I first blogged/explored the possibility of using it in 2018 (

Leverage - A Double-Edged Sword) but only took the plunge and used it (

SCB Wealth Lending) last year and it has been working well for us so far. I am not recommending the use of it but just wanted to share how we are using/risking to build wealth.

Anyway, there are 2 types of loans one can take - secured and unsecured loans. Unsecured loans are basically your credit card or a personal/renovation loan where you are borrowing without pledging any collateral. Since there's no collateral, the risk is higher for the bank, hence the interest will be higher. On the other hand, secured loans have a much lower interest because one is borrowing by pledging collateral which can be in any form (cash, insurance, stocks, private property, etc.). Ours is a secured loan where we pledge our stocks at an average LTV of 70%. What this means is for every 100k of stocks pledge, we can borrow up to 70k SGD at a fixed rate (1.5%) + 1-month SIBOR (~0.25%) or EUR at a fixed rate (1%) + 1-month LIBOR (~0.11%).

This is how much we have borrowed about ~15,000 euro and ~SG$85,000 (including $20,000 that is put into Singlife for 2.5% interest and ~$30,000 early this year to invest into ParkwayLife REIT, Mapletree Commercial Trust, and Mapletree Industrial Trust). Technically, we borrowed ~15,000 euro and ~SG$35,000 or ~SG$60,000 in total during 2020 to invest.

It is still relatively safe because our portfolio/the stocks we pledged would have to fall by ~59% before we trigger the first level of margin call where we will have to top up the account within the next 30 days before the stocks are being forced sell. Having said that, I think another risk that is not within our control is the bank changing/adjusting the LTV % of the stocks. I have seen it happening during March where some of them went from 70% LTV to 60% or lower.

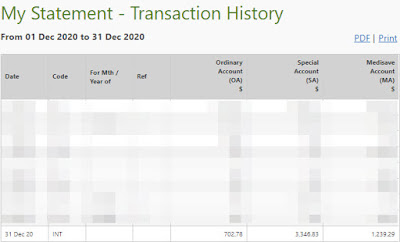

Anyway, this is our current leverage portfolio. Let's just ignore ParkwayLife REIT, Mapletree Commercial Trust, and Mapletree Industrial Trust since they were invested only this year. The total dividends received is

SG$1,936.03 while the total interest paid is

SG$374.45. We get to keep the difference of

SG$1,561.58 which is

~417% return. In addition, we are sitting on an unrealized profit of

SG$12,606.28. Using the interest as the cost of investment, the total return would be

SG$14,167.86 which is

~3783%. Woots, what an insane return (even Tesla (

743.44%)/Bitcoin (

302.8%) can't beat that. lol)! The power of leverage. Of course, it works both ways.

The above is tracked using StocksCafe and you can see that the current leverage portfolio is generating a yield of ~5%. As long as the interest remains low (1-2%), we will continue to use this strategy to grow our wealth. Given that Singlife has recently reduced its interest to 2% (1.5% + 0.5%) from 2.5%, we are likely to withdraw everything to either invest or pay back to the loan once the bonus 0.5% is gone in June. Tip - Topping up Revolut using Singlife debit card is an eligible spending. So what we are doing is Singlife -> Revolut -> StashAway/Syfe.

I would think this is another benefit/advantage of achieving SCB priority status besides lower/no minimum commission. Hope you find this interesting!

If you are interested in the smart portfolio tracker (

StocksCafe) which I am using as shown above, sign up using my link for a longer trial period :) Refer to our

Referrals page for more information.

Do like any of the following for the latest update/post!

1. FB Page -

KPO and CZM2. Twitter -

KPO and CZM3. Click

here to subscribe using email :)

4. Instagram -

KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)