Our portfolio has been doing pretty well but there will always be 老鼠屎 (rat shit) dragging down the overall performance. I am not too worried because I have seen worst. lol.

1. QAF

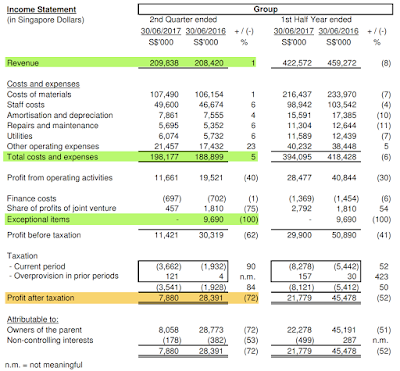

The first thing that came to mind would be the latest quarter result - QAF reports 72% fall in 2Q17 earnings to $8.1 million. I looked at the numbers and it is indeed quite depressing. However, the numbers can be quite misleading.

The numbers highlighted in yellow is where the 72% drop comes from. One has to note that part of the huge drop can be attributed to the one time "Exceptional items" gain due to the sale of 20% stake in Gardenia Bakeries (K.L.) which is missing this quarter. On the bright side, revenue actually increased by 1% which was offset by higher costs/expenses, taxes and a series of unfortunate events:

- Pork prices in the industry have fallen by approximately 20% in the first half of 2017 due to increased competition from the general oversupply situation

- Higher advertising and promotion expense due to launch of new products and heightened competition in the Philippines

- Higher truck rental expense from the increased distribution routes

- Foreign Exchange loss due to the depreciation of the Group’s AUD denominated assets against the Singapore dollar

- and much more. lol.

KPO then spent some time to compile the financial results achieved by QAF in the last 5 years.

Note that QAF has a very low PE in 2016 due to the "Exceptional items" mentioned above which resulted in a much higher EPS. Once excluded, you will see that QAF has been trading at an average PE of 12.931 and average PB of 1.312 from 2012 to 2016.

In the worst case scenario, I will simply assume that the next 2 quarters will be as poor as this quarter (EPS of $0.014) and based on the last closed price of $1.205, the PE will be 17.985 which is pretty high hence the heavy sell down? Will it get worst than this? I dun know but I would hope that higher advertising cost will be translated to higher sales in the next quarter. Furthermore, there is a proposed listing of Rivalea on the Australian Securities Exchange which will result in QAF receiving A$52 million.

Fundamentally, QAF remains to be an excellent business consistently generating free cash flow and rewarding shareholders with suistainable dividends (DPS remains lesser than EPS even in the above worst case scenario).

At what price should one buy QAF then? I dun know. At a price you are comfortable with! Any investment at the right price is a good investment! lol. Buying it at $1.20 would mean you will be looking at a 4.2% dividend yield. Based on the very simplified average PE and PB ratio computed by me, any price between $0.866 and $1.225?

Although I believe more in the numbers, I will end off with a chart. You can see the long term trend is up and QAF is currently at its first support $1.205 and the next support is at $1.15. With 50 MA crossing below 200 MA, it has formed a death cross! Furthermore, the price is now below all the moving averages. Extremely bearish!

This is the google spreadsheet if you want to take a closer look at the numbers. Ending off with numbers still better. lol.

1. QAF

The first thing that came to mind would be the latest quarter result - QAF reports 72% fall in 2Q17 earnings to $8.1 million. I looked at the numbers and it is indeed quite depressing. However, the numbers can be quite misleading.

The numbers highlighted in yellow is where the 72% drop comes from. One has to note that part of the huge drop can be attributed to the one time "Exceptional items" gain due to the sale of 20% stake in Gardenia Bakeries (K.L.) which is missing this quarter. On the bright side, revenue actually increased by 1% which was offset by higher costs/expenses, taxes and a series of unfortunate events:

- Pork prices in the industry have fallen by approximately 20% in the first half of 2017 due to increased competition from the general oversupply situation

- Higher advertising and promotion expense due to launch of new products and heightened competition in the Philippines

- Higher truck rental expense from the increased distribution routes

- Foreign Exchange loss due to the depreciation of the Group’s AUD denominated assets against the Singapore dollar

- and much more. lol.

KPO then spent some time to compile the financial results achieved by QAF in the last 5 years.

Note that QAF has a very low PE in 2016 due to the "Exceptional items" mentioned above which resulted in a much higher EPS. Once excluded, you will see that QAF has been trading at an average PE of 12.931 and average PB of 1.312 from 2012 to 2016.

In the worst case scenario, I will simply assume that the next 2 quarters will be as poor as this quarter (EPS of $0.014) and based on the last closed price of $1.205, the PE will be 17.985 which is pretty high hence the heavy sell down? Will it get worst than this? I dun know but I would hope that higher advertising cost will be translated to higher sales in the next quarter. Furthermore, there is a proposed listing of Rivalea on the Australian Securities Exchange which will result in QAF receiving A$52 million.

Fundamentally, QAF remains to be an excellent business consistently generating free cash flow and rewarding shareholders with suistainable dividends (DPS remains lesser than EPS even in the above worst case scenario).

At what price should one buy QAF then? I dun know. At a price you are comfortable with! Any investment at the right price is a good investment! lol. Buying it at $1.20 would mean you will be looking at a 4.2% dividend yield. Based on the very simplified average PE and PB ratio computed by me, any price between $0.866 and $1.225?

Although I believe more in the numbers, I will end off with a chart. You can see the long term trend is up and QAF is currently at its first support $1.205 and the next support is at $1.15. With 50 MA crossing below 200 MA, it has formed a death cross! Furthermore, the price is now below all the moving averages. Extremely bearish!

This is the google spreadsheet if you want to take a closer look at the numbers. Ending off with numbers still better. lol.

As you correctly pointed out, QAF is trading at roughly 17x PE ... which is historically high. Not sure how this is justifiable given it's anaemic growth. Also the current pork prices have virtually rendered a listing or a sale of Rivalea v difficult. I am of the view that QAF will continue to underperform. Just playing the devil's advocate here.

ReplyDeleteHi Gemini,

DeleteThanks for dropping by and playing the devil's advocate. You are definitely right and I can't deny that. However, given the right price, it would still make a good investment :)

Hi, I am not a pork expert so please take what I say with a HUGE grain of salt.

ReplyDeletePork is a commodity and hence, subject to fluctuations in prices due to market supply and demand. The current low price will not be a permanent feature. I would factor in this fluctuation in the price of QAF before I decide whether or not to make this investment.

Some questions that we can ask ourselves to determine if QAF is a good investment:

- has the management been making strategic moves to increase shareholders' value?

- has the management team been executing on the initiatives that it has promised to undertake in previous annual reports?

- is the current sell-off justified or is it an overreaction?

- what is the reason why QAF interests me as a possible investment in the first place?

My 2-cent worth. Have a good week ahead!

Hi ahwz,

DeleteThank you for leaving your 2 cents! You have bring up some very valid and important questions that every investor should always ask themselves first before making their decision to invest in the company.

Hope you have a great week ahead too :)