|

| Our WhatsApp group chat |

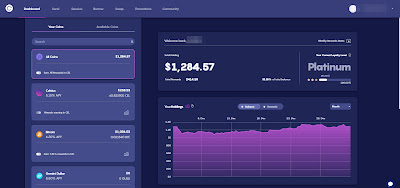

Let me introduce the concept of net worth and its importance once again for the new readers.

Net worth can be calculated by taking all the assets and subtracting away all the debts/liabilities. This is the classic comic where everyone is actually poorer than the beggar who has a net worth of $2.73. Your friends/colleagues may be living in a huge condominium, driving some fancy car but it could all be financed by debts. There is absolutely nothing wrong with that as long as their income allows so but anything can happen! Do not be the The "Poor" Pilot With Multiple Properties. You can refer to the following article on the importance of net worth by InvestmentMoats - Don’t Track Your Expenses or Budget First. Plot Your Net Worth Instead.

CashThis is all the money we have in our savings accounts. Regular readers will know we are investing aggressively that we hardly keep/hold onto cash. No emergency fund as well which I do not recommend since it is personal finance 101. We felt that there's no need for it at the moment, will probably work start saving when CZM retires?

Our Cash: ~ $25,000

CPF

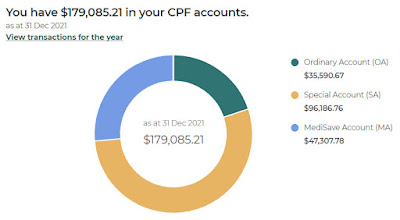

Every month, I will try to show CZM her net worth in order to motivate her to work harder towards financial freedom. However, she would always say I inflate her net worth because I included CPF. lol. I am sure some of you may have the same mentality but like I always tell her, CPF is our money and should be included as our retirement planning.

Our CPF: ~ $380,000 (OA + SA + MA)

|

| The screenshot was taken after 2021 so numbers will not tally |

I can imagine people selling their house at market value + markup, thinking that they made money from the sale but it is totally possible that market price + markup < total payment + remaining loan. Does this make sense or is it too confusing? lol.

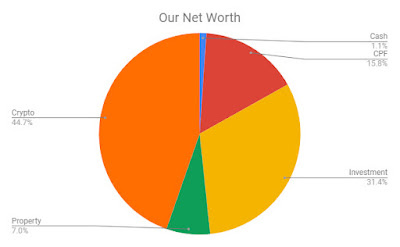

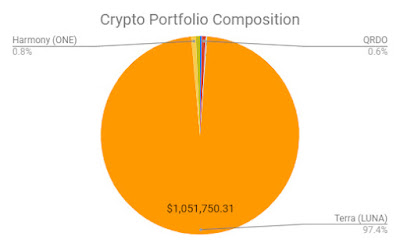

Here you go! Our net worth pie chart, it looks pretty yummy to me :)

Are you tracking your net worth?

You might be interested in these blog posts too:

- 2017 Net Worth: ~$510,000

- 2018 Net Worth: ~$640,000

- 2019 Net Worth: ~$886,000

- 2021 Net Worth: ~$2,404,000

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)