Our portfolio didn't hit a new high last month but something else did - my cholesterol -.-"

I have not done a health checkup for the last 2 years after I changed job and things got a lot more hectic with the arrival of Baby Ong. I decided to do it last month after CZM's nagging, only to find out how I am dying I have neglected my health. I am currently on medication (Trolip 100 fenofibrate) and will be making some lifestyle changes (healthier diet and exercising). In fact, I was planning to change/look for a new job a few weeks back when I found out one of my ex-manager moved to a crypto company (my area of interest nowadays) but I guess that's not important anymore. My priority is to reduce my cholesterol and stay alive. lol. Alright, enough with the sharing of such bad news.

Last month, we went on a Royal Caribbean cruise - Spectrum of the Seas (cruise to nowhere) together with my parents. It was a nice break from work and being able to "travel" after covid but travelling with a child is really tiring.

|

| What CZM sent me after the trip |

Baby Ong probably enjoyed herself the most given that she had many new experiences - 1 happy baby with never-ending energy with 4 happy and tired adults. lol.

Leverage/Debt: $1,212,960

Gearing: 42.91%

Our Passive Income - Dividends

Our Passive Income - Anchor Earn

Dividends for this month: $432.00

Total dividends collected for 2022: $14,221.93

Average dividends per month for 2022: $3,555.48

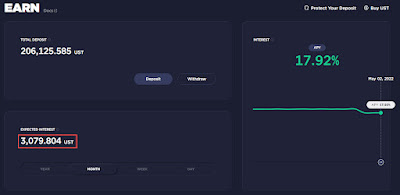

Estimated interest for this month: US$3,079.80 (~SSG$4,262.49 )

Total interest collected for 2022: $21,322.62

Average interest per month for 2022: $5,330.65

A few things for the lower passive crypto income:

1. Anchor yield has been lowered to 18%

2. I moved 50k to repay my Anchor borrow/loan to have more buffer/prevent liquidation as LUNA price falls

3. I moved 50k to THORSwap to provide liquidity with the plan to get more yield under the impression that the initial capital will be protected by the Impermanent Loss Protection (ILP). Just take note - ILP does NOT protect you from both assets depreciating! This is loss, as this would occur if you were just holding the assets regardless.

3. I moved 50k to THORSwap to provide liquidity with the plan to get more yield under the impression that the initial capital will be protected by the Impermanent Loss Protection (ILP). Just take note - ILP does NOT protect you from both assets depreciating! This is loss, as this would occur if you were just holding the assets regardless.

In this case, we are losing money because of the lower RUNE price. I only realized it when the protection amount didn't seem right while I am writing this article. Not sure why I made such a noob mistake. Must be the cholesterol. Anyway, I will be looking to exit this position once it turns positive not because I do not believe that RUNE will recover/moon but because this is CZM's retirement fund which shouldn't have exposure to such volatility. In fact, at the current RUNE price, it has the lowest speculative premium while its deterministic price is rising makes it a pretty good investment...

Total passive income for this month: $4,694.49

Total passive income collected for 2022: $35,544.55

Average passive income per month for 2022: $8,886.13

The best part is these are all tax-free :) Technically, our passive income is much higher but I excluded staking yields and LP rewards because they are much harder to track and I have been using staking yields for buying NFTs. lol.

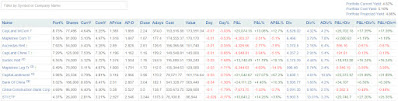

Stocks

We decided to deploy more leverage to buy more REITs given that Singapore is slowly opening up and these prices are still way below pre-covid levels or our average entry price:

- Ascendas Reit

- Ascott Trust

- Mapletree Log Tr

- Ascott Trust

- Mapletree Log Tr

The idea of using leverage is simple, borrow the money, buy a good/excellent REIT/stock, use the dividends to pay the interests, and keep the difference while ensuring that we will never get a margin call/trigger. Once again, leverage has its risk and is definitely not for everyone. We see it as our way of buying a second property without incurring any of those taxes (ABSD, rental income tax, etc.). You can take a look at this - Leverage Performance 2020.

