Update - We are no longer buying REIT ETF. Read this instead - Lion-Phillip S-REIT ETF - High Cost and Low Yield

Apart from the increase in GST and the government ang bao (red packet), one thing that really interest us is the extended tax transparency treatment of Singapore listed REITs (Real Estate Investment Trusts) to ETFs (Exchange Traded Funds) - Singapore Budget 2018: Reit ETFs to enjoy tax transparency. In short, this means that the REITs ETFs will no longer have to pay the 17% tax and the dividend yield will increase significantly! I blogged about 3rd REIT ETF - Lion-Phillip S-REIT ETF previously and how we will give it a miss because of the tax and its impact on the estimated yield.

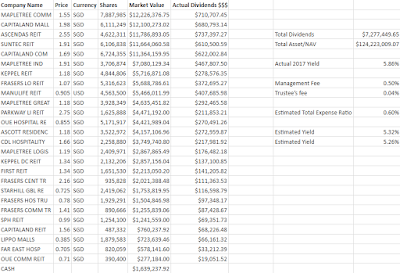

As usual, I took some time off and played with the numbers. Interestingly, the holdings are slightly different as compared to its IPO. You can look at the google spreadsheet here if the picture is too small. The indicative holdings (as of 23rd Feb 2018) are obtained from the Lion Global Lion-Phillip S-REIT ETF website.

The estimated (using 2017 full year dividends) yield is around the same at 5.86%. Assuming that the total expense ratio for a year is around 0.6%, the dividend yield would be 5.26% if one were to purchase the ETF at its NAV of $0.999. At the point of calculation, the ETF closed at $1.015 with a CD status and will XD on 2nd Mar 2018 with $0.0168 dividend. $0.999 + $0.0168 ~ $1.0158. Do note that this is only an estimation and the dividend yield will definitely be lower for this year because the tax transparency will only take effect on/after 1st July 2018. Having said that, we would be expecting at least 5% dividend yield in FY 2019 onwards which brings me to our new strategy!

As some of the readers may know, we have a mutual/common fund called KPO Fund (surprise, surprise) where we were contributing $1,000 each every month. You can read more about it here - Managing Finances As A Couple. The fund is divided into "Expenses" and "Investments" where we put $1,000 into each monthly. With the promotion and pay bump (Salary - You Are Your Best Investment), we have decided to increase our contribution to $1,500 each every month. However, we agreed that our expenses should not increase hence the monthly contribution has become $1,000 to "Expenses" and $2,000 to "Investments".

The $2,000 can be further broken down into $1,000 to StashAway - Automating Capital Growth Through StashAway and $1,000 to Lion-Phillip S-REIT ETF! Hopefully, we will be able to remove the emotional side and properly DCA (Dollar Cost Averaging) Lion-Phillip S-REIT ETF on a monthly basis. We are supposed to DCA STI ETF on a quarterly basis but that has not been very successful. lol. With that, we bought 2,000 units of Lion-Phillip S-REIT ETF @ $1.016 today. Our "Investments" fund had ~$2,000 and we decided to fully utilize it :)

What is your strategy?

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

Apart from the increase in GST and the government ang bao (red packet), one thing that really interest us is the extended tax transparency treatment of Singapore listed REITs (Real Estate Investment Trusts) to ETFs (Exchange Traded Funds) - Singapore Budget 2018: Reit ETFs to enjoy tax transparency. In short, this means that the REITs ETFs will no longer have to pay the 17% tax and the dividend yield will increase significantly! I blogged about 3rd REIT ETF - Lion-Phillip S-REIT ETF previously and how we will give it a miss because of the tax and its impact on the estimated yield.

As usual, I took some time off and played with the numbers. Interestingly, the holdings are slightly different as compared to its IPO. You can look at the google spreadsheet here if the picture is too small. The indicative holdings (as of 23rd Feb 2018) are obtained from the Lion Global Lion-Phillip S-REIT ETF website.

The estimated (using 2017 full year dividends) yield is around the same at 5.86%. Assuming that the total expense ratio for a year is around 0.6%, the dividend yield would be 5.26% if one were to purchase the ETF at its NAV of $0.999. At the point of calculation, the ETF closed at $1.015 with a CD status and will XD on 2nd Mar 2018 with $0.0168 dividend. $0.999 + $0.0168 ~ $1.0158. Do note that this is only an estimation and the dividend yield will definitely be lower for this year because the tax transparency will only take effect on/after 1st July 2018. Having said that, we would be expecting at least 5% dividend yield in FY 2019 onwards which brings me to our new strategy!

As some of the readers may know, we have a mutual/common fund called KPO Fund (surprise, surprise) where we were contributing $1,000 each every month. You can read more about it here - Managing Finances As A Couple. The fund is divided into "Expenses" and "Investments" where we put $1,000 into each monthly. With the promotion and pay bump (Salary - You Are Your Best Investment), we have decided to increase our contribution to $1,500 each every month. However, we agreed that our expenses should not increase hence the monthly contribution has become $1,000 to "Expenses" and $2,000 to "Investments".

