Last month, we celebrated Baby Ong turning 1 year old! Time flies! I'm guessing it was very fun for her (lots of presents too) but it was extremely tiring for us because we had to hold multiple parties across different days/weekends for our families and friends due to the covid visiting restrictions.

Last month has been a crazy month for LUNA as it broke all-time high a couple of times to reach a high of ~US$100. When that happened, I received a couple of DMs from FB and Twitter thanking me for sharing about LUNA. The thing is you guys made the decision to invest in it so thank yourself for taking the action and not me. Similarly, I wouldn't want you to be blaming me if things turn out the other way. Like Chicken Genius always says, "you burn, I burn more". lol.

Interestingly, I also received the most ridiculous email/request since I started blogging many years back - someone actually reached out and asked for financial help after losing money/getting liquidated by trading speculatively on crypto (money which he needs to pay for his uni fees). I replied and told him the honest and harsh truth - there's zero chance an anonymous blogger is going to help him financially and there's no easy way out in life. Regardless, I hoped that he will overcome this difficulty and learn from his mistakes.

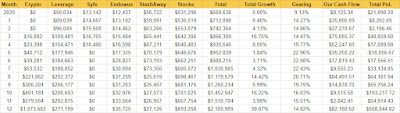

Anyway, our portfolio reaches another new high! It increased by 39.07% to $2,100,909 - $82,160.52 of capital injection and $508,044.82 of capital gain. This includes $271,199 of leverage/debt (gearing/debt ~14.82%).

If you prefer to look at numbers, this is the raw data used to generate the above bar graph. These numbers are as of the last day of the month.

"Cash Flow" is the amount of money being injected/withdrawn from the portfolio (buying stocks = +ve cash flow while selling stocks and collecting dividends = -ve cash flow)

SOLD

- None

- None

BOUGHT

- Mapletree Logistic Trust (12,000 units) @ $1.870- CapitaLand China Trust (20,000 units) @ $1.160

- Ascendas REIT (12,000 units) @ $2.920

We are going to change our plan again given that our crypto portfolio is much bigger than the stocks portfolio now. I am pretty sure that we will become crypto multi-millionaires *finger crossed* even if we stop investing more now. UST hitting US$10B market cap is just the beginning...

Instead of converting the crypto back to fiat in the future to derisk, it makes more sense to just go back to stocks now. Another reason for doing that is we are planning to retire CZM soon but we are also planning to decouple and get 2 properties in the future (another 3 years once we reach MOP). Yes, that sounds like a boomer move but we are actually using leverage/good debt to convert crypto profit into physical assets. I believe no bank is going to lend her anything without an income or based on our crypto portfolio but we might be able to borrow using stocks as collateral. Grand plans or it could just be a dream. lol.

Hence, we took on more leverage (~SG$78k) by purchasing more REITs. The idea of using leverage is simple, borrow the money, buy a good/excellent REIT/stock, use the dividends to pay the interests, and keep the difference while ensuring that we will never get a margin call/trigger. Once again, leverage has its risk and is definitely not for everyone. We see it as our way of buying a second property without incurring any of those taxes (ABSD, rental income tax, etc.). You can take a look at this - Leverage Performance 2020.

Given that it is the last month of the year, I have contributed another $1,264 to my SRS to max it by year-end. As mentioned previously, I will be using only Endowus for my SRS as I proceed to move funds out of StashAway.

Our Monthly DCA for December - $1,264

Our Monthly DCA for December - $1,264

$1,264 KPO's SRS - Endowus Loss Tolerance -60%

Dividends

The total dividends collected this month is $3,027.71. The breakdown is as follows:

Company PayDate Shares Total

Frasers Hospitality Trust 29-Dec-21 4,000 $32.16

Mapletree NAC Trust 24-Dec-21 15,335 $525.37

First REIT 17-Dec-21 9 $0.05

AIMS APAC REIT 17-Dec-21 1,600 $40.00

Frasers L&C Trust 16-Dec-21 24,297 $624.42

Sysma Holdings Ltd 15-Dec-21 10,000 $550.00

Mapletree Logistics Trust 14-Dec-21 8,000 $173.84

Parkway Life REIT 8-Dec-21 5,000 $178.00

Mitsubishi UFJ Financial 6-Dec-21 3,000 JPY 34,296.48 (SG$417.15)

Mapletree Industrial Trust 3-Dec-21 9,600 $333.12

NetLink NBN Trust 1-Dec-21 6,000 $153.60

Total dividends collected for 2021: $31,265.01

Average dividends per month for 2021: $2,605.42

Average dividends per month for 2021: $2,605.42

According to StocksCafe, our projected dividends for 2022 will be around SG$3.2k! Deducting our estimated monthly interest of SG$120+, we should have around SG$3k per month of passive income.

