I blogged about Endowus Fund Smart Review when it launched last year and had plans to use it to invest my CPF but never took action. As a result, I am now paying the price for my procrastination (by investing at a higher price) instead of sitting on a nice profit. To be honest, I finally made the decision to do so because I feel that I needed to increase my exposure to traditional investments as I have been pumping most of my money into crypto. lol. Anyway, let me share the steps/experience I had while investing my CPF OA through Endowus.

Next, select CPF OA as the funding source and select the risk/loss tolerance that is suitable for yourself. Of course, I selected the maximum risk.

Endowus also provides a goal/investment projection. I am interested in 2045 or 24 years later because that will be when I turn 55 years old. Had I left the SG$10k in my OA, it will grow to SG$18k as compared to SG$25k to SG85k by investing them.

One will have to agree to the disclaimer when using Fund Smart which is not a surprise. Basically, it just means you are responsible for your own decision. Nothing new.

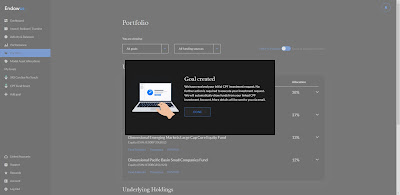

Once you agree to everything and successfully authenticate to the SMS OTP, it will take a few working days for the deduction of the CPF OA to investing them.

Let me share more about the additional fees associated with investing using CPF. As indicated during the initial portfolio set up as well as the completed transaction, we can see SG$10k being reflected in the system.

However, on the CPF side, you will actually see a deduction of more than SG$10k.

Unfortunately, this is due to the agent bank charges when using our CPF to invest. Regardless of whether you use Endowus or not, as long as you invest through the CPFIS, these charges are unavoidable. In fact, it is even more expensive if you were to invest in stocks/funds yourself because of the quarterly charges (e.g. 4 stocks = $10 per quarter). However, Endowus actually makes it more affordable such that the quarterly charge is based on per portfolio (e.g. 1 portfolio with 5 funds = $2.50 per quarter). That is why I will not be doing any monthly investment. The current plan is to invest ~SG10k lump sum per year and only exceed that if the market falls by >20%-30% from my average entry price.

I chose Fund Smart because I wanted to pick my own fund which is the one with the lowest fees.

I have decided to build an extremely simple portfolio where I will just allocate 100% of the portfolio to LionGlobal Infinity US 500 Stock Index Fund which is equivalent to investing in S&P500. In addition, this fund has the lowest fund-level fees 0.4% after the trailer fees rebate. I will not be doing monthly investment for this portfolio because there are additional fees involved and I explain more later but the initial investment will be SG$10k.

I found the warning to be quite entertaining where it states my selection is too conservative for my risk tolerance. I'm not sure how I can build a more risky portfolio with a 100% equities allocation. Maybe need some crypto in it? lol. Jokes aside, you can see the total annual fee to be just 0.8% including the 0.4% Endowus fees. The average annual return from 2003 is 7.84%, much higher than the CPF OA interest of 2.5%.

|

| Screenshot from Endowus FAQ |

Endowus has also lowered the minimum investment required from SG$10k to just SG$1k to help more people to invest especially those that are just starting out. In addition, they have also launched a new promotion until 31 July 2021 for new clients where one can get $100 worth of rewards on your first $10,000 invested in any of their General Investing or Cash Smart portfolios. One can get an additional $50 worth of rewards for every additional $5,000 invested (up to a total of $500 worth of rewards for the first $50,000 invested. You can refer to here for more information.

If you are interested in Endowus, do use our referral link for our readers! You will get a $20 access fee credit with no expiry date, so you are free to invest at a pace of your liking! We will get $20 too!

On a side note, Futu's moomoo app has made their sign-up bonus even more attractive (one free Apple share + one free Nio share with 5 trades + other benefits) and it has been extended to 30th June 2021 (2000hr SGT)! Take a look at the latest benefits here.

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

On a side note, Futu's moomoo app has made their sign-up bonus even more attractive (one free Apple share + one free Nio share with 5 trades + other benefits) and it has been extended to 30th June 2021 (2000hr SGT)! Take a look at the latest benefits here.

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

No comments:

Post a Comment