The crypto space is really a whole new world. Besides staking and earning high interest using BlockFi and Celsius Network which I have blogged about previously (Earning High Interest Using BlockFi and Celsius Network Part 2), the next exciting thing/crazy high yield (triple digit yield) is to explore DeFi (Decentralized Finance).

|

| Triple yield at PancakeSwap |

A reader recommended me to try out PancakeSwap which is on the Binance Smart Chain (BSC) instead of some other platform using Ethereum because the gas fees are too high now. While I was reading and researching more about it, it just so happen that Chicken Genius posted a video where he interviewed Dr. Julian Hosp on DeFi, CakeDeFi, and BTC. CakeDeFi was founded by Dr. Julian Hosp and U-Zyn Chua both based in Singapore to make DeFi more accessible. Long story short, I decided to give it a try and used his referral. I will be sharing my experience and the spreadsheet I am using to track the return.

CakeDeFi currently provides 3 features - Liquidity Mining, Staking, and Lending.

|

| Liquidity Mining for these 6 liquidity pairs |

|

| Staking for DFI and DASH |

|

| Lending for BTC, ETH, and USDT |

There's nothing new about staking and lending, what's interesting is liquidity mining which is providing an estimated 90-100% yield. I'm not even going to try explaining what that is in my article because it is going to be too long and complicated so I will leave it up to you to research it and the risks associated if you are really interested. In short, one provides liquidity to a market/exchange by pledging 2 coins of the same value and in return, we get a portion of the trading fees usually in the form of a governance token (in this case, that will be DFI - DeFiChain).

Unfortunately, there is no option to buy/fund the account using xfers/wire transfer if one is based in Singapore. The only way is to transfer the supported coin into the account and I chose to do it through Luno because it has the least transfer fee (I am wrong! It seems that Gemini is a better alternative because it has 10 free transfer per calendar month). So I bought SG$5,000 worth of BTC and transferred it to CakeDeFi.

Luno's withdrawal fee is priced dynamically and I had to pay around 0.00013605 ($10.55) at that time while most have a fixed fee of 0.0004-0.0005 (~$30-$40).

Anyway, I was too lazy and didn't want to create more accounts at these exchanges which I will likely not use so I swap slightly more than half of my BTC to DFI within CakeDeFi. Notice how the total value in my account (top right-hand corner) dropped significantly after the swap! That's because of my laziness for buying DFI at a premium and immediately realizing the "loss" when pricing DFI at market price. My train of thought was I can easily recover from the loss with a yield of 90-100%.

|

| Max-ing BTC not allowed due to insufficient DFI |

|

| Max-ing DFI |

The next thing to do is to add liquidity to the pool. Doing that is simple, click on the "Max" button for either BTC or DFI. As mentioned previously, an equal value of the coins will have to be supplied in exchange for new LP (Liquidity Pool) shares (in this case BTC-DFI LP share).

|

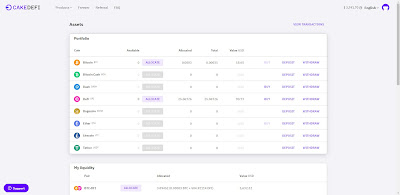

| Snapshot of my account 1 week later in USD |

|

| Snapshot of my account 1 week later in SGD |

As of today (11th April 2021) which is about 1 week after trying it out, I have regained slightly more than my capital. As high as the number looks, I don't believe this is a platform for people to make quick bucks. To realize the gain/profit, we will need to move all these coins to the exchange to sell/convert to fiat. Similar to all other platforms, CakeDeFi has its fixed fee for withdrawal and I am not planning to withdraw it anytime soon. Some of the potential catalysts for DFI to increase further in price are listing in other/more exchanges as well as new products being launched - these were mentioned/discussed in Chicken Genius video.

Let me show you what is impermanent loss. If you compare the screenshots I have taken on the day I first provided the liquidity against the latest screenshot (1 week later), you will see that the BTC-DFI LP shares are the same but the underlying number of BTC and DFI coins have changed. To put it simply, the value of underlying coins has to be equal so whenever the price moves, the number of underlying coins will change accordingly but it is actually more complicated than that. It has to also do with the total number of underlying coins in the pool too. End of the day, what matters is the total return, as long as the rewards > the impermanent loss, I will be making money.

You can find the CakeDeFi Liquidity Mining spreadsheet here. Simply export all your transactions from CakeDeFi and paste them into the _raw sheet. If you are mining other DFI pairs, just modify the formula accordingly.

