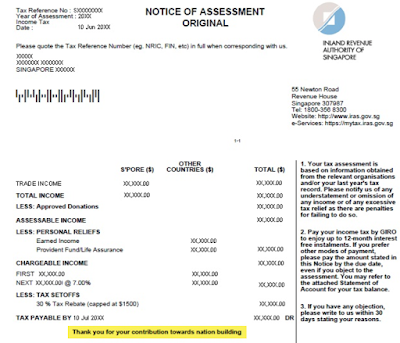

We are close to the end of the 2017 year and have worked for almost another year. In a few months time, we will be thanked "for our contribution towards nation building". lol. I am referring to the income tax.

I have been thinking if I should be doing a CPF RSTU (Retirement Sum Top Up) to lower my tax. It is interesting to see how the facebook finance communities (Seedly Personal Finance Community (SG) and BIGS World - Build Wealth, Live a Good Life) advocates topping up of CPF as compared to my random conversations with my colleagues who almost all showed disgust towards doing it. My colleagues would look at it as though I am crazy and say something along the line of "topping up of CPF is one-way direction, you will never get it out". I would not argue with that statement because it is true to a certain extent.

I double confirm with CPF Board via Facebook messenger and gave them a hypothetical question to ensure that my understanding is correct. As you can see, one will be able to withdraw any amount in excess of FRS (Full Retirement Sum). Based on my FRS forecast, it will probably be around $300,000 when we are 55 years old (28 years later) assuming the FRS continues to increase at a 2-3% rate. I am pretty confident I will be able to exceed FRS if I continue to work and the policy does not change again. lol. My previous article on CPF Milestone ($40k in Special Account) and The Power of Compound Interest assumes that even if I stop working now and do nothing, the SA would have grown to $141,000.

As usual, KPO starts punching various numbers into Google Spreadsheet... The numbers generated are based on KPO's profile who has an earned income $1,000 relief and an NSman $3,000 relief which is group under "Other Reliefs". You can download the spreadsheet and modify the numbers to fit your profile.

The taxable/chargeable income is calculated by deducting the 20% CPF employee contribution and other reliefs against the total annual salary + bonus. The income tax rate would differ accordingly based on the taxable/chargeable income. You can refer to IRAS income tax rates for more information.

A $7,000 CPF RSTU would lower the taxable/chargeable income. When the stars are aligned, one can even have a 100% tax savings! lol. Having said that, it is definitely not feasible when we look at the below table. The amount $7,000 is relative to one person income. To enjoy that $80/100% tax savings, he would have to contribute 25% of his take home pay.

Besides looking at it from a tax saving point of view, one can also look at it from an investment point of view. The dollar tax savings can be treated as a return on investment/dividend. The reason is that I would probably use the $7,000 to buy stock and continue to grow our portfolio. From an investment point of view, the ROI would be equivalent to your income tax rate (most of the time except when you suddenly belongs to a lower tax bracket). On top of that, there is also a guaranteed 4% capital growth (SA interest) year on year. Hence, your guaranteed return for the first year would be your tax rate + 4% interest. The higher your income tax, the higher the return, the lesser it affects your cash flow (take home pay) which is limited to the CPF Annual Limit of $37,740.

To be honest, I have no idea where/how one can find such a high return, risk-free investment elsewhere. The market return may be higher but it is definitely not guaranteed. With this numbers, I am pretty sure what I will be doing. So is it worth it? It depends. Hahahaha. If someone says it is good, it doesn't necessarily mean that it is good for you, you got to make the decision yourself.

You can download a copy of the spreadsheet here - CPF RSTU. Have fun with the spreadsheet and I hope it helps in your tax planning/investment!

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right -->)

|

| NOA Sample from HDB |

I have been thinking if I should be doing a CPF RSTU (Retirement Sum Top Up) to lower my tax. It is interesting to see how the facebook finance communities (Seedly Personal Finance Community (SG) and BIGS World - Build Wealth, Live a Good Life) advocates topping up of CPF as compared to my random conversations with my colleagues who almost all showed disgust towards doing it. My colleagues would look at it as though I am crazy and say something along the line of "topping up of CPF is one-way direction, you will never get it out". I would not argue with that statement because it is true to a certain extent.

