June has been pretty eventful. We went on a

Shangri-La Garden Wing Staycation With Baby Ong and I decided not to procrastinate any further by

Investing my CPF OA Through Endowus. We recently heard Baby Ong calling "Papa" and "Mama". Although it was probably random babbling and the words have no meaning to her, it felt so nice! We also started having thoughts of selling our HDB once it reaches MOP (another 3 years!) in order to buy another one that is within 1km of a good primary school for Baby Ong as well as whether to decouple for multiple properties. Unfortunately, all these might mean delaying FIRE but I guess these are the things parents are willing to do for their children.

Anyway, our portfolio reaches another new high! It increased by 3.71% to $988,215 - $17,819.43 of capital injection and $17,556.51 of capital gain. This includes $184,663 of leverage/debt (gearing/debt ~22.98%).

If you prefer to look at numbers, this is the raw data used to generate the above bar graph. These numbers are as of the last day of the month.

"Cash Flow" is the amount of money being injected/withdrawn from the portfolio (buying stocks = +ve cash flow while selling stocks and collecting dividends = -ve cash flow)

BOUGHT- Keppel DC REIT (4,000 units) @ $2.57

- Mapletree Industrial Trust (1,600 units) @ $2.64

- Tuan Sing (483 units) @ $0.37267

We decided to buy more Keppel DC REIT because it seems to be the only REIT with a falling price while the rest are recovering. As much as possible, we do not really time the market and would try to invest on a monthly basis and we would just go for the most "value" purchase. Fundamentally, I do not believe anything has changed for Keppel DC REIT, looking at its latest quarterly results, DPU is still increasing. I guess people are realizing $3 and 2% yield was extremely overvalued? lol.

Mapletree Industrial Trust had a rights issue recently which we oversubscribed for it and was allocated 1,600 units. The rights issue were funded using leverage (easier to track given the original shares were purchased using leverage).

As for Tuan Sing, I opted for shares instead of cash for its recent dividends. I blogged about it back in

2018. In my opinion, it is still quite undervalued despite the recent increase in price. Its recent divestment were all at a premium to the book value which shows how conservative its NAV is. Having said that, I am tempted to realize the 50%+ profit I am sitting on because unfortunately, the share has no LTV for me to increase my leverage ability.

Anyway, the idea of using leverage is simple, borrow the money, buy a good/excellent REIT/stock, use the dividends to pay the interests, and keep the difference while ensuring that we will never get a margin call/trigger. Once again, leverage has its risk and is definitely not for everyone. We see it as our way of buying a second property without incurring any of those taxes (ABSD, rental income tax, etc.). You can take a look at this -

Leverage Performance 2020.

On a side note, I gave up on buying IWDA already. Instead, the monthly allocated capital together with that of Syfe will be deployed to Crypto DeFi farming instead. Yes, I have successfully persuaded CZM to let me do that (although she was very reluctant) by betting my chance to FIRE on it. End of the day, if this plan fails and I lose it all, what's the worst that can happen? I FIRE at 50 instead of 40 lor. I shall elaborate more on why I see so much potential below.

Given that it is a brand new year, I have adjusted my SRS contribution to $1,276 per month with the intention of maxing it by year-end. We have also decided to open another StashAway portfolio for Baby Ong. You can read about

Our Insurance and Investment Plan for Baby Ong.

Our Monthly DCA for June - $4,876

$1,500 Cash for Ourselves - StashAway Risk Index 22%

$100 Cash for Baby Ong - StashAway Risk Index 36%

$638 KPO's SRS - StashAway Risk Index 36%

$638 KPO's SRS - Endowus Loss Tolerance -60%

$2,000 Cash - Crypto ($1k BTC and $1k ETH)

Dividends

The total dividends collected this month is $4,581.91. The breakdown is as follows:

Company PayDate Shares Total

Bank Of China Ltd 30-Jun-21 30,000 HKD 6,416.38 (~S$1,114)

