This is one of the many posts that was sitting in draft mode for a long long time.

Firstly, what is a credit score? It is a number used by lenders as an indicator of how likely an individual is to repay his debts and the probability of going into default. It is an independent assessment of the individual's risk as a credit applicant. This will affect your credit card application, mortgage/home loan, etc. You can refer to the detailed explanation from our Credit Bureau.

Next, how do I find out what's my score? You will need a credit report and there are 2 ways to get it: You can either purchase your report at a price of $6.42 inclusive of GST or you can get a free credit report whenever you apply for a credit card. Interesting old (2015) statistic - Of the 870,766 consumers who applied for a new credit facility in 2015, 85 per cent have never seen their personal credit files, said CBS. Source: Free credit report when you apply for a loan, credit card or overdraft

I applied for another credit card (UOB PRVI Visa) back in January when SingSaver was having the Air Miles vs Cash Back "competition". Needless to say, Air Miles won the competition and we all had $30 more cash on top of the existing signup bonus :) Ops, I digress. The credit card application gave me free access to my credit report which I will be sharing below.

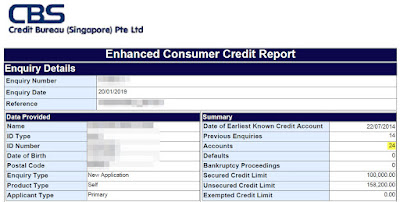

KPO's Credit Report

I have 24 accounts?! Unfortunately, the report does not include a breakdown of these accounts so my guess would be all the credit cards (including terminated ones) + loans. Miles game is tough - I always tell people I have > 10 credit cards and if you want a simple 1 credit card kind of life, it is definitely not suitable for you.

The $100k secured credit comes from my pledged shares to SCB at 70% LTV (loan to value) which I blogged about here - Leverage - A Double-Edged Sword.

The unsecured credit limit is simply the total limit of all my credit cards.

I have a longer account history but you will get the point of it with the above screenshot. This shows the transactions/activity of all your account/credit card/loan for the last 3 years. I shall not go into details what the various alphabet stands for.

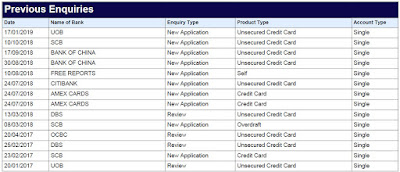

This shows you the history of banks enquiring your credit report from the Credit Bureau. You can see that the banks do conduct a regular/yearly review on one's credit score too.

Here comes the grand finale - KPO has a credit score of 1956 (grade - AA) and a probability of default at 0.14%. The report also provided some factors/reasons why KPO does not has a perfect score with 0% probability of default:

1. Immature Credit History - My earliest known credit account was back in 2014 (age 24) when I was still in university and I still remembered it was the Citi Clear Student Card. My first credit card was a cash back card. lol. Anyway, I still do not understand why people would use a debit card over a credit card.

2. Credit Exposure - I supposed this is referring to the total secured and unsecured credit limit which is > $250k? Definitely looks impossible to repay all of them if I were to go crazy one day and utilize all of them. No! I will not sell our shares/investment. lol.

3. Too Many Enquiries - I will cancel cards that I do not use after 6 months and then reapply when there are cash incentive/attractive signup bonus + all the reviews the banks will be conducting. My credit score will never be perfect!

The above are just specific to me so it will probably be different or have some similarity with yours.

To be honest, I find the above pretty surprising or should I say shocking?? Credit card and housing loan look pretty normal but not for the other two. It seems that majority of the people (>86%) have taken some form of personal loan and >88% of the people have a motor vehicles loan?? Note that the above statistics are for my age group, so I was not expecting the majority of the people who have work less than 5-10 years to be buying a car.

On a side note, this is my last year in this age group, not sure if I should be sad or happy about it. Shall share the next age group when I have the chance next time. lol.

What are you waiting for? Go check yours out!

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

|

| Taken from Credit Bureau Singapore - What Is A Credit Score? |

Next, how do I find out what's my score? You will need a credit report and there are 2 ways to get it: You can either purchase your report at a price of $6.42 inclusive of GST or you can get a free credit report whenever you apply for a credit card. Interesting old (2015) statistic - Of the 870,766 consumers who applied for a new credit facility in 2015, 85 per cent have never seen their personal credit files, said CBS. Source: Free credit report when you apply for a loan, credit card or overdraft

I applied for another credit card (UOB PRVI Visa) back in January when SingSaver was having the Air Miles vs Cash Back "competition". Needless to say, Air Miles won the competition and we all had $30 more cash on top of the existing signup bonus :) Ops, I digress. The credit card application gave me free access to my credit report which I will be sharing below.

KPO's Credit Report

I have 24 accounts?! Unfortunately, the report does not include a breakdown of these accounts so my guess would be all the credit cards (including terminated ones) + loans. Miles game is tough - I always tell people I have > 10 credit cards and if you want a simple 1 credit card kind of life, it is definitely not suitable for you.

The $100k secured credit comes from my pledged shares to SCB at 70% LTV (loan to value) which I blogged about here - Leverage - A Double-Edged Sword.

The unsecured credit limit is simply the total limit of all my credit cards.

I have a longer account history but you will get the point of it with the above screenshot. This shows the transactions/activity of all your account/credit card/loan for the last 3 years. I shall not go into details what the various alphabet stands for.

This shows you the history of banks enquiring your credit report from the Credit Bureau. You can see that the banks do conduct a regular/yearly review on one's credit score too.

Here comes the grand finale - KPO has a credit score of 1956 (grade - AA) and a probability of default at 0.14%. The report also provided some factors/reasons why KPO does not has a perfect score with 0% probability of default:

1. Immature Credit History - My earliest known credit account was back in 2014 (age 24) when I was still in university and I still remembered it was the Citi Clear Student Card. My first credit card was a cash back card. lol. Anyway, I still do not understand why people would use a debit card over a credit card.

2. Credit Exposure - I supposed this is referring to the total secured and unsecured credit limit which is > $250k? Definitely looks impossible to repay all of them if I were to go crazy one day and utilize all of them. No! I will not sell our shares/investment. lol.

3. Too Many Enquiries - I will cancel cards that I do not use after 6 months and then reapply when there are cash incentive/attractive signup bonus + all the reviews the banks will be conducting. My credit score will never be perfect!

The above are just specific to me so it will probably be different or have some similarity with yours.

|

| Fun fact - statistics for consumers in my age group (21-29) |

On a side note, this is my last year in this age group, not sure if I should be sad or happy about it. Shall share the next age group when I have the chance next time. lol.

What are you waiting for? Go check yours out!

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

No comments:

Post a Comment