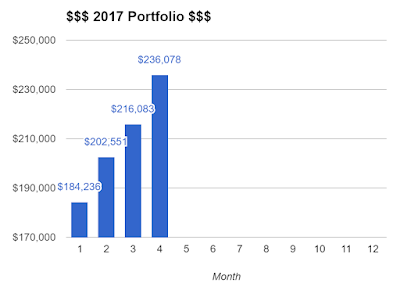

Our portfolio grew by 9.25% this month (through both capital injection and capital gain) bringing it to $236k! Total capital injection YTD (Year Till Date) is $57,818 and capital growth of $11,349. With that we have exceeded our target/goal for the year and we are on track to our 1 million portfolio in 10 years time - refer to Our Goals.

For the month of April, we bought 1 stock (GuocoLand) and subscribed to Ascott REIT rights issue. GuocoLand has a NAV of $2.96 and has been paying dividends ($0.05/$0.08) over the years. This stock was brought to my attention by one of AK's blog post where he gave a detailed analysis over here - Invested in Guocoland with Mr. Quek Leng Chan.

I fully subscribe to Ascott REIT 1,450 rights issue and over subscribe/allocated another 1,150 shares. Based on my last analysis on the rights issue, I was previously sitting on a loss of -$395.62 (-6.66%). However, as of the last closing price ($1.11), I am currently sitting on a gain of +325.98 (+3.91%). That is how it is, up and down, there is no need to be too affected by the volatility of the stock price.

For the month of April, we bought 1 stock (GuocoLand) and subscribed to Ascott REIT rights issue. GuocoLand has a NAV of $2.96 and has been paying dividends ($0.05/$0.08) over the years. This stock was brought to my attention by one of AK's blog post where he gave a detailed analysis over here - Invested in Guocoland with Mr. Quek Leng Chan.

I fully subscribe to Ascott REIT 1,450 rights issue and over subscribe/allocated another 1,150 shares. Based on my last analysis on the rights issue, I was previously sitting on a loss of -$395.62 (-6.66%). However, as of the last closing price ($1.11), I am currently sitting on a gain of +325.98 (+3.91%). That is how it is, up and down, there is no need to be too affected by the volatility of the stock price.

BOUGHT

- GuocoLand (9,000 units) @ $1.85

- Ascott REIT (2,600 units) @ $0.919 [Total units: 7,600 units]

The total dividends collected this month is $678.40. The breakdown is as follows:

- CapitaLand Mall Trust - $81.90

- First REIT - $149.80

- Soilbuild Business Space REIT - $446.70

- Soilbuild Business Space REIT - $446.70

Total dividends collected for 2017: $2771.01

Average dividends per month for 2017: $230.92

[Sneak Peek] May will be an excellent month for dividends! StocksCafe is showing me $1,183.75 as of now xD

Average dividends per month for 2017: $230.92

[Sneak Peek] May will be an excellent month for dividends! StocksCafe is showing me $1,183.75 as of now xD

No comments:

Post a Comment