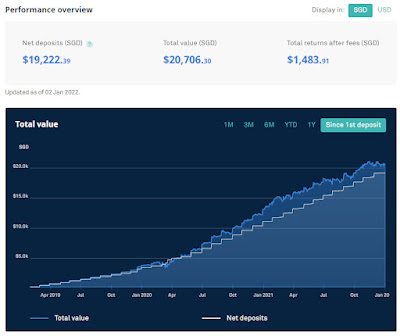

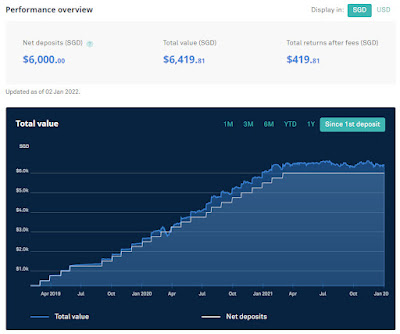

StashAway

StashAway

|

| KPO |

|

| CZM |

Capital: $25,222.39

Current: $27,126.11

If you are interested in StashAway, do use our referral link. You get $10,000 free management fees for 6 months and we will get $16!

If you want to extract those transactions information from StashAway, do take a look at this article - StashAway Transactions Parser.

If you are interested in StashAway, do use our referral link. You get $10,000 free management fees for 6 months and we will get $16!

If you want to extract those transactions information from StashAway, do take a look at this article - StashAway Transactions Parser.

Endowus

Capital: $29,430.00

Current: $35,725.48

Current: $35,725.48

I decided to invest my CPF OA a few months back and blog about it here - Investing CPF OA Through Endowus.

If you are interested in Endowus, do use our referral link for our readers! You will get S$10,000 managed free for 6 months ($20 equivalent) and we will get $20 too! This access fee has no expiry date.

Crypto

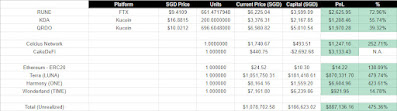

Tracking crypto investment becomes very painful when the number of coins increases or when I move across to different networks. Hence, to simplify the tracking, I will just be tracking the capital I put in vs the current value at the end of the month.

Capital: SG$186,623.00

Current: SG$1,078,702.58

Current: SG$1,078,702.58

Crypto - FTX

I am holding some RUNE on FTX. Initially wanted to try out providing liquidity on Thorchain because of the unique ILP (Impermanent Loss Protection) but got lazy to deep dive further because the set-up was troublesome (new wallet, upgrade BEP2 RUNE to native RUNE, etc.).

FTX: We will receive 25.00% of your trading fees and you will receive a 5.00% fee discount on all of your trades.

Crypto - CakeDeFi

CakeDeFi - Deposits US$50 or more into your CakeDeFi account, you will earn US$30 in DFI and we will earn US$10 in DFI too.

Crypto - Kucoin

Similar to Kadena (KDA), I bought some QRDO due to Twitter Terra influencers. QRDO is supposedly the new tech/infra that will be onboarding institutional clients to crypto. Both allocations are kept small because of the lack of conviction.

Kucoin - You get stars after you complete certain tasks which can be exchanged for free USDT and random coin. To be honest, it looks complicated. You can check it out here.

Crypto - Celsius Network

I still have a bit of BTC and Celsius token which I accumulated previously while earning high interest using GUSD. No plans on moving them at the moment.

Celsius Network: Earn US$50 in BTC with your first transfer of US$400 or more and we will earn US$50 in BTC too.

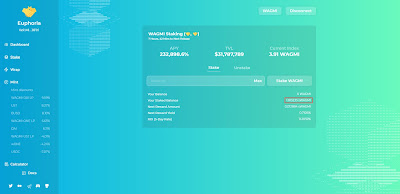

Crypto DeFi - Harmony ONE & Avalanche

|

| Wonderland (TIME) on Avalanche |

|

| Euphoria (WAGMI) on Harmony ONE |

I started looking at other alternatives and decided to try out these OHM forked which I blogged about here - DeFi 2.0 - Protocol Owned Liquidity (OlympusDAO, Wonderland and Euphoria) back in November 2021. I average down and bought another US$2k worth of TIME when the price dropped to ~US$4k and have finally accumulated >1 TIME. Not going to allocate more money and will just watch it crash to 0 or huat. lol. Similarly, small allocation due to its risks.