Total: $2,009,985.89

Leverage/Debt: $649,158.56

Leverage/Debt: $649,158.56

If you are interested in the smart portfolio tracker (StocksCafe) which I am using as shown above, sign up using my link for a longer trial period :) Refer to our Referrals page for more information.

Endowus

Endowus

Capital: $62,280.70

Current: $63,790.61

Current: $63,790.61

I decided to invest my CPF OA last year and blog about it here - Investing CPF OA Through Endowus.

If you are interested in Endowus, do use our referral link for our readers! You will get S$10,000 managed free for 6 months ($20 equivalent) and we will get $20 too! This access fee has no expiry date.

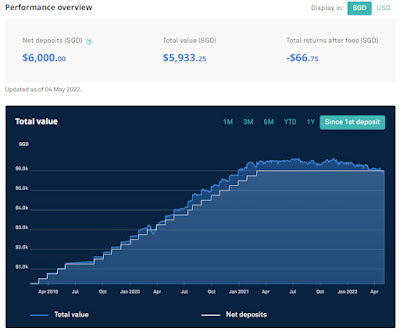

StashAway

Current: $5,933.25

Crypto

The only remaining portfolio with StashAway is CZM's SRS. No plan of doing anything at the moment.

If you are interested in StashAway, do use our referral link. You get $10,000 free management fees for 6 months and we will get $16!

Crypto

We are not too concerned with the fall in price and are still holding on to ~12k LUNA. I will only be worried if it falls below $70 which will be near our liquidation price >.<

Total excluding NFTs: $1,960,120.94

Leverage/Debt: $563,800.99

Leverage/Debt: $563,800.99

Nothing much happened last month except some Terra NFT drama which resulted in one of my favourite NFT launchpad/marketplace (Luart) getting boycotted. What is exciting for the first week of May (happening right now!) is a series of lockdrop happening for ASTRO, ANC and PRISM tokens. Personally, I prefer participating in lockdrop as compared to airdrop although both are "free" money, one gives me a lot more. lol. To put it simply, you can see them as the government "dropping" GST/U-Save vouchers/credits. lol.

Not going to spend too much time going into the details but my gameplan is as follows:

|

| Deposit xASTRO for RETRO on Retrograde |

Assuming xASTRO costs US$2.88579, I am locking US$26,922.56 temporarily to get an additional US$20k for free.

Using the same valuation, my airdrop amount is just ~US$93. Do you see why I prefer lockdrop? lol.

|

| Deposit ANC for RCT on Reactor |

Assuming ANC costs US$1.886, I am locking US$8,285.12 temporarily to get an additional US$5.8k for free. Magic!

|

| Deposit xPRISM for PSI on Nexus |

Assuming xPRISM costs US$0.485, I am locking US$4,850 temporarily to get an additional US$3.1k for free. Must be ponzi!

Anyway, these are just estimated returns but I do expect them to be lower when the lockdrop ends as more tokens are being locked/provided as liquidity. In addition, I am pretty sure after vesting, people will dump the respective token and the price of those free tokens will definitely be less than what they are being valued at now. Did I mention that about half of my ASTRO tokens were "free"/from lockdrop too? lol.

You can refer to our crypto portfolio (except for CZM's retirement Anchor) on Ape Board for a more detailed breakdown of how we DeFi although you wouldn't see all of it because some of my coins are still with the exchanges.

These are the top 10 coins in our portfolio.

Did not manage to update my NFT spreadsheet + felt lazy but at one point in time, my NFTs were worth slightly more than SG$100k in total (definitely lower now). Shall just briefly mention some of them here.

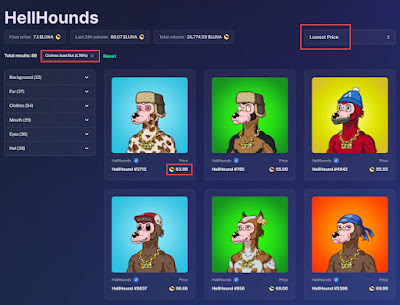

The most hyped NFT project released last month was HellHounds. I minted 4 of them (150 UST each) because I was whitelisted for holding 4 HellCats and one of them had the "Iced Out" trait with a floor price of around 64 LUNA (~US$4.6k). That's easily more than a ~30x return and much more if I were to include the 3 other hounds.