I double confirm with CPF Board via Facebook messenger and gave them a hypothetical question to ensure that my understanding is correct. As you can see, one will be able to withdraw any amount in excess of FRS (Full Retirement Sum). Based on my FRS forecast, it will probably be around $300,000 when we are 55 years old (28 years later) assuming the FRS continues to increase at a 2-3% rate. I am pretty confident I will be able to exceed FRS if I continue to work and the policy does not change again. lol. My previous article on CPF Milestone ($40k in Special Account) and The Power of Compound Interest assumes that even if I stop working now and do nothing, the SA would have grown to $141,000.

As usual, KPO starts punching various numbers into Google Spreadsheet... The numbers generated are based on KPO's profile who has an earned income $1,000 relief and an NSman $3,000 relief which is group under "Other Reliefs". You can download the spreadsheet and modify the numbers to fit your profile.

The taxable/chargeable income is calculated by deducting the 20% CPF employee contribution and other reliefs against the total annual salary + bonus. The income tax rate would differ accordingly based on the taxable/chargeable income. You can refer to IRAS income tax rates for more information.

A $7,000 CPF RSTU would lower the taxable/chargeable income. When the stars are aligned, one can even have a 100% tax savings! lol. Having said that, it is definitely not feasible when we look at the below table. The amount $7,000 is relative to one person income. To enjoy that $80/100% tax savings, he would have to contribute 25% of his take home pay.

Besides looking at it from a tax saving point of view, one can also look at it from an investment point of view. The dollar tax savings can be treated as a return on investment/dividend. The reason is that I would probably use the $7,000 to buy stock and continue to grow our portfolio. From an investment point of view, the ROI would be equivalent to your income tax rate (most of the time except when you suddenly belongs to a lower tax bracket). On top of that, there is also a guaranteed 4% capital growth (SA interest) year on year. Hence, your guaranteed return for the first year would be your tax rate + 4% interest. The higher your income tax, the higher the return, the lesser it affects your cash flow (take home pay) which is limited to the CPF Annual Limit of $37,740.

To be honest, I have no idea where/how one can find such a high return, risk-free investment elsewhere. The market return may be higher but it is definitely not guaranteed. With this numbers, I am pretty sure what I will be doing. So is it worth it? It depends. Hahahaha. If someone says it is good, it doesn't necessarily mean that it is good for you, you got to make the decision yourself.

You can download a copy of the spreadsheet here - CPF RSTU. Have fun with the spreadsheet and I hope it helps in your tax planning/investment!

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right -->)

I have done about $10k topup to save on tax but I feel that I would rather have it more liquid. Pretty sure I won't mind so much in the future.

ReplyDeleteIt's not exactly risk-free too. First, it's totally illiquid. Second, there is the risk of policy changes or interest rate risk (the rate is supposed to be tied to government bonds; who knows how long this current arrangement will last.).

My advise is if anyone have inherited the house from parents and don't plan to buy house in future can transfer all from OA to SA to maximise the 5% interest from SA and stay in OA for a mere 2.5% interest. For 100k in SA 20 years time can earn u 100k interest!

DeleteThe tax exemption is for only $7k when you top up your RA/SA. Why do a $10k top up?

DeleteHi owq,

DeleteYou are right, the trade off is the liquidity. As mentioned by unknown, I am pretty surprised as to why you top up $10k. You are losing $3k liquidity for no reason. On the bright side, you are contributing and building your retirement fund :)

No matter how they change the policy, the money is still ours. They can delay it, increase the minimum amount, etc. but we just got to adapt accordingly. I would rather let my money compound and grow then to do nothing, worrying about policy changes or go protest at hong lim park. lol.

Hi Unknown,

DeleteI am not too sure about that advise. I would think inherited houses would have a much shorter lease remaining unless got freehold (shiok). lol.

Transferring OA to SA is definitely recommended but must be done with proper planning! SA 5% (additional 1%) is only for first 40k-60k depending on the OA amount. That's the power of compounding interest!