StashAway sent out an email earlier today that they will be re-optimising our portfolio (except the Income portfolio) to an All-Weather strategy. If you are wondering what is this strategy, we will have to go back to their ERAA framework which invests and make asset allocation decisions based on the economic regime.

The All-Weather Portfolio

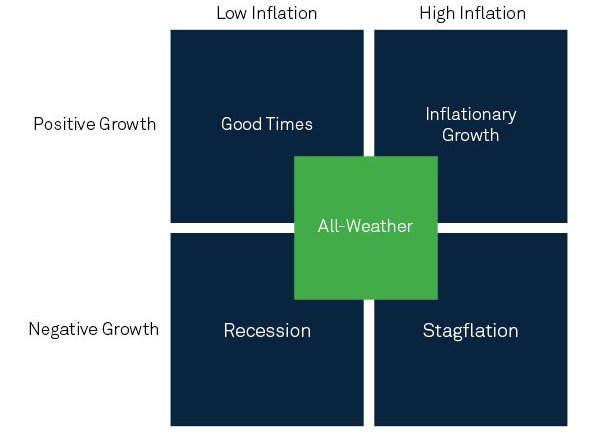

What happens to StashAway portfolios when economic data are not clear? If growth is 0.1%, is this “positive enough” to invest in a growth-oriented portfolio? If growth is negative 0.1%, is the right thing to do to have a defensive portfolio?

In the face of unclear economic data, ERAA® first looks at the momentum (rate of change) of growth and/or inflation to see if there is clear guidance on direction. If the momentum is not solid enough to provide predictive guidance, ERAA® resorts to adjusting clients’ portfolios to an All-Weather strategy that is specifically designed to simultaneously protect capital and perform well in uncertain economic conditions until clarity is once again achieved. The All-Weather portfolios will differ if the uncertainty is relative to growth, relative to inflation, or both.

The key points for the re-optimisation are:

1. Adjusted for Valuation Gaps

2. Decreased US Dollar exposure

3. Introduced Chinese Technology to the ERAA investable universe

4. Increased (or, depending on your portfolio, maintained) exposure to Gold

You can read about them in greater details here but let me show you what will be changing for our portfolio.

KPO and CZM Cash - StashAway Risk Index 22%

There is an increase in bonds.

A decrease in equities. Bye S&P! Hi China Internet ETF! Generally, I think this is an interesting ETF (China + Tech/Internet definitely has lots of potentials) but the expense ratio is unfortunately on the high side (0.76%). If you are interested in the top holdings:

Last but not least, an increase in commodities, gold the safest asset! lol.

KPO SRS - StashAway Risk Index 36%

A decrease in US equities for the riskiest portfolio offered by StashAway.

Increase in international equities. Bye S&P! Hi China Internet ETF!

The introduction of Real Estate (Vanguard Global ex-U.S. Real Estate ETF) and Commodities into the portfolio. The Real Estate ETF has a distribution yield of 9.9% and expense ratio of 0.12%. Not bad.

A decrease in US equities for the riskiest portfolio offered by StashAway.

Increase in international equities. Bye S&P! Hi China Internet ETF!

The introduction of Real Estate (Vanguard Global ex-U.S. Real Estate ETF) and Commodities into the portfolio. The Real Estate ETF has a distribution yield of 9.9% and expense ratio of 0.12%. Not bad.

CZM SRS - StashAway Risk Index 14%

Increase in bonds.

A decrease in equities. S&P is too risky for this portfolio but not the China Internet ETF. lol.

Increase in commodities/gold too.

That's all folks! One of the benefits of a robo-advisor, re-optimisation of your portfolio to reduce your risk at no additional cost.

Anyway, if you are interested in signing up for StashAway, do use our referral link - KPO and CZM Referral Link. You will get $10,000 free management fees for 6 months and we will get $16!

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

No comments:

Post a Comment