I was telling my friends/"business partners" about Terra which I blogged here - DeFi - Terra (LUNA) & Anchor Protocol (20% Interest) and they got interested in Mirror Protocol and the delta-neutral strategies it offers despite the risk of liquidation. Before I knew it, I was convinced by them that it is actually relatively safe. lol. I guessed I got traumatized by my previous experience when my leveraged CAKE farm got liquidated in Alpaca Finance (BSC) which I mentioned here.

The main difference for Mirror is that the underlying assets are mostly mirrored stocks called mAssets compared to various crypto coins in Alpaca. It is less likely to be liquidated in Mirror because stocks do not swing as much. Let's take a look at a few examples:

Basically, if I were to open a short position in Mirror at a 200% collateral ratio (liquidation happens at 150%), the underlying stock will have to increase by 33.33% before I get liquidated. It is highly unlikely for stocks especially those with the highest market capitalization to increase by >30% overnight which was my initial concern - getting liquidated while I am sleeping. I have opened a few positions for a few weeks and it looks pretty "stable" (no risk of liquidation). With the main risk out of the picture, let me share more about the strategy.

Delta-neutral simply means you earn/profit regardless if the underlying asset increases/decreases in price by owning and shorting the asset at the same time. This can be executed in 3 different ways in Mirror:

1. Short farm the mAsset, buy the equivalent number of mAsset that was shorted and hold (easiest to execute but typically the lowest yield as short farm yield fluctuates a lot)

2. Short farm the mAsset, buy the equivalent number of mAsset that was shorted, provide liquidity with an equivalent amount of UST (LP) to long farm (highest yield with some exposure to impermanent loss)

3. Borrow the mAsset, provide liquidity with an equivalent amount of UST (LP) to long farm (exposure to impermanent loss)

Let's take a look at an example of strategies 1 and 2 using mAAPL with an initial capital of 10k UST.

|

| 0.15 UST to open this short position |

1. I provide $5,000 UST worth of collateral in aUST (which is an interest bearing asset earning 20%. One can get aUST by depositing UST into Anchor) to borrow the mAAPL shares to short. The money from shorting will be unlocked after 2 weeks.

|

| 1.52 UST to buy the mAAPL shares |

2. Immediately open another position by buying the equivalent number of mAAPL shares which I shorted above.

At this point in time, my position in mAAPL is delta-neutral and I will be earning a 21.21% yield on my short farm of ~$2.5k UST as well as 20% on my $5k UST collateral no matter if the price of AAPL goes up or down. This is strategy 1.

|

| 1.62 UST to provide liquidity to long farm |

3. Provide liquidity with an equivalent amount of UST (mAAPL-UST LP) to long farm

With that, my position in mAAPL is still delta-neutral and I will be earning a 21.21% yield on my short farm of ~$2.5k UST, 33.53% on my $5k UST worth of LP on the long farm as well as 20% on my $5k UST collateral. This is strategy 2.

As usual, I have created a spreadsheet if you want to check it out further. There is another spreadsheet made by some CEO that is actually incorrect where it is calculated/instructing one to pledge collateral to both short and borrow the mAsset. If you truly understand it, you will know that's not a delta-neutral position at all. lol.

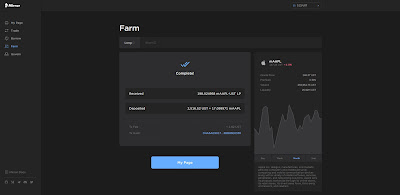

Meanwhile, the collaterals are growing at 20% (you can compare with the above screenshot when I first opened the short position by pledging the aUST) which also lowers the risk of liquidation.

The world of crypto is just mind-blowing. With the above delta-neutral strategies, I am getting 30-50% yield with minimum risk (liquidation). Where can we find this in the world of traditional finance?

On a side note, I have moved most of my crypto in BSC, Polygon and Fantom over to Terra. The plan is to move everything to Terra in the next few weeks/months with the majority of our funds invested into LUNA. Oddly, our crypto portfolio is very concentrated and not diversified at all. lol. Stay tuned to our next monthly update for a more detailed breakdown :)

To the moon!

On a side note, Futu's moomoo app sign-up promotion is now slightly different (Pfizer and Haidilao shares are given with deposit and 3 trades each on US and HK markets. T&C here) and has been extended to 19:59 hrs SGT, 31st August 2021! As part of the collaboration, I will be giving away 5 moomoo 'neck-fix and chill' pillow (not for sale but can be redeemed in the app) to 5 randomly chosen readers who signed up through our referral link for this month! More information can be found here - Futu's moomoo August Campaign + Merchandise Giveaway!

On a side note, I have moved most of my crypto in BSC, Polygon and Fantom over to Terra. The plan is to move everything to Terra in the next few weeks/months with the majority of our funds invested into LUNA. Oddly, our crypto portfolio is very concentrated and not diversified at all. lol. Stay tuned to our next monthly update for a more detailed breakdown :)

To the moon!

Anyway, I have blogged about different ways to leverage crypto to build wealth for people with different risk appetites:

The safer approach using stablecoins

Risky approach but more hassle-free

Highest risk and you are on your own

- DeFi apps on Binance Smart Chain (BSC) such as PancakeSwap and PancakeBunny

- DeFi - Terra Mirror Protocol Delta Neutral Strategies

If you are interested in the platform I am using, do sign up using our referral links for some bonus :)

BlockFi: Deposits US$100 or more into your BlockFi Interest Account (BIA), you will earn US$10 in BTC and we will earn US$10 in BTC too.