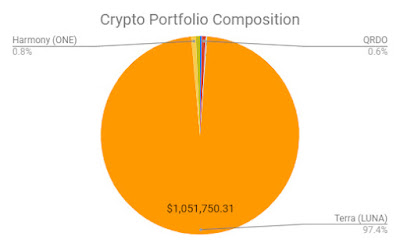

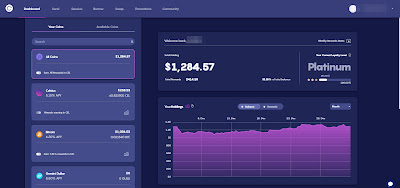

Crypto DeFi - Terra

Astroport launched last month and I decided to lock about US$30k worth of LP for a year to get some astro tokens and to prevent my itchy finger from selling/trading anything. lol. Besides that, I have decided to become more aggressive by borrowing more UST from Anchor (if you compare against last month, our debt have almost doubled), buying LUNA and pledging back as bLUNA.

In my opinion, LUNA can easily go to 3 digits (it already did so maybe a high 3 digits xD) because it is based on the demand for UST which will only increase as time goes by where more projects are being launched (it is happening right now!), UST going cross chains, and getting listed on more exchanges. We have about 6.4k LUNA now with 57% of them staked, 35% in bLUNA used as collateral in Anchor and the remaining in the wallet/exchange.

Regardless, you can refer to our Terra portfolio on Ape Board below for a more detailed breakdown:

Our Terra Address: terra19erxpg9zvsmptqalsmvwrsmuquk55luzynsl7r

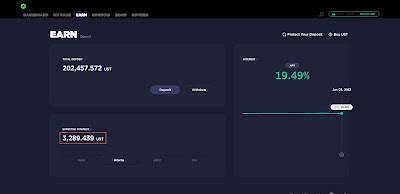

I have also created another wallet (non-ledger so we can use it more flexibily) and move some funds into Anchor for CZM's retirement which should give us US$3.3k (SG$4.4k) monthly of passive income. The interest here can be used to offset/pay for most of our daily expenses by using Bidali and Terra Cards to purchase gift cards (with UST) from Grab, Shopee, Amazon, Lazada, Redmart, Dairy Farm, Cold Storage, etc. without the need to off-ramp. We have decided to keep this wallet address private as there's nothing to see/learn except how we are living our semi-retired life.

I guess this is what they meant by making life changing money from crypto. Our passive income is estimated to be around SG$7k conservatively but it is definitely much higher. At the start of 2021, we never thought we could accelerate our FIRE journey by so much. I remember telling CZM that we should be able to FIRE in the next 5 years but all it took was a few months into DeFi (specifically Terra LUNA). I am glad that I finally decided to take the plunge after all these years instead of sitting on the fence (know and read about it but not doing anything about it). Even CZM is a convert now who can transact on the Terra blockchain. lol.

2021 has been a great year for us and hopefully 2022 will be better! Huat ah!

Anyway, I have blogged about different ways to leverage crypto to build wealth for people with different risk appetites:

The safer approach using stablecoins

Risky approach but more hassle-free

Highest risk and you are on your own

- DeFi apps on Binance Smart Chain (BSC) such as PancakeSwap and PancakeBunny

If you are interested in the platform I am using, do sign up using our referral links for some bonus :)

BlockFi: Deposits US$100 or more into your BlockFi Interest Account (BIA), you will earn US$10 in BTC and we will earn US$10 in BTC too.

BlockFi: Deposits US$100 or more into your BlockFi Interest Account (BIA), you will earn US$10 in BTC and we will earn US$10 in BTC too.

Celsius Network: Earn US$50 in BTC with your first transfer of US$400 or more and we will earn US$50 in BTC too.

CakeDeFi - Deposits US$50 or more into your CakeDeFi account, you will earn US$30 in DFI and we will earn US$10 in DFI too.

Gemini: We will both receive US$10 of bitcoin after you buy or sell US$100.

Crypto.com: Sign up using our link, stake SG$500 worth of CRO and we both get US$25 in CRO

FTX: We will receive 25.00% of your trading fees and you will receive a 5.00% fee discount on all of your trades.

If you are interested in the smart portfolio tracker (StocksCafe) which I am using as shown above, sign up using my link for a longer trial period :) Refer to our Referrals page for more information.

On a side note, Futu's moomoo app free AAPL share sign-up promotion is back for this month. Do read the T&C here for more information. If you have yet to open an account, you can do so using our referral link :)

Accidentally clicked on the annoying ads? Let me thank you in advance as you are indirectly doing good as we will be Donating 100% Ads Revenue Going Forward!

