About a year ago, we made the decision to invest $1,000 every month on Lion-Phillip S-REIT ETF after it was announced in the Singapore Budget 2018 that REIT ETFs will be able to enjoy tax transparency (withholding tax of 17%) - New Singapore Budget, New REIT Strategy!

We have sold all 12,000 units of Lion-Phillip S-REIT ETF after doing a review and concluded that it is unable to meet our target dividend yield of 5%. After holding it for 300+ days and including all the dividends collected, the total annualized return should be around ~7-10%. Seems like there is a bug with the computation of average days leading to incorrect annualized return...

The tax transparency took effect on or after 1st July 2018 and I have been waiting for the latest dividend to make a more accurate estimation of its yield. The latest dividend that was declared in January 2019 for the period from 01/08/2018 to 31/12/2018 (153 days) was $0.0211. The annualized dividend will be ($0.0211 / 153 * 365) ~ $0.05034.

Using the 52 weeks high and low price, the dividend yield will be between the following:

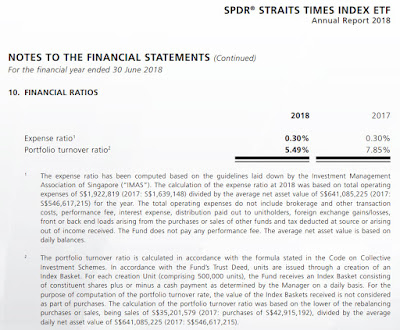

The expense ratio was unavailable in the initial prospectus (indicated to be around 0.5%) but can now be seen in their Semi-Annual Report and it turns out to be higher at 0.59%. In addition, it does not include brokerage and other transactions costs. Now if we were to look at the portfolio turnover ratio, it is also very high at 34.01%. The portfolio turnover ratio is a measure of how frequently assets within a fund are bought and sold by the managers. Let's compare this with SPDR STI ETF ratios.

In comparison, both the expense ratio and the portfolio turnover ratio of Lion-Phillip S-REIT ETF are much higher. With such a high portfolio turnover ratio, the brokerage fees involved should be quite significant but is not reflected in the expense ratio.

Interestingly, with the high turnover ratio, Lion-Philip S-REIT ETF still has a higher tracking error as compared to SPDR STI ETF based on data from trackinsight.

If you think STI ETF isn't a fair comparison, you can take a look at the tracking error/difference for the other 2 REITs ETF:

- Phillip SGX APAC Dividend Leaders REIT ETF

- Nikko AM StraitsTrading Asia ex Japan REIT ETF

It just didn't look like a well-managed ETF with a relatively high (hidden) cost.

Bye Lion-Phillip S-REIT ETF!

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

We have sold all 12,000 units of Lion-Phillip S-REIT ETF after doing a review and concluded that it is unable to meet our target dividend yield of 5%. After holding it for 300+ days and including all the dividends collected, the total annualized return should be around ~7-10%. Seems like there is a bug with the computation of average days leading to incorrect annualized return...

The tax transparency took effect on or after 1st July 2018 and I have been waiting for the latest dividend to make a more accurate estimation of its yield. The latest dividend that was declared in January 2019 for the period from 01/08/2018 to 31/12/2018 (153 days) was $0.0211. The annualized dividend will be ($0.0211 / 153 * 365) ~ $0.05034.

Using the 52 weeks high and low price, the dividend yield will be between the following:

High: 1.042 ---> 0.05034 / 1.042 ~ 4.83%

Low: 0.944 ---> 0.05034 / 0.944 ~ 5.33%The expense ratio was unavailable in the initial prospectus (indicated to be around 0.5%) but can now be seen in their Semi-Annual Report and it turns out to be higher at 0.59%. In addition, it does not include brokerage and other transactions costs. Now if we were to look at the portfolio turnover ratio, it is also very high at 34.01%. The portfolio turnover ratio is a measure of how frequently assets within a fund are bought and sold by the managers. Let's compare this with SPDR STI ETF ratios.

In comparison, both the expense ratio and the portfolio turnover ratio of Lion-Phillip S-REIT ETF are much higher. With such a high portfolio turnover ratio, the brokerage fees involved should be quite significant but is not reflected in the expense ratio.

|

| Lion-Phillip S-REIT ETF |

|

| SPDR STI ETF |

- Phillip SGX APAC Dividend Leaders REIT ETF

- Nikko AM StraitsTrading Asia ex Japan REIT ETF

Bye Lion-Phillip S-REIT ETF!

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

Its very simple. The index is not market cap weighted, resuĺting in high turnover. Higher fees due to "smart" index, which also have high turnover. Seriously we need a sg version of vanguard to shake things up.

ReplyDeleteHi,

DeleteOps, I forgot to check my comment section. Why are you using assi's name? lol

7-10% annualised looks correct, including capital gains.

ReplyDeleteHi JD,

DeleteOps, I forgot to check my comment section. Yeah. The annualized return is 10.3%!

Hi KPO and CZM, thanks for the post and analysis on Lion-Phillip S-REIT ETF. I was originally seriously pondering whether wanted to diversify further my current portfolio by going into the Phillips REIT fund. But did not know the dividend yield is so low and the high expenses for this fund. Looks like have to wait for some better REIT ETF funds setup.

ReplyDeleteHi Blade Knight,

DeleteOps, I forgot to check my comment section. Not sure if there will ever be one if lower expenses. If only there were a REITs ETF that pays out dividend monthly! Hahaha.

They were just offloading the reits bought cheap years ago into an ETF at higher prices for IPO when market rally to naive investors.

ReplyDeleteHi Henry,

DeleteOps, I forgot to check my comment section. Point taken that we are one of those "naive" investors. lol.

Anyway, if one chooses to use a REITs ETF to diversify the risk and have it manage by others, then it is only natural that the fees will be higher.

If the ETF is just for S-REIT, why should people buy it? We can do it ourselves with reasonable judgment locally. Why not save the admin & various expenses? For example, it would give me better reason to diversify into Asia Pacific region (for catching the relatively higher economic growth) & engage the use of ETF fund manager if I am not confident of how to pick investments in Australian market. Meanwhile, I think it is a bit misleading (literally correct but ethically wrong) for Lion-Phillip ETF to claim that it is the 1st Singapore ETF to invest in S-REIT. No doubt there was at least another REIT ETF listed earlier in Oct 2016 embracing S-REIT as well as regional countries' dividend leaders.

ReplyDeleteIt is almost always not cost effective to do it ourselves. End of the day, it is just different product for different people. There will be people that prefer this REIT ETF because it is purely just S-REIT which was why we got it previously. Nothing is perfect! Just do whatever that suits your style :)

Delete