With the Phase 2 Heightened Alert, my parents have offered to take care of Baby Ong instead of us having to continue to send her to the infant care. We are very appreciative because being able to work from home again just makes things so much more convenient and less tiring. Imagine waking up at 8am vs 6am to prepare for work and send her to infant care as well as the time spent on commuting. Hopefully, the COVID situation will improve and easing will happen after the 13th June.

While compiling our portfolio snapshot for May, I noticed that I have inflated April's number by including Accordia Golf Trust which has already been delisted and I blame SCB for including it in my monthly statement after so long. The actual number should have been $946,521 - $10,875 = $935,646.

Anyway, our portfolio reaches another new high! It increased by 1.84% to $952,839 - $35,250 of capital injection (mostly came from the US$10k leverage which is ~SG$13k and SG$8k to purchase more REIT when Singapore went into Phase 2 Heightened Alert) and -$18,056 of capital loss. This includes $177,946 of leverage/debt (gearing/debt ~22.96%).

If you prefer to look at numbers, this is the raw data used to generate the above bar graph. These numbers are as of the last day of the month.

"Cash Flow" is the amount of money being injected/withdrawn from the portfolio (buying stocks = +ve cash flow while selling stocks and collecting dividends = -ve cash flow)

On a side note, I have made the decision to close our Syfe portfolio and you can read about it here -

Bye Bye Syfe!

BOUGHT- Mapletree Commercial Trust (5,000 units) @ $2.05

- Ascendas REIT (5,000 units) @ $2.96

- iShares Hang Seng Tech ETF (700 units) @ HK$16.44

I redeploy the cash (~$18k) from the closure of Syfe portfolio to buy Ascendas REIT and took out a bit of leverage (~$8k) to buy Mapletree Commercial Trust. This was a few days after Singapore announced Phase 2 Heightened Alert. We were expecting the market to react more but it was slightly disappointing with a maximum drop of ~5%. Regardless, we decided to just enter the market with this little opportunity. Buying iShares Hang Seng Tech ETF is simply following our monthly DCA plan.

Anyway, the idea of using leverage is simple, borrow the money, buy a good/excellent REIT/stock, use the dividends to pay the interests, and keep the difference while ensuring that we will never get a margin call/trigger. Once again, leverage has its risk and is definitely not for everyone. We see it as our way of buying a second property without incurring any of those taxes (ABSD, rental income tax, etc.). You can take a look at this -

Leverage Performance 2020.

On a side note, I gave up on buying IWDA already. Instead, the monthly allocated capital together with that of Syfe will be deployed to Crypto DeFi farming instead. Yes, I have successfully persuaded CZM to let me do that (although she was very reluctant) by betting my chance to FIRE on it. End of the day, if this plan fails and I lose it all, what's the worst that can happen? I FIRE at 50 instead of 40 lor. I shall elaborate more on why I see so much potential below.

Given that it is a brand new year, I have adjusted my SRS contribution to $1,276 per month with the intention of maxing it by year-end. We have also decided to open another StashAway portfolio for Baby Ong. You can read about

Our Insurance and Investment Plan for Baby Ong.

Our Monthly DCA for May - $5,876

$1,500 Cash for Ourselves - StashAway Risk Index 22%

$100 Cash for Baby Ong - StashAway Risk Index 36%

$638 KPO's SRS - StashAway Risk Index 36%

$638 KPO's SRS - Endowus Loss Tolerance -60%

$1,000 Cash - iShares Hang Seng Tech ETF

$2,000 Cash - Crypto ($1k BTC and $1k ETH)

Dividends

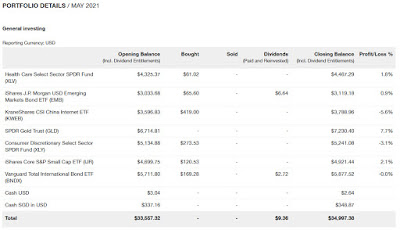

The total dividends collected this month is $4,046.51. The breakdown is as follows:

