DBS will be decreasing the Multiplier interest w.e.f 1st August. Most impacted will be those with salary crediting and 1 category (credit card). Surprisingly, DBS has decided to leave the 3 or more categories alone this time round when one would think this group of people are less likely to leave/change their savings account.

Anyway, I took a quick look at the various savings account and felt that the Multiplier is still one of the better savings accounts that do not really encourage/require you to meet a minimum spending per month. However, the low 1%+ interest is really a hard pill to swallow so we have decided to fulfill another category - Investments by starting a $100 monthly/regular savings plan (DBS Invest-Saver) on Nikko STI ETF which will only be recognized for the first 12 consecutive months. Alternatively, you can consider refinancing your housing loan but that is out of the question for us when we refinance a few months ago with UOB - My Experience with Mortgage Brokers - Redbrick and iCompareLoan.

There is really nothing new here. When we blogged about DBS Multiplier + SSBs + Joint Account = Higher Interest! 2 years ago, we decided to take the SSBs bond ladder route because it seems less troublesome and "permanent" but I guess not. lol. Since the SSBs are now useless, we went to redeem all 6 of them in order to partially finance this new plan as well as to hold more cash for the crash/baby whichever comes first. Haha.

If you have not tried redeeming the SSB before, you can take a look above. Honestly, it is not very intuitive as one will have to select the year and month you would like to redeem. To do it correctly, you will have to log in to your CDP in order to view them. Not sure how it is going to work if one were to redeem the incorrect bond, will the $2 admin fee be forfeited?

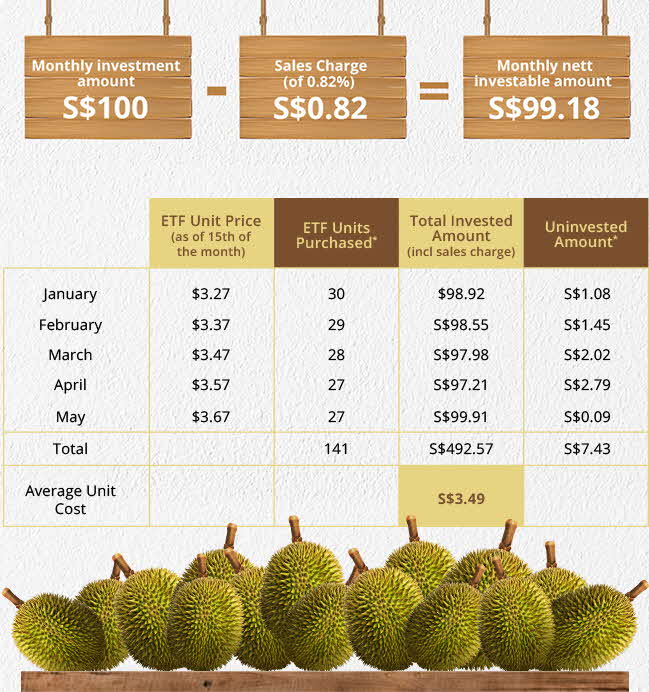

DBS Invest-Saver has a sales charge/fee of 0.82% which is a small price to pay for more interest. Assuming if we have $20k in our savings account, with 1.8% interest, we can get ~$30 by "sacrificing" $0.82 monthly. On the other hand, doing nothing will net us just ~$18 interest with 1.1% interest. Meanwhile, the $99.18 monthly investment might continue to grow too. The only troublesome part is this will only be recognized for the first 12 consecutive months so one will have to take note of its ending period and change to another ETF in order to fulfill the Investments category. Another benefit of fulfilling 2 or more categories is the increase in account balance (from $25k to $50k) that will be eligible for the bonus/higher interest.

In my opinion, DBS will probably nerf/cut the interest for the Multiplier account again in the next few months but it will be targeting those people with 3 or more categories. It is simply unsustainable in this low interest environment. Wait for it, it is definitely coming!

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

Anyway, I took a quick look at the various savings account and felt that the Multiplier is still one of the better savings accounts that do not really encourage/require you to meet a minimum spending per month. However, the low 1%+ interest is really a hard pill to swallow so we have decided to fulfill another category - Investments by starting a $100 monthly/regular savings plan (DBS Invest-Saver) on Nikko STI ETF which will only be recognized for the first 12 consecutive months. Alternatively, you can consider refinancing your housing loan but that is out of the question for us when we refinance a few months ago with UOB - My Experience with Mortgage Brokers - Redbrick and iCompareLoan.

There is really nothing new here. When we blogged about DBS Multiplier + SSBs + Joint Account = Higher Interest! 2 years ago, we decided to take the SSBs bond ladder route because it seems less troublesome and "permanent" but I guess not. lol. Since the SSBs are now useless, we went to redeem all 6 of them in order to partially finance this new plan as well as to hold more cash for the crash/baby whichever comes first. Haha.

If you have not tried redeeming the SSB before, you can take a look above. Honestly, it is not very intuitive as one will have to select the year and month you would like to redeem. To do it correctly, you will have to log in to your CDP in order to view them. Not sure how it is going to work if one were to redeem the incorrect bond, will the $2 admin fee be forfeited?

DBS Invest-Saver has a sales charge/fee of 0.82% which is a small price to pay for more interest. Assuming if we have $20k in our savings account, with 1.8% interest, we can get ~$30 by "sacrificing" $0.82 monthly. On the other hand, doing nothing will net us just ~$18 interest with 1.1% interest. Meanwhile, the $99.18 monthly investment might continue to grow too. The only troublesome part is this will only be recognized for the first 12 consecutive months so one will have to take note of its ending period and change to another ETF in order to fulfill the Investments category. Another benefit of fulfilling 2 or more categories is the increase in account balance (from $25k to $50k) that will be eligible for the bonus/higher interest.

In my opinion, DBS will probably nerf/cut the interest for the Multiplier account again in the next few months but it will be targeting those people with 3 or more categories. It is simply unsustainable in this low interest environment. Wait for it, it is definitely coming!

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

dont worry, i tried redeeming the wrong bond. the last stage of the transaction wont go thru. apparantly they know which bond you have or dont have. so dont wry about losing your money for kopi siew dai

ReplyDeleteHaha. That's good to know. I can only see the $2 admin fee being deducted immediately from my account, didn't know they will refund if it doesn't go through.

Deletemany have stated that it is a strategy to get customers to transact more with the bank by nerfing the base+1, then base+2. this ultimately slowly shift customer to start transacting in one more new category during each nerfing. another possible reason is base+2 is a subset of base+3 customers, and nerfing base+2 will contribute to a higher cost cutting as compared to nerfing base+3. it makes sense to do a change that attribute to greater cost cutting.

ReplyDeleteHaha. The strategy is clearing working! It just doesn't make much sense to stay in 1 category when 2 categories can be easily achieved too. Yeah, but it's just a matter of time before 3 or more categories get nerfed.

Delete