The $2,000 can be further broken down into $1,000 to StashAway - Automating Capital Growth Through StashAway and $1,000 to Lion-Phillip S-REIT ETF! Hopefully, we will be able to remove the emotional side and properly DCA (Dollar Cost Averaging) Lion-Phillip S-REIT ETF on a monthly basis. We are supposed to DCA STI ETF on a quarterly basis but that has not been very successful. lol. With that, we bought 2,000 units of Lion-Phillip S-REIT ETF @ $1.016 today. Our "Investments" fund had ~$2,000 and we decided to fully utilize it :)

What is your strategy?

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

how abt the philips reits ETFs? compared to the lion-philip reit etf...

ReplyDeleteand does this new tax rule, affect the philips reits etf too?

Hi foolish chameleon,

DeleteIt affects Phillip SGX APAC Dividend Leaders REIT ETF too but to a much smaller extend. The tax transparency is only for REITs listed on SGX. Phillip SGX APAC Dividend Leaders REIT ETF has REITs from other countries right?

Took a quick look and these are the top 5 holdings:

Link REIT 10.98% HongKong

Scentre Group 9.16% Australia

Westfield Corp 7.85% Australia

Stockland 7.39% Australia

Vicinity Centres 6.07% Australia

None of them from SG. lol.

yikes... ok.. so there is no effect on the phillips ETF.

Deletebut i guess the strategy is different for both etfs, since their components are different too.

There is... Just not as much as Lion-Phillip S-REIT ETF.

DeleteHi, do you feel that the management fees are a tad too high? Even if we compare to the STI ETF (G3B and ES3), the fees for this REIT ETF are almost double, taking quite a big of the dividends (practically 10% of the yield even after the 17% DWT is removed). Was looking to invest in this as a 'lazy' option but was concerned about the fees!

ReplyDeleteHi Jia Ying,

DeleteHahahaha. There will always be cheaper alternatives in life right? Investing in STI ETF vs REIT ETF is different to begin with. STI ETF gives market return while REIT ETF give you passive income. I can also argue that 0.6% is cheaper than StashAway at 0.8% but we know they are different.

Like you pointed out yourself, investing in REIT ETF is not only the 'lazy' option, it is also the safer option. What if I suay suay pick/buy 1 REIT and it happens to be the next Sabana REIT? One does not have to worry if he/she is investing in a ETF which is diversified into multiple REITs. Lastly, there is no free lunch, 'lazy' means pay more fees :) CZM and I are perfectly fine with the fees.

This comment has been removed by the author.

DeleteOops deleted my post cos I left out something. Firstly, I see, that is true! I am leaning quite towards index/lazy investing, and the point about safety is very relevant for REITs given some examples such as the one you mentioned. I will do more research before deciding about this, thanks a lot! But in the meantime, do you know about how they settle rights issues, and are you concerned with issues such as low trading liquidity? I am unsure about the rights issues part, but regarding low liquidity I was wondering if, as a long-term investor, that would be a smaller issue or even a non-issue. Also, do you have opinions vs. the other REIT ETFs, given that they are not S-REIT-only and hence may already be taxed at source? Thanks!

DeleteNo problem! I believe they will/should subscribe to whatever rights issues that is allocated (to avoid diluting the existing holdings), as to whether they will oversubscribe, I have no idea.

DeleteI am not concern with the low trading liquidity. To be fair, it is a very new ETF and it is not that bad compared to some stocks I have seen. I can see the units increasing overtime and with the tax transparency announced in the 2018 budget, I am guessing it will get better. Long term wise, I would like to think it is a non-issue :)

As for your last question, you answered it yourself! Hahaha. Apart from saving on fees, avoiding the 17% tax would be more ideal hence we are only looking at Lion-Phillip S-REIT ETF and not the other REIT ETFs.

Hi,

Deleteregarding the rights issues.

where is the ETF going to get the funds to take up the rights?

Honestly, I have no idea how they are going to do it but a few guesses would be selling other REITs to rebalance the whole portfolio or using the cash on hand. If you look at the indicative holdings, you will see that they do hold cash and it is calculated into its NAV.

DeleteI like the idea of investing in Lion Global Lion-Phillip S-REIT ETF for passive income even though its attract more fees than buying individual reit where i would need to invest my precious time to gain just slightly higher return. I rather invest my time in hunting for US stocks generally much higher return. While doing so, i have reit etf to generate passive income for future to pay my bills etc when I retired as soon as I could afford to do so.

ReplyDeleteExactly, you brought up a very valid point! There will always be trade-off and time is definitely much more valuable! One would no longer have to worry about those corporate actions when buying/investing in the REIT ETF.

DeleteGood to know that the 17% tax is removed. I'm also interested in doing DCA on Lion Global Lion-Phillip S-REIT ETF. Could you recommend a good broker which I can my this ETF monthly?

ReplyDeleteHi Dean,

DeleteA good broker is pretty subjective. You got to research and decide yourself. Personally, I think that cost/commission might be an issue since there isn't any regular savings plan at the moment. A typical cash upfront account charges around $10 minimum commission per transaction while the others can go as high as $20-$25 minimum commission. Alternatively, one can DCA every quarter instead of every month.

We can do it easily because we are using SCB Priority Online Trading Platform and the commission is at 0.18% (without any minimum commission).

I did a research after I post this comment. I found that Maybank Kim eng and poems both provide regular savings plan. I will also look into SCB Priority Online Trading Platform.

DeleteThis comment has been removed by the author.

ReplyDelete