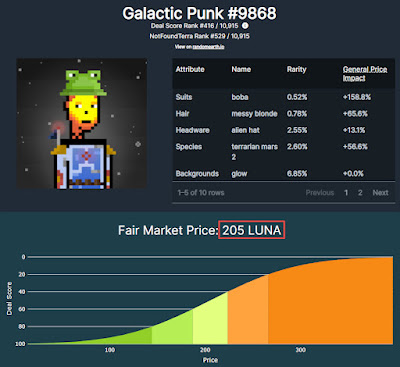

My most valuable NFT will be this Galactic Punk that comes with a glitch valued at 205 LUNA (~US$15k) based on NFT Deal Score. lol. Diamond hands until it reaches 6 digits!

You might be interested in these blog posts too:

- 2021 Net Worth

Anyway, I have blogged about different ways to leverage crypto to build wealth for people with different risk appetites:

The safer approach using stablecoins (I have stopped using this)

Risky approach but more hassle-free (I have stopped using this too)

Highest risk and you are on your own

- DeFi apps on Binance Smart Chain (BSC) such as PancakeSwap and PancakeBunny

Retirement Hack

If you are interested in the platform I am using, do sign up using our referral links for some bonus :)

BlockFi: Deposits US$100 or more into your BlockFi Interest Account (BIA), you will earn US$10 in BTC and we will earn US$10 in BTC too.

BlockFi: Deposits US$100 or more into your BlockFi Interest Account (BIA), you will earn US$10 in BTC and we will earn US$10 in BTC too.

Celsius Network: Earn US$50 in BTC with your first transfer of US$400 or more and we will earn US$50 in BTC too.

CakeDeFi - Deposits US$50 or more into your CakeDeFi account, you will earn US$30 in DFI and we will earn US$10 in DFI too.

Gemini: We will both receive US$10 of bitcoin after you buy or sell US$100.

Crypto.com: Sign up using our link, stake SG$500 worth of CRO and we both get US$25 in CRO

FTX: We will receive 25.00% of your trading fees and you will receive a 5.00% fee discount on all of your trades.

On a side note, Futu's moomoo app is giving free SEA share for their sign-up promotion. Do read the T&C here for more information. If you have yet to open an account, you can do so using our referral link :)

Accidentally clicked on the annoying ads? Let me thank you in advance as you are indirectly doing good as we will be Donating 100% Ads Revenue Going Forward!

- 2021 Net Worth

- Our CPF 2021

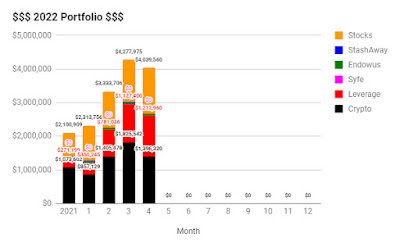

- Portfolio - December 2021 - $2,100,909

- Portfolio - January 2021 - $2,307,446

- Portfolio - February 2022 - $3,333,706

- Portfolio - March 2022 - $4,277,975

- Portfolio - April 2022 - $4,039,560

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

thanks for the explanation bro! i have also moved to a crypto company recently.. hahaha that's why now i am reading up all these stuff to beef up my lack of awareness for yield chase in the past 2 years. all the best and luna really dropped to <$70 last night! hope you caught it in the middle of the night.

ReplyDeleteHope you are staying safe during this crazy volatile period! Luna briefly went to 25 earlier :(

ReplyDeleteYes, hopefully he is out of his position

Deletehope you have cut off the losses. LUNA looking very bad now

ReplyDeleteLuna just hit below $10 omg this is crazy...

ReplyDeletewaiting for your naw to update on crypto. did you manage to siam the plunge and cash out?

ReplyDeleteGood luck. Seeing that a good portion of your portfolio is in Luna, UST and leverage.

ReplyDeleteHope you're doing OK.. thinking of you.

ReplyDelete