Update - We are no longer buying REIT ETF. Read this instead - Lion-Phillip S-REIT ETF - High Cost and Low Yield

Apart from the increase in GST and the government ang bao (red packet), one thing that really interest us is the extended tax transparency treatment of Singapore listed REITs (Real Estate Investment Trusts) to ETFs (Exchange Traded Funds) - Singapore Budget 2018: Reit ETFs to enjoy tax transparency. In short, this means that the REITs ETFs will no longer have to pay the 17% tax and the dividend yield will increase significantly! I blogged about 3rd REIT ETF - Lion-Phillip S-REIT ETF previously and how we will give it a miss because of the tax and its impact on the estimated yield.

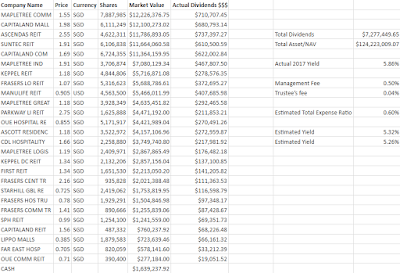

As usual, I took some time off and played with the numbers. Interestingly, the holdings are slightly different as compared to its IPO. You can look at the google spreadsheet here if the picture is too small. The indicative holdings (as of 23rd Feb 2018) are obtained from the Lion Global Lion-Phillip S-REIT ETF website.

The estimated (using 2017 full year dividends) yield is around the same at 5.86%. Assuming that the total expense ratio for a year is around 0.6%, the dividend yield would be 5.26% if one were to purchase the ETF at its NAV of $0.999. At the point of calculation, the ETF closed at $1.015 with a CD status and will XD on 2nd Mar 2018 with $0.0168 dividend. $0.999 + $0.0168 ~ $1.0158. Do note that this is only an estimation and the dividend yield will definitely be lower for this year because the tax transparency will only take effect on/after 1st July 2018. Having said that, we would be expecting at least 5% dividend yield in FY 2019 onwards which brings me to our new strategy!

As some of the readers may know, we have a mutual/common fund called KPO Fund (surprise, surprise) where we were contributing $1,000 each every month. You can read more about it here - Managing Finances As A Couple. The fund is divided into "Expenses" and "Investments" where we put $1,000 into each monthly. With the promotion and pay bump (Salary - You Are Your Best Investment), we have decided to increase our contribution to $1,500 each every month. However, we agreed that our expenses should not increase hence the monthly contribution has become $1,000 to "Expenses" and $2,000 to "Investments".

The $2,000 can be further broken down into $1,000 to StashAway - Automating Capital Growth Through StashAway and $1,000 to Lion-Phillip S-REIT ETF! Hopefully, we will be able to remove the emotional side and properly DCA (Dollar Cost Averaging) Lion-Phillip S-REIT ETF on a monthly basis. We are supposed to DCA STI ETF on a quarterly basis but that has not been very successful. lol. With that, we bought 2,000 units of Lion-Phillip S-REIT ETF @ $1.016 today. Our "Investments" fund had ~$2,000 and we decided to fully utilize it :)

What is your strategy?

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

Apart from the increase in GST and the government ang bao (red packet), one thing that really interest us is the extended tax transparency treatment of Singapore listed REITs (Real Estate Investment Trusts) to ETFs (Exchange Traded Funds) - Singapore Budget 2018: Reit ETFs to enjoy tax transparency. In short, this means that the REITs ETFs will no longer have to pay the 17% tax and the dividend yield will increase significantly! I blogged about 3rd REIT ETF - Lion-Phillip S-REIT ETF previously and how we will give it a miss because of the tax and its impact on the estimated yield.

As usual, I took some time off and played with the numbers. Interestingly, the holdings are slightly different as compared to its IPO. You can look at the google spreadsheet here if the picture is too small. The indicative holdings (as of 23rd Feb 2018) are obtained from the Lion Global Lion-Phillip S-REIT ETF website.

The estimated (using 2017 full year dividends) yield is around the same at 5.86%. Assuming that the total expense ratio for a year is around 0.6%, the dividend yield would be 5.26% if one were to purchase the ETF at its NAV of $0.999. At the point of calculation, the ETF closed at $1.015 with a CD status and will XD on 2nd Mar 2018 with $0.0168 dividend. $0.999 + $0.0168 ~ $1.0158. Do note that this is only an estimation and the dividend yield will definitely be lower for this year because the tax transparency will only take effect on/after 1st July 2018. Having said that, we would be expecting at least 5% dividend yield in FY 2019 onwards which brings me to our new strategy!

As some of the readers may know, we have a mutual/common fund called KPO Fund (surprise, surprise) where we were contributing $1,000 each every month. You can read more about it here - Managing Finances As A Couple. The fund is divided into "Expenses" and "Investments" where we put $1,000 into each monthly. With the promotion and pay bump (Salary - You Are Your Best Investment), we have decided to increase our contribution to $1,500 each every month. However, we agreed that our expenses should not increase hence the monthly contribution has become $1,000 to "Expenses" and $2,000 to "Investments".

The $2,000 can be further broken down into $1,000 to StashAway - Automating Capital Growth Through StashAway and $1,000 to Lion-Phillip S-REIT ETF! Hopefully, we will be able to remove the emotional side and properly DCA (Dollar Cost Averaging) Lion-Phillip S-REIT ETF on a monthly basis. We are supposed to DCA STI ETF on a quarterly basis but that has not been very successful. lol. With that, we bought 2,000 units of Lion-Phillip S-REIT ETF @ $1.016 today. Our "Investments" fund had ~$2,000 and we decided to fully utilize it :)

What is your strategy?

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)