based on the demand for UST which will only increase as time goes by where more projects are launched, UST going cross chains, and getting listed on more exchanges. We have about 3.5k LUNA with 57% of them staked, 20% as bLUNA, 16% in LUNA-bLUNA LP and 7% in slow burn. The target is to accumulate 4k LUNA before the next mainnet upgrade which fortunately has been delayed. For a more detailed breakdown, you can refer to our Terra portfolio on Ape Board below.

My Terra Address:

Anyway, I have blogged about different ways to leverage crypto to build wealth for people with different risk appetites:

The safer approach using stablecoins

Risky approach but more hassle-free

Highest risk and you are on your own

- DeFi apps on Binance Smart Chain (BSC) such as PancakeSwap and PancakeBunny

If you are interested in the platform I am using, do sign up using our referral links for some bonus :)

BlockFi: Deposits US$100 or more into your BlockFi Interest Account (BIA), you will earn US$10 in BTC and we will earn US$10 in BTC too.

BlockFi: Deposits US$100 or more into your BlockFi Interest Account (BIA), you will earn US$10 in BTC and we will earn US$10 in BTC too.

Celsius Network: Earn US$50 in BTC with your first transfer of US$400 or more and we will earn US$50 in BTC too.

CakeDeFi - Deposits US$50 or more into your CakeDeFi account, you will earn US$30 in DFI and we will earn US$10 in DFI too.

Gemini: We will both receive US$10 of bitcoin after you buy or sell US$100.

Crypto.com: Sign up using our link, stake SG$500 worth of CRO and we both get US$25 in CRO

If you are interested in the smart portfolio tracker (StocksCafe) which I am using as shown above, sign up using my link for a longer trial period :) Refer to our Referrals page for more information.

- 2020 Net Worth

- Portfolio - December 2020 - $669,630

- Portfolio - January 2021 - $712,898

- Portfolio - February 2021 - $742,364

- Portfolio - March 2021 - $866,309

- Portfolio - April 2021 - $946,521 $935,646

- Portfolio - May 2021 - $952,839

- Portfolio - June 2021 - $988,215

- Portfolio - July 2021 ($1 Million Achieved!) - $1,030,905

- Portfolio - August 2021 - $1,179,579

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

What do you use for leverage to buy your stocks?

ReplyDeleteHi Jonas,

DeleteI'm using SCB secured wealth lending - https://www.sc.com/sg/wealth/investment/secured-wealth-lending/