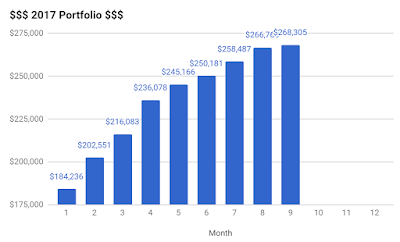

Our portfolio grew by 0.58% to $268,305 - $3,263.93 of capital injection which was partially offset by market moving against us, -$1,723.93! At one glance, the decrease can be mainly attributed to Soilbuild REIT (-$750), Guocoland (-$720) and Capitaland (-$560).

SOLD

- Lippo Malls Trust (4,000 units) @ $0.44 (PnL: $611.81)

Lippo Malls Trust is one of my "legacy" stocks which I have been holding for about 3 years (first purchased on 27-05-2014, back in my university days). If I remembered correctly, I bought it because it had a high dividend yield. lol. Anyway, Heartland Boy wrote an excellent piece on what is going to happen to it - Why Heartland Boy Sold Off Lippo REIT. In short, income support will be ending/ended + negative retail rental reversion will result in DPU dropping and the price will follow suit.

Looking at the above "Closed Details" computed by StocksCafe, the annualized gain is 11.9%. Not too bad ;)

BOUGHT

- SingHoldings (4,400 units) @ $0.395

- STI ETF (1,000 units) @ $3.27

Using the money from the sale of Lippo Malls Trust, I redeployed the capital to SingHoldings. It has a NAV of $0.6375 which is a 38% discount from my entry price. Most of the property/construction stocks have already ran up and this is slightly slower. Assuming if it were to trade at the industry average PB of 0.7585, the price would be around $0.48.

We are supposed to buy 1,000 units of STI ETF every quarter and it was about time.

The total dividends collected this month is $484.72. The breakdown is as follows:

Total dividends collected for 2017: $8,526.92

Average dividends per month for 2017: $710.58

StashAway

Capital: $1,500

Current: $1,503.52 (0.002%)

I forgot to transfer on 2017-09-25 during our vacation and only transferred $500 to StashAway on 2017-10-01. You can refer to the spreadsheet - KPO & CZM StashAway Portfolio VS STI ETF to follow our simulated STI ETF portfolio (opportunity cost of investing using StashAway). Only time will tell which is the better investment...

Health - KPO Needs to Lose Weight

Date: 2017-10-01

Weight: 80.4 kg

BMI: 26.8

SOLD

- Lippo Malls Trust (4,000 units) @ $0.44 (PnL: $611.81)

Lippo Malls Trust is one of my "legacy" stocks which I have been holding for about 3 years (first purchased on 27-05-2014, back in my university days). If I remembered correctly, I bought it because it had a high dividend yield. lol. Anyway, Heartland Boy wrote an excellent piece on what is going to happen to it - Why Heartland Boy Sold Off Lippo REIT. In short, income support will be ending/ended + negative retail rental reversion will result in DPU dropping and the price will follow suit.

Looking at the above "Closed Details" computed by StocksCafe, the annualized gain is 11.9%. Not too bad ;)

BOUGHT

- STI ETF (1,000 units) @ $3.27

Using the money from the sale of Lippo Malls Trust, I redeployed the capital to SingHoldings. It has a NAV of $0.6375 which is a 38% discount from my entry price. Most of the property/construction stocks have already ran up and this is slightly slower. Assuming if it were to trade at the industry average PB of 0.7585, the price would be around $0.48.

We are supposed to buy 1,000 units of STI ETF every quarter and it was about time.

The total dividends collected this month is $484.72. The breakdown is as follows:

| Company | Symbol | ExDate | Shares | Total |

| Asian Pay Television Trust | S7OU | 18-Sep-17 | 5,000 | $81.25 |

| Saizen Real Estate Investment Trust | T8JU | 15-Sep-17 | 8,900 | $303.47 |

| OUE Ltd | LJ3 | 15-Sep-17 | 10,000 | $100 |

Total dividends collected for 2017: $8,526.92

Average dividends per month for 2017: $710.58

StashAway

Capital: $1,500

Current: $1,503.52 (0.002%)

I forgot to transfer on 2017-09-25 during our vacation and only transferred $500 to StashAway on 2017-10-01. You can refer to the spreadsheet - KPO & CZM StashAway Portfolio VS STI ETF to follow our simulated STI ETF portfolio (opportunity cost of investing using StashAway). Only time will tell which is the better investment...

Health - KPO Needs to Lose Weight

Date: 2017-10-01

Weight: 80.4 kg

BMI: 26.8

Hi KPO,

ReplyDeleteWhile waiting for my flight to take off.. I happen to see your post about your updates on your portfolio!! Congratulations on locking your gains for LMIT.

Hi sleepydevil,

DeleteThanks. Safe flight!

Hi KPO,

ReplyDeleteSaizen has been delisted. Existing shareholders are waiting for final payment from the residual value. You got paid in Sep?

Hi Destiny,

DeleteThe Ex Date is on 15/09/2017 and the Pay Date is 02/10/2017 (today)! SCB will take one more day to process the dividend so I should be getting it tomorrow :)