Company PayDate Shares Total

Parkway Life Real Estate Investment Trust 31-May-21 5,000 $178.50

OUE Ltd. 28-May-21 11,000 $110.00

Suntec Real Estate Investment Trust 28-May-21 11,000 $224.95

DBS Group Holdings Ltd. 24-May-21 900 $162.00

City Developments Ltd. 21-May-21 2,400 $288.00

Chip Eng Seng Corp. Ltd. 21-May-21 8,000 $160.00

Raffles Medical Group Ltd. 20-May-21 20,000 $400.00

Pacific Century Regional Developments Ltd. 19-May-21 14,000 $644.00

CapitaLand Ltd. 18-May-21 17,434 $1,569.06

Wilmar International Ltd. 6-May-21 2,000 $310.00

Total dividends collected for 2021: $10,309.23

Average dividends per month for 2021: $2,061.85

StashAway

|

| KPO |

|

| CZM |

Capital: $58,240.00

Current: $70,179.18

If you are interested in StashAway, do use our

referral link. You get $10,000 free management fees for 6 months and we will get $16!

If you want to extract those transactions information from StashAway, do take a look at this article -

StashAway Transactions Parser.

Endowus

Capital: $14,338.00

Current: $17,325.44

If you are interested in Endowus, do use our

referral link for our readers! You will get S$10,000 managed free for 6 months ($20 equivalent) and we will get $20 too! This access fee has no expiry date.

Crypto

Tracking crypto investment becomes very painful when the number of coins increases as well as when I move across to different networks. Hence, to simplify the tracking, I will just be tracking the capital I put in vs the current value at the end of the month.

Capital: SG$31,778.98 + US$40,000 ~ SG$84,672.38

Current: SG$40,712.41 + US$40,000 ~ SG$93,605.81

If you prefer a pie chart.

Crypto - BlockFi

The amount of BTC I have has increased but the value dropped significantly when the price fell by ~40% towards the end of the month. The BTC in BlockFi is earning about 5% interest now.

BlockFi: Deposits US$100 or more into your BlockFi Interest Account (BIA), you will earn US$10 in BTC and we will earn US$10 in BTC too.

Crypto - Celsius Network

Celsius Network recently launched a web app which is so much more convenient now (at least to me). Unfortunately, Celsius has decreased the interest for GUSD again to 8.88% (didn't know ang mo also will choose such a huat number. lol) while CEL is earning 4.86%. I was given some DAI and BTC from referrals which I have transferred to BlockFi for higher interest. Thanks for using our link!

Singlife decrease interest again?! Why don't you read the below articles and consider Celsius at 8.88%?

Celsius Network: Earn US$40 in BTC with your first transfer of US$400 or more and we will earn US$40 in BTC too.

Crypto - Binance

All of my ADA are still with Binance and staked for a 7.79% yield.

Crypto - CakeDeFi

I am currently losing money on CakeDeFi (

-$598.40) which is expected after the crypto market crashed but it definitely didn't fall as much. For this portfolio to perform well, it relies heavily on the price of BTC and DFI. Even if the prices remain as it is now, it will likely be in profit again given the high yield.

CakeDeFi - Deposits US$50 or more into your CakeDeFi account, you will earn US$30 in DFI and we will earn US$10 in DFI too.

Crypto DeFi

I have blogged about the possibility of generating cashflow through DeFi farming and the incredible thing is how little capital is required compared to traditional investments -

DeFIRE with DeFi. Our total capital in DeFi is ~SG$62k (technically it is even lower because I'm leveraging by borrowing from the bank) but let's just assume I am not for simplicity. For May, I have generated ~SG$2.7k if I had simply just sold everything and convert them back to fiat.

That's higher than our monthly dividends which we have spent 7 years building! Out of those tokens, there are 2 tokens with vesting period/locked - ADDY is locked for 3 months while VIPER will be locked until Dec 2021. Even if I remove those from the computation, I am still looking at ~SG1.5k of "passive income" (they are only true income if I convert them to stablecoins) and that is why I see so much potential in DeFi farming. Having said that, there are a lot of risks involved and you never know when the value of these tokens/coins will become worthless like what I have experienced recently (more information below).

Crypto DeFi - Binance Smart Chain

|

| End of April 2021 |

|

| End of May 2021 |

Similarly, I started with a capital of SG$5k to try out DeFi farming on Binance Smart Chain (BSC) which grown to US$7,490.62 (~SG$10k) last month but it all disappeared during the crypto crash + I got exploited by a hacker causing me to lose 97% of my capital/investment which I blogged about here -

DeFi - Risks and Dangers (I Lost 97% Overnight). Ultra double whammy. The current remaining amount is just US$2,161.48 + ~US$200 at Popsicle Finance (a total of ~SG$3.1k). I essentially doubled my capital in a month and lose it all the next month. So did I lose 7k or 2k? lol. Let's hold a year and see how thing goes.

