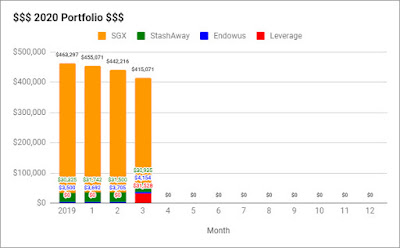

Besides buying aggressively on our own portfolio - Portfolio - March 2020, I have also made additional contributions ($250 on 12 March and $500 on 18 March) to both Endowus and StashAway. I was even considering investing my CPF OA using Endowus but before a decision was made, the market has sort of recovered and I dropped the idea. Let's see how that goes.

Risk Profile

Goal type: General wealth accumulation

Risk tolerance: Maximise returns (loss tolerance -60%)

Current: $4,153.50 (-22.84%)

There are quite a few differences as compared to StashAway. Firstly, all the cash has been invested while StashAway keeps 1% of the portfolio in cash. Secondly, the fees are not deducted on a monthly basis. The Access Fee charged by Endowus will be deducted at the end of each quarter as stated in their FAQ.

Asset Allocation

This shows that the number of Dimensional World Equity Fund units (247.9700) owned. It will be great if they actually showed my average price vs the current market price.

Transactions

Bought 15.3700, 32.6160 and 154.0330 shares of Dimensional World Equity Fund @ $16.27, $15.33 and $16.63!

That's all! Overall, I think the statement is pretty straightforward and easy to read.

Anyway, Endowus has reached out and offered a masked referral link for our readers! You will get S$10,000 managed free for 6 months ($20 equivalent) and we will get $20 too!

You might be interested in previous months update too:

- Endowus CPF/SRS Review

- Endowus - January 2020 - $3,692.02

- Endowus - February 2020 - $3,704.57

- Endowus - March 2020 - $4,153.50

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

Risk Profile

Goal type: General wealth accumulation

Risk tolerance: Maximise returns (loss tolerance -60%)

Monthly investment using SRS: $250

Capital: $5,000.00Current: $4,153.50 (-22.84%)

There are quite a few differences as compared to StashAway. Firstly, all the cash has been invested while StashAway keeps 1% of the portfolio in cash. Secondly, the fees are not deducted on a monthly basis. The Access Fee charged by Endowus will be deducted at the end of each quarter as stated in their FAQ.

Asset Allocation

This shows that the number of Dimensional World Equity Fund units (247.9700) owned. It will be great if they actually showed my average price vs the current market price.

Transactions

Bought 15.3700, 32.6160 and 154.0330 shares of Dimensional World Equity Fund @ $16.27, $15.33 and $16.63!

That's all! Overall, I think the statement is pretty straightforward and easy to read.

Anyway, Endowus has reached out and offered a masked referral link for our readers! You will get S$10,000 managed free for 6 months ($20 equivalent) and we will get $20 too!

You might be interested in previous months update too:

- Endowus CPF/SRS Review

- Endowus - January 2020 - $3,692.02

- Endowus - February 2020 - $3,704.57

- Endowus - March 2020 - $4,153.50

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)