BlockFi: Deposits US$100 or more into your BlockFi Interest Account (BIA), you will earn US$10 in BTC and we will earn US$10 in BTC too.

Celsius Network: Earn US$40 in BTC with your first transfer of US$400 or more and we will earn US$40 in BTC too.

On a side note, Futu's moomoo app sign-up promotion is now slightly different (Pfizer and Haidilao shares are given with deposit and 3 trades each on US and HK markets. T&C here) and has been extended to 19:59 hrs SGT, 31st August 2021! As part of the collaboration, I will be giving away 5 moomoo 'neck-fix and chill' pillow (not for sale but can be redeemed in the app) to 5 randomly chosen readers who signed up through our referral link for this month! More information can be found here - Futu's moomoo August Campaign + Merchandise Giveaway!

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

I have saw briefly that there is an 'Insurance Coverage' for both anchor / Mirror, are you using any? Or do you see it as necessary

ReplyDeleteHi Marc,

DeleteApologies on the late reply. Hasn't been checking blog/email recently.

Yes, there are a few but I am not using any. I think it is up to your level of comfort and whether getting that insurance will give you a piece of mind/better sleep. The way I see it is the moment there are insurance coverage, it simply means the products (UST/Anchor/Mirror) are relatively safe because insurance is there to make money for its shareholders/"stakers".

I am fairly certain UST will not depeg to the level (~0.86) where you will be able to make a claim from the coverage. In addition, after col 5 upgrade, there is a new dapp (white whale) that will help to maintain peg as well. I will rather deposit UST/luna there and earn/profit from helping to maintain peg then to buy insurance. lol.

hi kpo,

ReplyDeletefor your delta-neutral strategy, can i close the short position by "offering" the long position that I bought at the same time? does it work this way or I need to close off by buying the same amount of shares at the current price.

thanks

Hi ADN,

DeleteYes. You close the short by using what you bought for the long position. If you long farm what you bought and ended up with lesser mtokens due to IL, then just buy the difference to close the short position.

thank you so much KPO. I will follow yr steps when closing my position. All the best~!

DeleteNp. All the best to you too!

DeleteHi! Thanks for this! Not quite sure on how to close positions on strategy 1. Should I wait two weeks and then sell...

ReplyDeleteThanks!

Hi Dampi,

DeleteFor strategy 1, you are short farming the mAsset which means after you minted it with your collateral, it is immediately sold. However, you can only claim the UST you will be getting from selling the mAsset 2 weeks later.

To close the position, you will need to use the mAsset which you should have bought to close the short position in order to redeem your collateral. You can close it anytime but ideally, you shouldn't close your positions shortly after opening them because there will be protocol fees which you have to pay and the yield you see is only if you hold the position for a year.

Hope this clarifies.

>>>Hope this clarifies.

DeleteYes! Thanks a lot for the info. Really appreciate it!

Hi KPO, many thanks for the detailed step by step guide, it is VERY VERY useful!

ReplyDeleteWhile it helps to understand the buying part, may I kindly ask how do we "sell", especially for Strategy 2 of Short Farm + Long LP? Step 4 suggest "After two weeks the UST from STEP 2 (short sell) are unlocked and can be withdrawn".

Using your case as reference:

Qns 1 - After 2 weeks I presume we have to withdraw it ourselves? And if after withdraw, does Step 3 of "Add LP and Long Farm" automatically get closed out since we have withdrawn the UST (245) that is supposedly used to provide LP?

Qns 2 - On Step 1, after 2 weeks, do we then close out the position by buying back the same number of asset(17.09 mAAPL)?

Many thanks in advance!

Hi KKK,

DeleteSorry for the late response! I have forgotten to reply and I hardly check the blog nowadays.

Ans 1: Yes, you got to withdraw it yourself. No, nothing gets automatically close out until you go close the positions yourself. What you are doing is merely collecting the UST you are getting from short selling the mAsset, not from the LP.

Ans 2: To be delta neutral, you need to buy the same number of asset at the same time when you open the short sell position because that is when the price is similar. If you were to do it 2 weeks later, the price will most likely be different.

Hello KPO, please don't be sorry, you do not owe me a response. I am definitely thankful for your sharing and please know that it is appreciated :)

DeleteSo basically you short (borrow) 17.095260 mAAPL, and then buy 17.099971 mAAPL. After that provide liquidity mAAPL-UST LP.

1. So when you decide to "get out" of this strategy, you will need to unstake mAAPL-UST LP followed by selling 0.004711 mAAPL (17.099971 - 17.095260) to zerolise? Because you bought more than you borrowed?

2. In the event after 2 weeks you still wish to continue with the strategy to earn the APY, you will just need to claim the unlocked UST that was used to short farm yeah?

So basically you short (borrow) 17.095260 mAAPL, and then buy 17.099971 mAAPL. After that provide liquidity mAAPL-UST LP <--- Yes! That's correct. Ideally, you just try to buy as close as possible to the amount you are going to short but price moves so you might end up with slightly more or less units. It doesn't really matter because when you add it to LP, you will get a different amount back due to the potential impermanent loss.

ReplyDelete1. Yes, you unstake the LP and break them back to mAAPL and UST but you are not selling your mAAPL. You need to return/close your short position to get your remaining collateral back. What you did at the start is to borrow to short with collateral pledge, hence you need to return it.

2. Yes, you will need to claim the unlocked UST after 2 weeks but ideally you should keep both positions as long as possible (assuming no risk of liquidation) because you are only getting whatever yield you see after holding them for a year. Not 2 weeks.

Thank you for your detailed explanation, appreciate!

DeleteCheers!