Baby Ong will be 1 year old very soon! Somehow it suddenly felt like time flies and she's growing up very fast. I still remember vividly how CZM and I felt that time was moving so slowly about 11 months back and wondering when will she (just a newborn) grow up.

Nowadays, some of her actions are just so sweet which makes all the hard work worthwhile e.g. giving CZM a good morning kiss or being selective on who to carry her (she prefers me over everyone else including CZM). Last but not least, she can finally call me "Papa". Yay!

Anyway, our portfolio reaches another new high! It increased by 3.98% to $1,510,704 - $6,276.00 of capital injection and $51,480.84 of capital gain. This includes $202,875 of leverage/debt (gearing/debt ~15.51%).

If you prefer to look at numbers, this is the raw data used to generate the above bar graph. These numbers are as of the last day of the month.

"Cash Flow" is the amount of money being injected/withdrawn from the portfolio (buying stocks = +ve cash flow while selling stocks and collecting dividends = -ve cash flow)

Did not buy stocks or deploy any leverage but bought more LUNA... I am guessing our crypto portfolio will be bigger than our stocks portfolio very soon despite allocating a much smaller capital.

Anyway, the idea of using leverage is simple, borrow the money, buy a good/excellent REIT/stock, use the dividends to pay the interests, and keep the difference while ensuring that we will never get a margin call/trigger. Once again, leverage has its risk and is definitely not for everyone. We see it as our way of buying a second property without incurring any of those taxes (ABSD, rental income tax, etc.). You can take a look at this -

Leverage Performance 2020.

Given that it is a brand new year, I have adjusted my SRS contribution to $1,276 per month with the intention of maxing it by year-end. We have also decided to open another StashAway portfolio for Baby Ong. You can read about

Our Insurance and Investment Plan for Baby Ong.

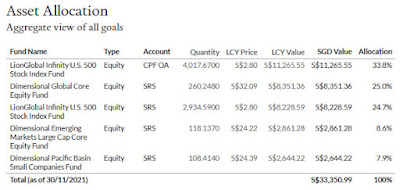

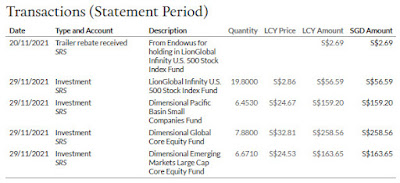

Our Monthly DCA for November - $1,376

$100 Cash for Baby Ong - StashAway Risk Index 36%

$638 KPO's SRS - StashAway Risk Index 36%

$638 KPO's SRS - Endowus Loss Tolerance -60%

Dividends

The total dividends collected this month is $3,433.59. The breakdown is as follows:

Company PayDate Shares Total

Mapletree Commercial Trust 30-Nov-21 22,000 $965.80

Suntec Real Estate Investment Trust 29-Nov-21 26,000 $580.32

DBS Group Holdings Ltd 26-Nov-21 1,200 $396.00

GuocoLand Ltd 25-Nov-21 9,000 $540.00

Ascott Residence Trust 9-Nov-21 30,913 $168.47

CapitaLand China Trust 8-Nov-21 29,000 $783.00

Total dividends collected for 2021: $28,237.30

Average dividends per month for 2021: $2,567.02

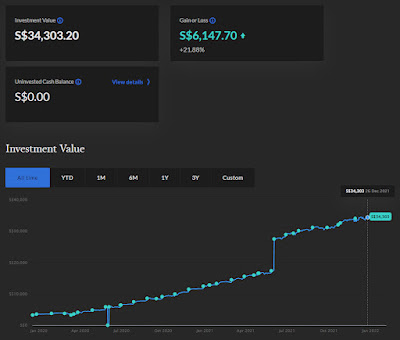

StashAway

|

| KPO |

|

| CZM |

Capital: $25,172.39

Current: $26,957.22

If you are interested in StashAway, do use our

referral link. You get $10,000 free management fees for 6 months and we will get $16!

If you want to extract those transactions information from StashAway, do take a look at this article -

StashAway Transactions Parser.

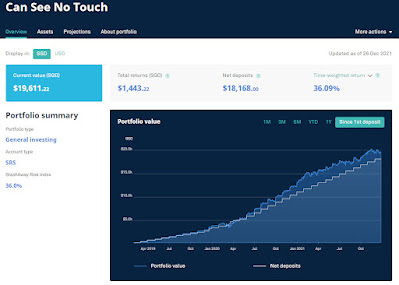

Endowus

Capital: $28,166.00

Current: $33,563.93

If you are interested in Endowus, do use our

referral link for our readers! You will get S$10,000 managed free for 6 months ($20 equivalent) and we will get $20 too! This access fee has no expiry date.

