We have decided to invest more money (from $500 to $1,000 monthly) through StashAway since January 2018 and I blogged about it here - Automating Capital Growth Through StashAway.

1. ACCOUNT SUMMARY (as of the last day of the month)

Based on the statement (31 May 2018), we gain $103.29. It has been a while since we see green green. Like I always say, the market goes up and down, as long as your investment horizon is long enough, it will become green :)

3. TRANSACTIONS

SGD $990.00 converted to USD $738.54 (USD $745.45 last month)

Exchange Rate: 1.3405 (1.3280 last month)

4. FEE CALCULATIONS

There will be no fee until August 2018 because I recommended some friend. Interestingly, we can see the GST stated as being absorbed by StashAway explicitly in this month statement. Not sure how it works but investors will not complain as long as they are not asked to pay more fees.

The actual fee as stated is based on the monthly-average assets SGD $7,267.86 x 0.8% / 365 days * 31 days = $4.94

StashAway VS STI ETF

Since there is no way to compare the performances among the robo-advisors, I came out with a spreadsheet to track our StashAway portfolio performance (General Investing - Risk Level 28) against that of STI ETF which I will be updating on a monthly basis. For simplicity, I shall assume that one can either invest in Nikko STI ETF using POSB Invest-Saver or invest in Nikko STI ETF/SPDR STI ETF using SCB Priority Online Trading (no minimum commission). These would be the opportunity costs while we continue to invest in StashAway.

Apart from the absolute P&L, we should also look at the Reward-to-Risk Ratio where risk/volatility is taken into account. For more information, do read StashAway Clarifications - Reward-to-Risk Ratio. StashAway has the highest ratio of 1.25 which is significantly higher than the other 2 STI ETFs (< 0.4). Let me quote Freddy Lim (Co-Founder & Chief Investment Officer of StashAway), "for every dollar of risk taken, StashAway P28 is producing 1.25 times the return".

This month commentary: In terms of both absolute return and XIRR, investing in either ETF through SCB priority online trading is giving higher returns. If you look closely at the fees paid by POSB Invest-Saver ($80+) as compared to the others at $20+, it simply shows why fees matter when it comes to investing. Having said that, the difference of $4 in fees between StashAway and SCB has minimum impact on the return for now...

Going forward will be pretty interesting because the commissions/fees incurred by StashAway are now greater than SCB Priority Online Trading and the difference will only continue to get bigger. This will be a battle between cheaper/lesser fees and asset allocation/diversification...

You might be interested in last month update too - StashAway April 2018.

I believe there is a need to redo/regenerate the volatility used to compute the Reward-to-Risk Ratio. Do take it with a pinch of salt for now. I have been compiling some data in order to do so :) Below is a sneak peek into the side project I have been working on (in case you missed it when I shared it in my previous post)!

Which is the best? Only time will tell :)

This is the link to our spreadsheet - KPO & CZM StashAway Portfolio VS STI ETF which I have also added to Our Portfolio page.

StashAway Referral Link for Our Readers

Here you go: KPO and CZM Referral Link

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right -->)

1. ACCOUNT SUMMARY (as of the last day of the month)

Based on the statement (31 May 2018), we gain $103.29. It has been a while since we see green green. Like I always say, the market goes up and down, as long as your investment horizon is long enough, it will become green :)

As of 6 Jun 2018, we gain $132.06 mostly from investment returns with a negative currency impact of -$1.25. Yay! In our last monthly update, I said that I would have preferred the USD to be weaker because we will be going to the US for our honeymoon. Weaker USD meant that we can convert the same SGD for more USD to invest too.

SGD time-weighted returns: 3.8%

USD time-weighted returns: 3.9%

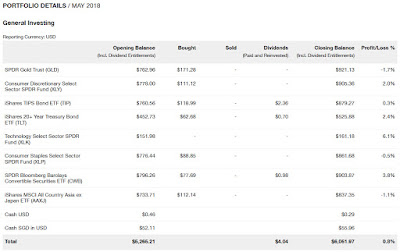

2. PORTFOLIO DETAILS USD time-weighted returns: 3.9%

3. TRANSACTIONS

SGD $990.00 converted to USD $738.54 (USD $745.45 last month)

Exchange Rate: 1.3405 (1.3280 last month)

4. FEE CALCULATIONS

There will be no fee until August 2018 because I recommended some friend. Interestingly, we can see the GST stated as being absorbed by StashAway explicitly in this month statement. Not sure how it works but investors will not complain as long as they are not asked to pay more fees.

The actual fee as stated is based on the monthly-average assets SGD $7,267.86 x 0.8% / 365 days * 31 days = $4.94

StashAway VS STI ETF

Since there is no way to compare the performances among the robo-advisors, I came out with a spreadsheet to track our StashAway portfolio performance (General Investing - Risk Level 28) against that of STI ETF which I will be updating on a monthly basis. For simplicity, I shall assume that one can either invest in Nikko STI ETF using POSB Invest-Saver or invest in Nikko STI ETF/SPDR STI ETF using SCB Priority Online Trading (no minimum commission). These would be the opportunity costs while we continue to invest in StashAway.

Apart from the absolute P&L, we should also look at the Reward-to-Risk Ratio where risk/volatility is taken into account. For more information, do read StashAway Clarifications - Reward-to-Risk Ratio. StashAway has the highest ratio of 1.25 which is significantly higher than the other 2 STI ETFs (< 0.4). Let me quote Freddy Lim (Co-Founder & Chief Investment Officer of StashAway), "for every dollar of risk taken, StashAway P28 is producing 1.25 times the return".

This month commentary: In terms of both absolute return and XIRR, investing in either ETF through SCB priority online trading is giving higher returns. If you look closely at the fees paid by POSB Invest-Saver ($80+) as compared to the others at $20+, it simply shows why fees matter when it comes to investing. Having said that, the difference of $4 in fees between StashAway and SCB has minimum impact on the return for now...

Going forward will be pretty interesting because the commissions/fees incurred by StashAway are now greater than SCB Priority Online Trading and the difference will only continue to get bigger. This will be a battle between cheaper/lesser fees and asset allocation/diversification...

You might be interested in last month update too - StashAway April 2018.

I believe there is a need to redo/regenerate the volatility used to compute the Reward-to-Risk Ratio. Do take it with a pinch of salt for now. I have been compiling some data in order to do so :) Below is a sneak peek into the side project I have been working on (in case you missed it when I shared it in my previous post)!

Which is the best? Only time will tell :)

This is the link to our spreadsheet - KPO & CZM StashAway Portfolio VS STI ETF which I have also added to Our Portfolio page.

StashAway Referral Link for Our Readers

Here you go: KPO and CZM Referral Link

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right -->)

No comments:

Post a Comment