Update on 22nd June 2021: Not applicable anymore. Yield has dropped drastically.

Anyway, after my previous article on DeFi - Aave, QuickSwap and AdamantVault on Polygon (Matic Network), besides the reader that left a comment stating how risky it was to borrow MATIC which is equivalent to shorting it, another reader asked me to check out Curve and I have changed the farming strategy to a much safer but higher yield approach.

To understand how it works, let's take a look at how the health factor is computed. It is (your collateral x the liquidation threshold) / borrowed asset. The liquidation threshold is constant/fixed and can be found here. Hence, the health factor will be affected by both the collateral and the debt/borrowed asset.

There are 2 ways to get liquidated:

1. When your collateral decreases (e.g. BTC or ETH price falls). This can happen when your collaterals are not stablecoins. If they are stablecoins like how I am doing it, then you can ignore this.

Not sure if you have figured it out after reading so far, in order to play the Aave game safely without the risk of being liquidated, one will have to deposit and borrow stablecoins. This is where Curve comes into the game plan. Similarly, the founder of Curve is made known, hence rug/exit scam will unlikely happen. You can read more about Curve here but to put it simply, it is a DEX for stablecoins. The yield at Curve is currently ~40%+ and behind the scene, they are also using Aave pool and have shared the other risks of using Aave. Do read it here.

2. When your debt increases (e.g. MATIC price increases). Although I deposited the same amount of MATIC back, the LTV of MATIC is just 50%. Hence, when the price of MATIC increases, the rate at which my debt increases will be doubled the increase in my collateral and the chance of being liquidated exist. On the other hand, if you were to borrow stablecoins, then you can ignore this.

If you are planning to farm on Aave and is interested in playing with the spreadsheet or using it to manage your risk, you can make a copy of it here.

Not sure if you have figured it out after reading so far, in order to play the Aave game safely without the risk of being liquidated, one will have to deposit and borrow stablecoins. This is where Curve comes into the game plan. Similarly, the founder of Curve is made known, hence rug/exit scam will unlikely happen. You can read more about Curve here but to put it simply, it is a DEX for stablecoins. The yield at Curve is currently ~40%+ and behind the scene, they are also using Aave pool and have shared the other risks of using Aave. Do read it here.

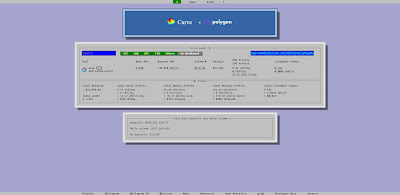

This is my current setup using Aave + Curve:

The majority of my capital is in USDC and I borrowed USDT from Aave. I can keep a much lower health factor than before (1.2 initially and it has fallen due to the price of ETH falling) because both my collateral and debts will not be moving much.

The borrowed USDT will then be deposited into Curve. If you are wondering why not just deposit into Curve directly, the answer is by leveraging I will be getting a higher yield which consists of more MATIC.

Of course, the yield will increase/decrease depending on the price of MATIC. This is like the movie - Inception where a dream happened within another dream. I am borrowing USD from the bank at 1%+, used the borrowed USD to borrow more USD to get a yield of 47%+. Easy money? Only time will tell :) If you looked closer, you will see that my initial US$30k has become just US$29.8k because of all the fees I had to pay to convert and transfer/bridge the money to its final USDC form in Polygon. I am sure I will earn it back soon.

The above seems too complicated? A more fuss-free approach is to just use Celsius Network for 10% interest where the capital is guaranteed and I have demonstrated how to withdraw the USD out too. Check out the articles below.

Anyway, I have blogged about different ways to leverage crypto to build wealth for people with different risk appetites:

The safer approach using stablecoins

Risky approach but more hassle-free

Highest risk and you are on your own

- DeFi apps on Binance Smart Chain (BSC) such as PancakeSwap and PancakeBunny

- DeFi - Farming MATIC using Aave + Curve

On a side note, Futu's moomoo app attractive sign-up bonus (one free Apple Share besides other benefits) has been extended to 31st May 2021 (1500hr SGT)! Take a look at the latest benefits here.

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

how did u bridge to polygon

ReplyDeleteHi Steven,

DeleteI did it from BSC (https://www.xpollinate.io/) and the Matic wallet from Ethereum (https://wallet.matic.network/). I am sure there are other ways, go research and decide how you want to do it.

xpollinate.io just removed their bridge from BSC to Matic (polygon) due to recent BSC issues. Not sure if there are other simpler options which don't require to jump so many hoops

DeleteHmm. You are right. I can't find a replacement for xpollinate.io. If really want, got to go through Ethereum or from fantom through xpollinate.io. Both way require you to pay quite a bit of fees...

DeleteFor "through Ethereum", gas fees are usually lowest during weekends so can still try during then

DeleteFor "from fantom through xpollinate.io", FTM tokens are too volatile (high slippage) to use as a transfer medium even if it does detour ETH’s gas and BSC’s issues. For small sums okay, but for thousands it can cost a lot

Other alternative ways for BSC to Polygon (until xpollinate.io is back up):

1) Binance TRC-20USDT to Ascendex (USDT token, 1 USDT fee) -> Swap to USDC at Ascendex -> Withdraw Ascendex USDC to Metamask (or other wallet) Matic mainnet (minimum withdrawal of 120 USDC, 0.2 USDC fee). No ETH gas fees incurred but note Ascendex has 24h cooldown after first acc opening.

