The last few weeks have been pretty challenging looking after Baby Ong as she decides to stop sleeping early (~7:30pm) one day. Her routine is as such: we would pick her up from the infant care at 6pm, reach home around 6:45pm, bathe, feed and put her to sleep at 7:30pm. Nowadays, she refuse to sleep until it's like 9/10pm. Those with kids will know, we can only get things done when they are sleeping. Hence, we have been a lot less productive @_@" Oh well, guess this is part of her growing up and we just got to adapt accordingly.

Investment for this month:

Baby Ong Cash - StashAway Risk Index 36% - $100

Baby Ong Cash - StashAway Risk Index 36% - $100

KPO SRS - StashAway Risk Index 36% - $638

Total: $738

1. PORTFOLIO SUMMARY (as of the last day of the month)

|

| KPO |

|

| CZM |

Based on the statement (30 September 2021), our total investment is $25,457.45! KPO lost $466.21 and CZM lost $148.97 for the month.

As of 24 October 2021, these are our portfolio performances:

Baby Ong Cash - StashAway Risk Index 36%: $781.20 (-7.60% - Capital: $800)

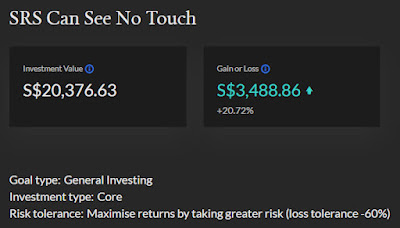

KPO SRS - StashAway Risk Index 36%: $19,384.62 (43.59% - Capital: $16,892)

CZM SRS - StashAway Risk Index 22%: $6,559.02 (25.93% - Capital: $6,000)

2. PORTFOLIO DETAILS

Note that these are reported in USD.

Note that these are reported in USD.

|

| Baby Ong Cash - StashAway Risk Index 36% |

|

| KPO SRS - StashAway Risk Index 36% |

|

| CZM SRS - StashAway Risk Index 22% |

3. FEE CALCULATIONS

The fee stated is based on the monthly-average assets SGD ($18,762.50 x 0.8%) / 365 days * 30 days = $12.34.

The fee stated is based on the monthly-average assets SGD $6,402.90 x 0.8% / 365 days * 30 days = $4.21.

StocksCafeEvan (founder of StocksCafe) made an improvement where one can now benchmark their portfolio against multiple indexes/ETFs. Looking at the time-weighted return (3.41%) for the year 2021, we can see that StashAway Risk Index 36% is underperforming all of the benchmarks (due to China Tech ETF - KWEB).

If we compare across the years, StashAway's portfolio is winning by a huge margin (43.67%) against STI but lost to SPY (73.68%) and IWDA (63.26%). The annualized return/XIRR of the portfolio is very impressive at 12.63% (it was impressive until I got into crypto where a savings equivalent product has a yield of 20% - DeFi - Terra (LUNA & UST) & Anchor Protocol (20% Interest)). Using the Rule of 72 means that the StashAway portfolio will double our money in 72 / 12.63 ~ 5.70 years. In comparison, if left in the bank account at a 2% interest rate, the same money will take 72 / 2 ~ 36 years to double.

Anyway, if you are interested in signing up for StashAway, do use our referral link - KPO and CZM Referral Link. You will get $10,000 free management fees for 6 months and we will get $16!

If you want to extract those transactions information from StashAway, do take a look at this article - StashAway Transactions Parser.

If you are interested in the smart portfolio tracker (StocksCafe) which I am using as shown above, sign up using my link for a longer trial period :) Refer to our Referrals page for more information.

On a side note, Futu's moomoo app sign-up promotion is slightly different for this month (from SGD 200 stock cash bundle to iPhone and AAPL shares. Do read the T&C here for more information). If you have yet to open an account, you can do so using our referral link :)

You might be interested in previous months update too:

- StashAway - December 2020 - $56,721.26

- StashAway - January 2021 - $59,991.38

- StashAway - February 2021 - $61,608.72

- StashAway - March 2021 - $64,759.72

- StashAway - April 2021 - $67,210.58

- StashAway - May 2021 - $70,178.91

- StashAway - June 2021 - $73,133.14

- StashAway - July 2021 - $73,355.47

- StashAway - August 2021 - $25,334.63 (Closed one portfolio - Bye Bye StashAway!)

- StashAway - September 2021 - $25,457.45

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)