- This is one of the largest amounts raised in Series A funding for a Singapore-based fintech firm

- Endowus has plans to expand in Asia, starting with Hong Kong

- It is on track to hit S$1 billion in assets under advice by the second quarter in Singapore

ESG portfolios are interesting but unfortunately only available for cash investment. Although Cash Smart Ultra is probably offering one of the higher interest in the market currently, it still feels meh to me. If you are considering/looking at cash management account. You might want to consider my way of cash management. US$53.78 was my interest for just 1 week with a deposit of US$30k.

Capital: $13,064.00

Current: $15,484.29 (18.57%)

There are quite a few differences as compared to StashAway. Firstly, all the cash has been invested while StashAway keeps 1% of the portfolio in cash. Secondly, the fees are not deducted on a monthly basis. The Access Fee charged by Endowus will be deducted at the end of each quarter as stated in their FAQ.

As of 20 April 2021, the portfolio value is $16,001.19 (+22.55%).

- Endowus has plans to expand in Asia, starting with Hong Kong

- It is on track to hit S$1 billion in assets under advice by the second quarter in Singapore

In comparison, StashAway raised USD $5.3 million in Series A, USD $12 million in Series B, and USD $16 million in Series C. Having said that, we do not have visibility into the shares/equity that were traded for the funding. Besides that, they have also launched Cash Smart Ultra (1.8%-2%) and ESG (Environmental, Social, and Governance) portfolios. Judging by all these, Endowus is doing pretty well and we do not have to worry about it closing down like Smartly.

ESG portfolios are interesting but unfortunately only available for cash investment. Although Cash Smart Ultra is probably offering one of the higher interest in the market currently, it still feels meh to me. If you are considering/looking at cash management account. You might want to consider my way of cash management. US$53.78 was my interest for just 1 week with a deposit of US$30k.

Most importantly, Endowus has finally decided to lower the minimum investment amount to $1,000, making investing more "affordable" to everyone!

Risk Profile

Goal type: General wealth accumulation

Risk tolerance: Maximise returns (loss tolerance -60%)

Monthly investment using SRS: $638

Risk tolerance: Maximise returns (loss tolerance -60%)

Monthly investment using SRS: $638

I have modified my monthly investment in order to max out my SRS contribution for the year.

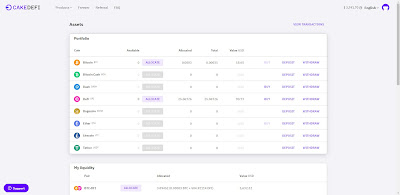

Account Summary

Current: $15,484.29 (18.57%)

There are quite a few differences as compared to StashAway. Firstly, all the cash has been invested while StashAway keeps 1% of the portfolio in cash. Secondly, the fees are not deducted on a monthly basis. The Access Fee charged by Endowus will be deducted at the end of each quarter as stated in their FAQ.

As of 20 April 2021, the portfolio value is $16,001.19 (+22.55%).

For the last few weeks, Endowus portfolio was like on steroids. This is the first time it overtook my SRS investment with StashAway given that both portfolios had the same capital/deposit.

Asset Allocation

This shows that the number of shares for each fund that I owned:

- Dimensional Global Core Equity Fund (201.0180)

- Infinity US 500 Stock Index Fund (2,404.0200)

- Dimensional Emerging Markets Large Cap Core Equity Fund (80.7250)

- Dimensional Pacific Basin Small Companies Fund (74.5680)

It will be great if they actually showed my average price vs the current market price. Anyway, the Feb SRS investment was not captured in the same month, hence the above looks identical to last month and you will see that there are no transactions below.

Transactions

- Dimensional Global Core Equity Fund (201.0180)

- Infinity US 500 Stock Index Fund (2,404.0200)

- Dimensional Emerging Markets Large Cap Core Equity Fund (80.7250)

- Dimensional Pacific Basin Small Companies Fund (74.5680)

It will be great if they actually showed my average price vs the current market price. Anyway, the Feb SRS investment was not captured in the same month, hence the above looks identical to last month and you will see that there are no transactions below.

Transactions

Given that Feb was a shorter month, the investment made in Feb spilled over to Mar.

That's all! Overall, I think the statement is pretty straightforward and easy to read. On a side note, StocksCafe does not has the ability to track funds, hence unable to do any form of comparison/benchmark.

Speaking of which, Endowus has finally launched a mobile app:

Android: https://play.google.com/store/apps/details?id=com.endowus.mobileapp

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

If you are interested in Endowus, do use our referral link for our readers! You will get S$10,000 managed free for 6 months ($20 equivalent) and we will get $20 too!

On a side note, Futu's moomoo app attractive sign-up bonus (one free Apple Share besides other benefits) has been extended to 30th April 2021 (1500hr SGT)! Take a look at our review here.

You might be interested in the previous monthly update too:

- Endowus - December 2020 - $12,466.20

- Endowus - January 2021 - $13,080.35

- Endowus - February 2021 - $13,549.30

- Endowus - March 2021 - $15,484.29

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)