- 2020 Net Worth

- 1% Net Worth to Crypto (I went down the rabbit hole and it is ~50% now. lol)

- Portfolio - December 2020 - $669,630

- Portfolio - January 2021 - $712,898

- Portfolio - February 2021 - $742,364

- Portfolio - March 2021 - $866,309

- Portfolio - May 2021 - $952,839

- Portfolio - June 2021 - $988,215

- Portfolio - July 2021 ($1 Million Achieved!) - $1,030,905

- Portfolio - August 2021 - $1,179,579

- Portfolio - September 2021 - $1,250,214

- Portfolio - October 2021 - $1,452,947

- Portfolio - November 2021 - $1,510,704

- Portfolio - December 2021 - $2,100,909

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

👍🏻👍🏻👍🏻 Well done KPO

ReplyDeleteThanks HK!

DeleteCongrats! Did you buy insurance for Anchor?

ReplyDeleteHi Andrew,

DeleteNope I did not. I'm not a fan of insurance. Hahahaha. On a more serious note, it is unlikely for UST to depeg again given that they have made some changes since last year May + there's White Whale that will arbitrage and keep the peg.

For smart contract risk, the Anchor team has audits and bug bounty program to address them. The last bug bounty Do even personally offered a 1 million bounty for critical bug and there was none found.

hi, you bought MIT for $1.87 ?? or you make a mistake ? :)

ReplyDeleteHi JAC,

DeleteI bought MLT (Mapletree Logistic Trust). I believe you made a mistake :)

Hi KPO, can I ask what your current LUNA / UST strategies are? I'm bullish on LUNA, so would like to participate in it, but LUNA staking strategies all seem to have a lockup of 21-24 days, even if using bLUNA. I recently looked at Stader Labs which has a liquid pooling, but it's using Lunax so not sure about that. Would like to hear your thoughts and recommendations, thanks!

ReplyDeleteHi jy,

DeleteIf you want to avoid the lockup, bluna will be the best bet currently. With astroport stable pool swap, you can swap bluna to luna with just a very slight loss.

My strategy changed along the way. Started with just staking for the airdrop to luna-bluna LP in terraswap. Right now is the most degen. lol. I am mostly using bluna as collateral in Anchor. When luna price goes up, I borrow more UST, convert to bluna and pledge back as collateral. I am managing my LTV around 30-40% and ensuring that I have a crash buffer of >30%.

Hi KPO, thanks for your reply! About the luna/bluna LP in terraswap, are you currently using that? I read that simply holding bluna in the Terra Station wallet gives you UST rewards in Anchor, any thoughts of doing this vs. the LP? I'm currently looking for a little more liquidity and not looking for leverage at the moment, so I think I won't be that comfortable doing the Anchor collateral part at the moment.

DeleteOn a side note, are you doing anything with the UST stablecoin? I read your post about the pylon staking, but haven't been able to find any pylon swaps atm. Thank you!

Yes, I still have some LP but I moved them to astroport. For LP, your rewards are autocompounded as luna/bluna while holding bluna give you UST. It depends on how bullish you are on luna and whether you prefer to earn your yield/rewards in UST or luna. Do check out our terra address on apeboard which I shared above to see what I am doing.

DeleteRight now I am just swapping all UST to luna. There is no pylon swap except for nexus liquid pool. Once you deposit your ust, you lose liquidity as well. It is like a fixed deposit. Check out https://gateway.pylon.money/

Hi KPO

ReplyDeleteBeen following your blog on the tardfi portfolio and eventually found Terra Luna. Question, for the NFT that you have (saw in apeboard), do you keep it on Random Earth or move it to a TS wallet? Am new to NFTs and just got a glitched GP, wondering where to keep it and how to move it.. very noob question

Hi Alpaca,

DeleteIt doesn't really matter if it is on RandomEarth or your wallet. When they take snapshot/airdrop, listing it on RE is considered owning a GP.

If you plan on selling/listing it then you can deposit it into RandomEarth. Otherwise, I am guessing you probably just purchased and it is probably still with RE/their settlement contract. You will have to go back to RE and withdraw it.

Hope this clarifies. I am hoping you got your GP before the recent craze :)

Hi KPO

DeleteThanks for your prompt reply. Yes I purchased it and it is in RE, can't see it yet on TS NFT tab. I got GP glitch few days back before it started getting really crazy.

Can just withdraw it to TS wallet?

Nice. Congrats man. Can see profit from NFT already. Haha. Hope you already figure it out. Once you withdraw from RE, you need to add the GP contract address to see it in the TS wallet.

DeleteThanks.. still figuring but will get there... eventually

Delete