Oversea-Chinese Banking Corp Ltd 29-Jun-21 919 $146.12

Frasers Hospitality Trust 29-Jun-21 4,000 $7.16

Mapletree Industrial Trust 28-Jun-21 8,000 $176.80

First Real Estate Investment Trust 28-Jun-21 9 $0.05

DBS Group Holdings Ltd 25-Jun-21 900 $162.00

Tuan Sing Holdings Ltd 25-Jun-21 30,000 $180.00

AIMS APAC REIT 24-Jun-21 1,600 $46.40

Mapletree NAC Trust 21-Jun-21 10,335 $340.95

Frasers Logistics & Commercial Trust 18-Jun-21 24,297 $923.28

Thai Beverage PLC 14-Jun-21 20,000 $114.57

Mapletree Logistics Trust 10-Jun-21 8,000 $172.88

NetLink NBN Trust 9-Jun-21 6,000 $153.00

Ascendas Real Estate Investment Trust 9-Jun-21 3,000 $168.90

Mapletree Industrial Trust 8-Jun-21 8,000 $264.00

Mapletree Commercial Trust 4-Jun-21 11,500 $611.80

Total dividends collected for 2021: $14,891.14

Average dividends per month for 2021: $2,481.85

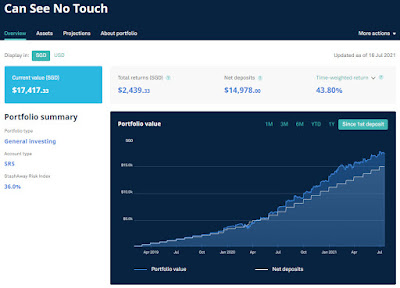

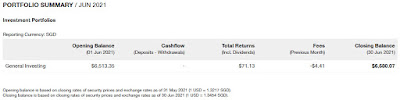

StashAway

|

| KPO |

|

| CZM |

Capital: $60,478.00

Current: $73,192.87

If you are interested in StashAway, do use our

referral link. You get $10,000 free management fees for 6 months and we will get $16!

If you want to extract those transactions information from StashAway, do take a look at this article -

StashAway Transactions Parser.

Endowus

Capital: $24,976.00

Current: $28,827.38

If you are interested in Endowus, do use our

referral link for our readers! You will get S$10,000 managed free for 6 months ($20 equivalent) and we will get $20 too! This access fee has no expiry date.

Crypto

Tracking crypto investment becomes very painful when the number of coins increases as well as when I move across to different networks. Hence, to simplify the tracking, I will just be tracking the capital I put in vs the current value at the end of the month.

Capital: SG$37,272.24 + US$40,000 ~ SG$91,209.84

Current: SG$39,280.96 + US$40,000 ~ SG$93,218.56

If you prefer a pie chart.

Crypto - BlockFi

BlockFi has reduced the interest for BTC to 4% now. Hence, I am planning to move my BTC out to either Polygon or Fantom for higher yield.

BlockFi: Deposits US$100 or more into your BlockFi Interest Account (BIA), you will earn US$10 in BTC and we will earn US$10 in BTC too.

Crypto - Celsius Network

Celsius Network recently launched a web app which is so much more convenient now (at least to me). Unfortunately, Celsius has decreased the interest for GUSD to 8.88% (didn't know ang mo also will choose such a huat number. lol) while CEL is earning 4.86%. I was given some BTC from referrals which I will be transferring out as well for higher interest. Thanks for using our link!

Singlife decrease interest again?! Why don't you read the below articles and consider Celsius at 8.88%?

Celsius Network: Earn US$40 in BTC with your first transfer of US$400 or more and we will earn US$40 in BTC too.

Crypto - Binance

I have moved 1,000 ADA to BSC to do leverage farming using Alpaca Finance. Most of the ADA is still with Binance and staked for a 7.79% yield.

Crypto - CakeDeFi

I am currently losing a few cents on CakeDeFi which is expected after the crypto market crashed. For this portfolio to perform well, it relies heavily on the price of BTC and DFI. Even if the prices remain as it is now, it will likely be in profit again given the high yield. On a side note, I decided to freeze all of my DFI for 6 months because they were having an

anniversary freezer promotion where one get 5% bonus top up.

CakeDeFi - Deposits US$50 or more into your CakeDeFi account, you will earn US$30 in DFI and we will earn US$10 in DFI too.

Crypto DeFi - Binance Smart Chain

Unfortunately, I lost even more money last month when one of my position got liquidated. After finally accumulating 100 CAKE, I moved them to from Beefy to Alpaca for leverage farming to increase the yield. I entered when CAKE price was around US$17+ and calculated that I will be liquidated at US$11 which I thought was unlikely to happen. Well, the crash happened, sent CAKE price briefly below US$11 and I got liquidated and got back only ~US$495.