Crypto DeFi - Polygon

The majority of our crypto portfolio is in the form of stablecoin deposited as collateral in Aave to farm MATIC. During the crash/dip, I bought ~US$7k worth of ETH @ ~US$2.1k using the borrowed USDT and deviated from the initial plan to farm borrowed USDT in Curve. It has proven to be a wise move so far. Anyway, this is where our future SG$2k monthly investment will go.

The remaining borrowed USDT are deposited in Curve similarly to farm MATIC. You can read more about the strategy here -

DeFi - Farming MATIC using Aave + Curve.

CZM's first crypto investment of SG$3k was put into a QUICK-MATIC LP and will be auto-compounded using Adamant Finance.

A small amount in IRON-USDC LP (both stablecoins) with minimum impermanent loss (one of the risk would be IRON losing its peg) auto-compounded in Beefy Finance with extremely high APY for a stable LP. Overall, I am sitting on a small unrealized profit in Polygon.

I blogged about my experience here -

DeFi - Harmony ONE and Fantom. Out of all the networks, I am losing the most money here. Similarly, I started with a capital of SG$5k, lost more than half and recently just injected another SG$1k to average down/"save" whatever remaining farms/LP. Previously I was farming on SpookySwap, SpiritSwap, and Waka Finance separately but I have moved them to Reaper Farms for auto-compounding yesterday after watching this

interview session with the founder. Generally, I still prefer developers/founders that show their face.

Crypto DeFi - Harmony ONE

Viper is one of the farms giving the highest return. The only con is 95% of the yield are locked.

With a capital of ~SG$2.1k and farming for just 1 month, I have ~US$720 locked until Dec 2021. I am well trained by CPF so no issue at all. Of course, the VIPER token could become 0 but you never know :)

If you made it so far, you are probably interested/already in DeFi as well. I am going to share a high risk high reward farm. I have only started farming this on 1st June so technically this should not be here but if I share it next month, it will probably be too late.

Harmony ONE has a new farm/DEX called LootSwap. It is a fork of ViperSwap with a different theme to it. LootSwap launched on 31st May and instead of giving airdrop, they increase the emission rate of the LOOT token. You can refer to

this for more information.

As a result, we are getting crazy high APR!

I started farming with just US$200 and after just 1 day, I had LOOT token worth more than my capital. I then decided that this is worth the risk so I removed my VIPER-ONE LP and converted them to LOOT-ONE LP.

Going at this rate, I believe I will probably have a few thousands worth of LOOT token while farming with a capital of just US$800. Similar to VIPER, the LOOT token is locked till Dec 2021 and we don't know what will be the price of the token. In my opinion, the biggest risk for this project is rug pull/exit scam given that the project is very new with anonymous developers and an exact fork of other projects. Stay safe and huat ah!

Anyway, I have blogged about different ways to leverage crypto to build wealth for people with different risk appetites:

The safer approach using stablecoins

Risky approach but more hassle-free

Highest risk and you are on your own

If you are interested in the platform I am using, do sign up using our referral links for some bonus :)

BlockFi: Deposits US$100 or more into your BlockFi Interest Account (BIA), you will earn US$10 in BTC and we will earn US$10 in BTC too.

Celsius Network: Earn US$40 in BTC with your first transfer of US$400 or more and we will earn US$40 in BTC too.

CakeDeFi - Deposits US$50 or more into your CakeDeFi account, you will earn US$30 in DFI and we will earn US$10 in DFI too.

Gemini: We will both receive US$10 of bitcoin after you buy or sell US$100.

Crypto.com: Sign up using our link, stake SG$500 worth of CRO and we both get US$25 in CRO

On a side note, Futu's moomoo app has made their sign-up bonus even more attractive (one free Apple share + one free Nio share with 5 trades + other benefits) and it has been extended to 30th June 2021 (2000hr SGT)! Take a look at the latest benefits

here.

You might be interested in these blog posts too:

-

2020 Net Worth- Portfolio - May 2021 - $952,839

Do like any of the following for the latest update/post!

1. FB Page -

KPO and CZM2. Twitter -

KPO and CZM3. Click

here to subscribe using email :)

4. Instagram -

KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)