In last month StashAway update, I mentioned the possibility of closing off StashAway to move more money into DeFi but has decided not to do it for 2 reasons:

1. CZM was not comfortable with that idea. When I closed Syfe, the money was used to invest in REITs (to increase the ability to leverage) so she's perfectly fine with it.

2. The yield has dropped drastically from 30-40% for stablecoins when I first discovered and blogged about it (DeFi - Farming MATIC using Aave + Curve) to 7-10% which makes it a lot less attractive now for the risks I will be taking on.

Investment for this month:

KPO and CZM Cash - StashAway Risk Index 22% - $1,500

Baby Ong Cash - StashAway Risk Index 36% - $100

KPO and CZM Cash - StashAway Risk Index 22% - $1,500

Baby Ong Cash - StashAway Risk Index 36% - $100

KPO SRS - StashAway Risk Index 36% - $638

Total: $2,238

1. PORTFOLIO SUMMARY (as of the last day of the month)

|

| KPO |

|

| CZM |

Based on the statement (31 May 2021), our total investment is $70,178.91! KPO gains $77.93 and CZM gains $14.40 for the month.

As of 25 June 2021, these are our portfolio performance:

As of 25 June 2021, these are our portfolio performance:

KPO SRS - StashAway Risk Index 36%: $17,206.92 (47.34% - Capital: $14,340)

CZM SRS - StashAway Risk Index 22%: $6,580.12 (26.34% - Capital: $6,000)

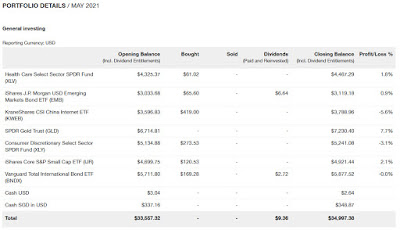

2. PORTFOLIO DETAILS

Note that these are reported in USD.

Note that these are reported in USD.

|

| KPO and CZM Cash - StashAway Risk Index 22% |

|

| Baby Ong Cash - StashAway Risk Index 36% |

|

| KPO SRS - StashAway Risk Index 36% |

|

| CZM SRS - StashAway Risk Index 22% |

3. FEE CALCULATIONS

The fee stated is based on the monthly-average assets SGD ($25,000.00 x 0.8% + $25,000.00 x 0.7% + $11,662.90 x 0.6%) / 365 days * 31 days = $37.79.

The fee stated is based on the monthly-average assets SGD $6,490.96 x 0.8% / 365 days * 31 days = $4.41.

StocksCafeEvan (founder of StocksCafe) made an improvement where one can now benchmark their portfolio against multiple indexes/ETFs. Looking at the time-weighted return (5.70%) for the year 2021, we can see that StashAway Risk Index 22% is underperforming all of our benchmarks.

If we compare across the years, StashAway's portfolio is winning by a huge margin (44.85%) against STI but lost to SPY (75.25%) and IWDA (63.69%). In addition, it has the lowest volatility and max drawdown. This is what StashAway meant by reducing risk and maximizing the return.

The annualized return/XIRR of the portfolio is very impressive too at 12.40%. Using the Rule of 72 means that the StashAway portfolio will double our money in 72 / 12.40 ~ 5.81 years. In comparison, the same money if left in the bank account at a 2% interest rate will take 72 / 2 ~ 36 years to double.

As for StashAway Risk Index 36%, the portfolio currently has a higher time-weighted return (47.79%) when compared against all the indexes (STI, SPY, and IWDA) but it is also clear that it is riskier in the sense that both its volatility/max drawdown are much higher when you compare against the benchmark and StashAway Risk Index 22% portfolio. The XIRR is 19.94%. Using the same rule, our money will double in 72 / 19.94 ~ 3.61 years.

Anyway, if you are interested in signing up for StashAway, do use our referral link - KPO and CZM Referral Link. You will get $10,000 free management fees for 6 months and we will get $16!

If you want to extract those transactions information from StashAway, do take a look at this article - StashAway Transactions Parser.

If you are interested in the smart portfolio tracker (StocksCafe) which I am using as shown above, sign up using my link for a longer trial period :) Refer to our Referrals page for more information.

On a side note, Futu's moomoo app has made their sign-up bonus even more attractive (one free Apple share + one free Nio share with 5 trades + other benefits) and it has been extended to 30th June 2021 (2000hr SGT)! Take a look at the latest benefits here.

You might be interested in previous months update too:

- StashAway - December 2020 - $56,721.26

- StashAway - January 2021 - $59,991.38

- StashAway - February 2021 - $61,608.72

- StashAway - March 2021 - $64,759.72

- StashAway - April 2021 - $67,210.58

- StashAway - May 2021 - $70,178.91

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

MP Board HSSC Model Papers are available for download. Common Language vs. Special Language Group of Humanities, Group of Mathematical Groups, Group of Commerce Groups, MP Board HSSC Model Paper 2022 Group of Science Groups, and MP Board Class XII Sanskrit Sanskrit Sanskrit Sanskrit Sanskrit History Geography Politics Economics and Science Sociology Science at Home Physics, Chemistry, and Anatomy Mathematical Biology Business Study Book should be kept.

ReplyDelete