I injected another US$500 and with my remaining US$496, I whacked some of the highest yield and most risky farm in an attempt to recover my lost. That was also when I decided to send 1,000 ADA to leverage farm for higher yield as well as compared to 7% yield from locked staking.

|

| Current farm |

The compensation plan by PancakeBunny isn't working/effective because their TVL has been dropping like crazy since the last exploit -

DeFi - Risks and Dangers (I Lost 97% Overnight). Despite that, they came up with another plan which is the MND Vault that allows holders of the token to get a share of the profits from their other launches/projects. I have dumped my remaining BUNNY to be swapped with MND at a 1.5x rate for the first week. Not too hopeful given that majority of my capital is already gone so I will take whatever they can give/compensate.

Crypto DeFi - Polygon

The majority of our crypto portfolio is in the form of stablecoin deposited in Curve to farm MATIC and CRV. It was a huge disappointment as both the yield of Aave and Curve have dropped drastically.

However, just as I was about to explore other alternative such as Terra, Curve added more incentives and brought the yield higher slightly. Shall continue to observe before moving the money around. On a side note, I bought a Ledger and have moved the majority of our funds over, hence the different wallet addresses.

CZM's first crypto investment of SG$3k was put into a QUICK-MATIC LP and will be auto-compounded using Adamant Finance. Had I not put her LP on Adamant, she will probably be in a losing position but after including the ADDY token, she came up at a slight profit.

I had to LP some of my ETH with AAVE as the yield is too pathetic on Aave. There were a few projects from the Ethereum network that came to Polygon (Balancer, Pickle and Impermax) and I put some money into them.

As for the rest of the MATIC, they are deposited into Qi Dao/Mai as collateral while I borrow MAI (stablecoin) to purchase QI as well as to farm at Balancer for higher yield.

I blogged about my experience here -

DeFi - Harmony ONE and Fantom. Out of all the networks, I am losing the most money here even after being exploited and liquidated at BSC. Similarly, I started with a capital of SG$5k, lost more than half when I entered FTM at its high (~US$0.90+) and recently just injected another SG$1k to average down/"save" whatever remaining farms/LP (FTM ~US$0.35). Guess what, FTM price is around US$0.20+ @_@" Previously I was farming on SpookySwap, SpiritSwap, and Waka Finance separately but I have moved them to Reaper and Beefy Farms for auto-compounding.

Crypto DeFi - Harmony ONE

Viper is one of my farms with the highest return. The only con is 95% of the yield are locked.

I blogged about LootSwap last month and entered when the LOOT token was about US$1+. Due to a series of events/drama (founder dumping token to secure funds to hire developer, etc.), the token price is now at US$0.10+. Despite that, I am still sitting on a profit due to its crazy high yield from the increase emission for the first few weeks. Similarly, 95% of the yield are locked.

Crypto DeFi - Avalanche

I decided to try out Penguin Finance in Avalanche because I came across an article/tweet on their upcoming

airdrop. I purchased SG$500 worth of AVAX in Binance and sent it to my wallet in Avalanche. I then realized it was quite troublesome where I got to bridge between different network within Avalanche to get it to my Metamask address. In my opinion, that's not very user friendly for someone new to crypto. Anyway, most of the AVAX are then converted to PERI and staked in the nest. The airdrop

happened on the last day of the month and I got ~10% more PERI. Decent profit (close to 100%) for now.

Anyway, I have blogged about different ways to leverage crypto to build wealth for people with different risk appetites:

The safer approach using stablecoins

Risky approach but more hassle-free

Highest risk and you are on your own

If you are interested in the platform I am using, do sign up using our referral links for some bonus :)

BlockFi: Deposits US$100 or more into your BlockFi Interest Account (BIA), you will earn US$10 in BTC and we will earn US$10 in BTC too.

Celsius Network: Earn US$40 in BTC with your first transfer of US$400 or more and we will earn US$40 in BTC too.

CakeDeFi - Deposits US$50 or more into your CakeDeFi account, you will earn US$30 in DFI and we will earn US$10 in DFI too.

Gemini: We will both receive US$10 of bitcoin after you buy or sell US$100.

Crypto.com: Sign up using our link, stake SG$500 worth of CRO and we both get US$25 in CRO

On a side note, Futu's moomoo app has made their sign-up bonus even more attractive (one free Apple share + one free Nio share with 5 trades + other benefits) and it has been extended to 2nd August 2021! Take a look at the latest benefits

here.

You might be interested in these blog posts too:

-

2020 Net Worth- Portfolio - June 2021 - $988,215

Do like any of the following for the latest update/post!

1. FB Page -

KPO and CZM2. Twitter -

KPO and CZM3. Click

here to subscribe using email :)

4. Instagram -

KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)