2) Through Binance Smart Chaion then xDai: Binance to metamask -> Omnibridge to xDai -> xpollinate to polygon

Just my 2 cents

Nice. I was thinking of buying some ETH from Gemini and then bridge over to Polygon to transfer fund but 1 and 2 looks like the best way to get stablecoins in with minimum fees. Thanks for sharing! This comment is more than 2 cents, quite a life saver. Hahahaha.

DeleteSaw this YouTube video using EvoDefi bridge https://www.youtube.com/watch?v=w4UIniGfmcA

DeleteThanks for sharing! I didn't know about Evodefi bridge but the fees seems high at 0.5%.

DeleteI am currently using this approach which is what the reader posted above:

I wire USD to Binance which gets converted to BUSD, then I send the BUSD (no fees) to my Metamask address on BSC.

Convert to either DAI, USDC or USDT on PancakeSwap (some fees), then go to https://omni.xdaichain.com/bridge to bridge to xDai.

If you bridge Dai (BSC) over, will need to convert to WxDai (some fees) and go to use https://wrapeth.com/ to unwrap WxDAI to xDAI. If you bridge USDC or USDT can skip this step.

Last but not least, use https://www.xpollinate.io/ to bridge Dai, USDC or USDT from xDAI to Polygon (some fees).

I believe the above is the most cost effective method but you can test it out yourself :)

Curve is a great project.

ReplyDeleteStay safe out there ;)

turtleinvestor

Hi TI,

DeleteI agree and I like it! I will try to but unfortunately I just suffered from an exploit on PancakeBunny - https://pancakebunny.medium.com/hello-bunny-fam-a7bf0c7a07ba

You stay safe too. Haha.

Thanks for sharing and forgive me for a noob question as i'm still exploring DeFi (usually I just hodl and use CeFi) I've read both articles on Aave and am still struggling to understand the rates.

ReplyDeleteBased on your screenshot of your Aave position and the borrowing of USDT, the rates are 3.68% and 16.82% APR. Do you mind explaining what those rates mean. Is that the cost of borrowing? I'm sure there would be interest to be paid on the USDT borrowing?

Thanks

Hi JD,

DeleteNo worries. The cost of borrowing USDT is 3.68%, so over time you will see the USDT you owe increase. The rate with the smaller font of 16.82% is the interest you earned by borrowing/participating in the market which is in MATIC and paid out in the top right hand corner under "Available rewards".

Net net, I am actually getting paid to borrow USDT (16.82% - 3.68%). On the deposit side, I will be paid the base currency (big font) + MATIC (small font) too. Do note that all the rates are variable rates. For example, a lot of people starts to borrow USDT, then they no longer need to reward you as much to get you to borrow so the MATIC rate (small font) will decrease while the cost of borrowing (big font) will increase.

Hope this is clearer now!

Dear KPO,

DeleteThank you for taking the time to reply and spelling it out! Much appreciated. Yes its clearer now and i can see the rationale much better now. Aave seems like an interesting proposition and will read more into it as i explore CeFi more.

Stay safe and hodl!

Haha. Np. Same to you! CeFi will give you higher interest than typical savings account already, meanwhile just read up more and make sure you know the risks and are comfortable with them before giving it a try :)

DeleteHi KPO,

ReplyDeleteThanks for all the write up, greatly appreciate your sharing.

Would like to understand if you have explore how to cash out/convert to fiat.

Do you happen to check or whether you would be using the same method as per your earlier sharing through AAVE/Curve>Metamask(ETH)>Gemini>Bank Account or AAVE/Curve>Metamask(BSC)>Binance>Bank ?

Hi WM,

DeleteYes, I gave it some thought but not planning to execute it anytime soon. You are somewhat correct, just that I wouldn't go the ETH route at least for now because of the high gas fee.

The initial plan is AAVE/Curve(Polygon) -- xpollinate.io --> Metamask(BSC) --> Binance --30 USD for wire transfer--> Bank but the xpollinate bridge is down. If you really want to cash out now, then probably will have to go through the ETH bridge/route. On the bright side, there is no withdrawal fee from Gemini.

Thanks for sharing. ! Will continue to explore other possibilities.

Deleteany concern now that borrowing USDT on Aave has a higher APY than the reward?

ReplyDeleteHi Andrew,

DeleteNot really, if you include the yield from Curve, it is still higher. Alternatively, you can just repay the USDT, borrow USDC/DAI instead to deposit to Curve.

If you want to know, how to Swap Bitcoin To USDT on Trust Wallet? Read this blog to convert or swap BTC to USDT on Trust wallet easily. Looking to exchange your Bitcoin for USDT? Our platform offers a seamless and secure way to swap BTC to USDT at competitive rates. Don't miss out on the opportunity to make the most of your cryptocurrency holdings. Start trading today!

ReplyDelete24h Withdrawal Lock on Crypto.com

Contact Blockchain Support Number

3 Best ways to Exchange BTC to USDT?

Coinbase Not Showing Balance Issue