CPF plays a crucial role towards retirement planning and should be managed accordingly. Our plan is to first max out MA (which will then overflow to SA/OA), then follow by SA (meeting the FRS) and let compounding take over to ensure that we will always be able to meet the new minimum sum in the respective accounts. Our CPF update will be done annually together with the interests that are being paid out.

KPO's CPF

|

| Age 30, Total CPF ~$150k |

In 2019, we paid the remaining downpayment for our BTO, hence you can see a drop in OA. The plan now is to keep at least $20k in OA as a buffer in the event if we lose our job/income, we can still continue to pay off the housing loan for the next 2-3 years without any worry.

Last year, we also chose to refinance our HDB housing loan to a bank loan for a saving of ~$200 per month. You can read more about it here - My Experience with Mortgage Brokers - Redbrick and iCompareLoan. I also did CPF RSTU (7k to CPF SA) and Voluntary Contribution (VC) to CPF MA for tax optimization.

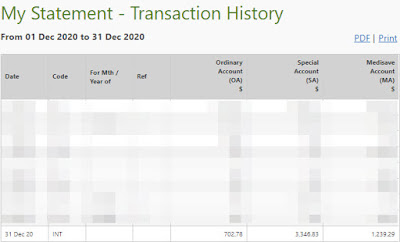

Interest received:

OA - $702.78

SA - $3,346.83

MA - $1,239.29

Total: $5,288.90

CZM's CPF

|

| Age 30, Total CPF ~$170k |

Interest received:

OA - $738.76

SA - $4,152.99

MA - $1,515.94

Total: $6,407.69

Together, the interest received are $11,696.59 :)

Together, the interest received are $11,696.59 :)

Something I like to do, assuming that CZM stopped working now and there will be $0 contribution to her CPF, will she be able to hit the minimum retirement sum? Using a finance calculator and her current SA of $95,347.55, the future value when we are 55 is $244,404.77. Pretty close to the lower bound of the estimation ($231,000 which is compounding the minimum sum at 1%). Guess CZM got to continue to work for a few more years. Hahahaha.

You might be interested in these blog posts too:

- 2017 Net Worth

- Our CPF 2019

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

No comments:

Post a Comment