Risk Profile

Goal type: General wealth accumulation

Risk tolerance: Maximise returns (loss tolerance -60%)

Monthly investment using SRS: $638

Capital: $28,168.00 (SRS $18,168 and CPF $10,000.00)

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

Goal type: General wealth accumulation

Risk tolerance: Maximise returns (loss tolerance -60%)

Monthly investment using SRS: $638

I have modified my monthly investment in order to max out my SRS contribution for the year.

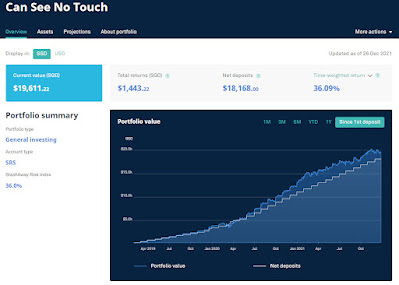

Account Summary

Current: $33,351.00 (20.32%)

There are quite a few differences as compared to StashAway. Firstly, all the cash has been invested while StashAway keeps 1% of the portfolio in cash. Secondly, the fees are not deducted on a monthly basis. The Access Fee charged by Endowus will be deducted at the end of each quarter as stated in their FAQ.

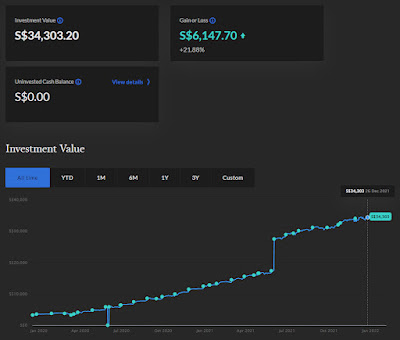

As of 26 December 2021, the portfolio value is $34,303.20. The return shown in percentage is just a simple return (P&L divided by capital) including the $10k investment from CPF OA.

There are quite a few differences as compared to StashAway. Firstly, all the cash has been invested while StashAway keeps 1% of the portfolio in cash. Secondly, the fees are not deducted on a monthly basis. The Access Fee charged by Endowus will be deducted at the end of each quarter as stated in their FAQ.

As of 26 December 2021, the portfolio value is $34,303.20. The return shown in percentage is just a simple return (P&L divided by capital) including the $10k investment from CPF OA.

It will be clearer/more accurate if we look at the respective portfolio.

I blogged about using Fund Smart to invest my CPF here. On a side note, Endowus is performing much better as compared with StashAway given that both portfolios had the same capital/deposit and started around the same time (StashAway had a few months of headstart).

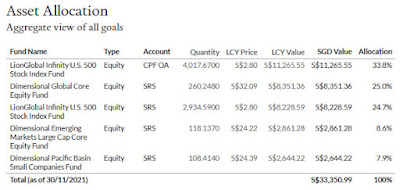

Asset Allocation

This shows that the number of shares for each fund that I owned:

CPF

- LionGlobal Infinity US 500 Stock Index Fund (4,017.6700)

SRS

- Dimensional Global Core Equity Fund (260.2480)

- LionGlobal Infinity US 500 Stock Index Fund (2,934.5900)

- Dimensional Emerging Markets Large Cap Core Equity Fund (118.1370)

- Dimensional Pacific Basin Small Companies Fund (108.4140)

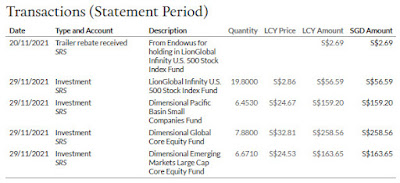

Transactions

- Dimensional Global Core Equity Fund (260.2480)

- LionGlobal Infinity US 500 Stock Index Fund (2,934.5900)

- Dimensional Emerging Markets Large Cap Core Equity Fund (118.1370)

- Dimensional Pacific Basin Small Companies Fund (108.4140)

Transactions

That's all! Overall, I think the statement is pretty straightforward and easy to read. On a side note, StocksCafe does not have the ability to track funds, hence unable to do any form of comparison/benchmark.

If you are interested in Endowus, do use our referral link for our readers! You will get S$10,000 managed free for 6 months ($20 equivalent) and we will get $20 too!

On a side note, Futu's moomoo app sign-up promotion is slightly different every month (AAPL shares, cash coupon, etc. Do read the T&C here for more information). If you have yet to open an account, you can do so using our referral link :)

You might be interested in the previous monthly update too:

- Endowus - December 2020 - $12,466.20

- Endowus - January 2021 - $13,080.35

- Endowus - February 2021 - $13,549.30

- Endowus - March 2021 - $15,484.29

- Endowus - April 2021 - $16,570.37

- Endowus - May 2021 - $17,325.44

- Endowus - June 2021 - $28,840.67

- Endowus - July 2021 - $30,013.78

- Endowus - August 2021 - $31,198.92

- Endowus - September 2021 - $30,827.27

- Endowus - October 2021 - $32,854.68

- Endowus - November 2021 - $33,351.00

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

Hi SP6190,

ReplyDeleteThanks! In my opinion, it's never too late similar to investing in stocks. I do believe that LUNA can go higher and action speaks louder than words. I was still buying LUNA at $98 - https://finder.terra.money/mainnet/tx/52ABBE97219BDDC5F1F9A97345FE9165DA056E77F9B2376172BCB0030297E881

I would say research/read up more first so that you will understand how LUNA/Terra works and maybe you will have the same level of conviction. Haha. End of the day, just invest in whatever that works/more comfortable for you :)