Crypto

Tracking crypto investment becomes very painful when the number of coins increases or when I move across to different networks. Hence, to simplify the tracking, I will just be tracking the capital I put in vs the current value at the end of the month.

Capital: SG$186,619.00 + US$3,132.08 (leverage) ~ SG$190,902.62

Current: SG$579,553.82 + US$3,132.08 (leverage) ~ SG$583,837.44

If you prefer a pie chart.

Crypto - FTX

I am holding some RUNE on FTX. Initially wanted to try out providing liquidity on Thorchain because of the unique ILP (Impermanent Loss Protection) but got lazy to deep dive further because the set-up was troublesome (new wallet, upgrade BEP2 RUNE to native RUNE, etc.).

FTX: We will receive 25.00% of your trading fees and you will receive a 5.00% fee discount on all of your trades.

Crypto - CakeDeFi

Sitting on a decent profit with the majority of my DFI in the freezer until Dec. The initial plan was to try this for a year but have decided to move the fund here to Terra/LUNA once the DFI are out of the freezer because I have more faith in that performing well. I have made multiple withdrawals into Kucoin. In my opinion, CakeDeFi is still a good starting place for someone that is planning to try out DeFi/getting high yields in crypto without worrying about any rug and exploit.

CakeDeFi - Deposits US$50 or more into your CakeDeFi account, you will earn US$30 in DFI and we will earn US$10 in DFI too.

Crypto - Kucoin

Similar to Kadena, I bought some QRDO due to Twitter Terra influencers. QRDO is supposedly the new tech/infra that will be onboarding institutional clients to crypto. Both allocations are kept small because of the lack of conviction.

Kucoin:

New referral system is under development! So there is no benefit. lol.

Crypto - Celsius Network

I still have a bit of BTC and Celsius token which I accumulated previously while earning high interest using GUSD. No plans on moving them at the moment.

Celsius Network: Earn US$50 in BTC with your first transfer of US$400 or more and we will earn US$50 in BTC too.

Crypto DeFi - Harmony ONE & Avalanche

|

| Wonderland (TIME) on Avalanche |

|

| Euphoria (WAGMI) on Harmony ONE |

Crypto DeFi - Terra

On a side note, Ape Board is not capturing the Psi tokens I got from Pylon Swap which is worth around US$15k. The actual total portfolio in Terra is ~US$404k.

Regardless, you can refer to our Terra portfolio on Ape Board below for a more detailed breakdown:

Some of you might see/observe the Crypto "Business" disappearing in the breakdown. This business started a few months back and I blogged about it

here. Long story short, we had a breakthrough last month where we had decent profits and the best part is everything has been fully automated. My 2 friends are like god-like teammates (神一般的队友) and did everything I never thought was possible (I am the 猪一样的队友). lol. Given the decent profits last month, we have decided to go "private" and stop sharing about this. Anyway, in all my 8 years of investing, I got to say this is my best investment despite taking just a smaller % of the profits and considering our initial capital was just US$3k (US$1k each). Not sure how long we can sustain this kind of profit but we do foresee more competition in the future and it is all about making hay while the sun shines. Huat ah!

Anyway, I have blogged about different ways to leverage crypto to build wealth for people with different risk appetites:

The safer approach using stablecoins

Risky approach but more hassle-free

Highest risk and you are on your own

If you are interested in the platform I am using, do sign up using our referral links for some bonus :)

BlockFi: Deposits US$100 or more into your BlockFi Interest Account (BIA), you will earn US$10 in BTC and we will earn US$10 in BTC too.

Celsius Network: Earn US$50 in BTC with your first transfer of US$400 or more and we will earn US$50 in BTC too.

CakeDeFi - Deposits US$50 or more into your CakeDeFi account, you will earn US$30 in DFI and we will earn US$10 in DFI too.

Gemini: We will both receive US$10 of bitcoin after you buy or sell US$100.

Crypto.com: Sign up using our link, stake SG$500 worth of CRO and we both get US$25 in CRO

FTX: We will receive 25.00% of your trading fees and you will receive a 5.00% fee discount on all of your trades.

If you are interested in the smart portfolio tracker (

StocksCafe) which I am using as shown above, sign up using my link for a longer trial period :) Refer to our

Referrals page for more information.

On a side note, Futu's moomoo app sign-up promotion is slightly different for this month (from SGD 200 stock cash bundle to iPhone and AAPL shares. Do read the T&C

here for more information). If you have yet to open an account, you can do so using our

referral link :)

You might be interested in these blog posts too:

-

2020 Net Worth- Portfolio - November 2021 - $1,510,704

Do like any of the following for the latest update/post!

1. FB Page -

KPO and CZM2. Twitter -

KPO and CZM3. Click

here to subscribe using email :)

4. Instagram -

KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)