CakeDeFi is definitely the easier way to try out DeFi and is more suitable for new crypto investors. I will be sharing more about my experience with PancakeSwap in my next article. Stay tuned!

Luno: Sign up using our link, deposit, and buy SG$100 worth of BTC (Luno exchange not included) and we both get SG$5.00 worth of BTC

On a side note, Futu's moomoo attractive sign-up bonus (one free Apple Share besides other benefits) has been extended to 30th April 2021 (1500hr SGT)! Take a look at our review here.

You might be interested in these articles too:

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

If you are interested in the platform I am using, do sign up using our referral links for some bonus :)

CakeDeFi - Deposits US$50 or more into your CakeDeFi account, you will earn US$30 in DFI and we will earn US$10 in DFI too.

Gemini: We will both receive US$10 of bitcoin after you buy or sell US$100.

On a side note, Futu's moomoo attractive sign-up bonus (one free Apple Share besides other benefits) has been extended to 30th April 2021 (1500hr SGT)! Take a look at our review here.

You might be interested in these articles too:

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

"As high as the number looks, I don't believe this is a platform for people to make quick bucks."

ReplyDeleteSorry, I didn't quite get this part...isn't the yield estimated to be 90-100%?

Hi Reader,

DeleteThat's because that are actually many moving parts. The price of BTC, DFI as well as impermanent loss. The 90-100% is an estimated annualized yield (holding a year isn't exactly quick bucks right?) and as more people provide more liquidity, the yield will likely fall. Even with a 90-100% yield, if the price of BTC/DFI/your capital falls 50%, also GG. lol.

Most importantly, the withdrawal fees makes quick bucks less feasible. Let's say I put in SG$1k and see SG$100 profit few days later, when I try to withdraw the BTC, there's a fee of 0.0005 BTC which is about SG$40, almost half gone right?

Hey cakedefi is absolutely not defi. It's fully custodial (you trust your btc with a known scammer and nothing is open source or verifiable) There is no financial utility (lending/borrowing, trading, derivs) to the project at all and it is set up purely as a ponzi to scam retail noobs. BTW the bitcoin blockchain can ONLY do value transfer/ledger keeping, whatever soft fork crap hosp claims is basically a centralised server run by himself.

ReplyDeleteNot sure how an educated person like yourself could have put any money in this without due diligence but your audience is mainly singaporean and nothing saddens me more than sinkie pawn sinkie. There are legit defi projects on ethereum and some on binance smart chain. Don't shill this shit please.

Hi SG defi power user,

DeleteThanks for your comment! By the look of your name, I scare already. Very powerful. I agree that it is not DeFi because it is not even decentralized and you even got to do KYC! Why is that a need for KYC? Is it because they are applying for PSA license from MAS? Why don't you take a look at this site - https://www.mas.gov.sg/regulation/payments/entities-that-have-notified-mas-pursuant-to-the-ps-esp-r? Oh. Maybe this site is a scam or CAKE PTE. LTD. isn't real to you? I don't know man. I am not a defi power user, I am just a retail noobs that started blogging about my experience in crypto for less than a month :)

Not sure if you left the same comment with Chicken Genius but I guess even if you did, he might not entertain/waste his time on you. Unfortunately, I am just a small blogger with 2 comments instead of 1.4k comments and I appreciate you taking time to leave a comment, hence I am wasting my time to reply to you. Not sure why I put money in this? Because I can afford to lose them :) Forget about me and my audience. Chicken Genius is one that concentrates his portfolio into Tesla and only Tesla. Buying anything else will be a donkey move but he decided to put some money there and made a few videos on it, not sure why he trying to pawn more sinkie than me.

Yes, there are other real DeFi projects. Is PancakeSwap on Binance Smart Chain real enough for you? When I read this on PancakeSwap - https://docs.pancakeswap.finance/contact-us/customer-support, I damn scare so will others. You need to understand different people have different risk profile/preferences and that's why there are CeFi also. To be honest, I have tried PancakeSwap and comparing both my experiences, CakeDeFi does make the whole liquidity mining process less daunting. Does holding my shares in CDP really matters to me? No. That's why I don't care whether the coins are in my own wallets and there will be others like me. Why are you forcing me and my readers to put our shares in CDP and calling me out for using a custodian? That sounds so ridiculous as I am typing it out. lol.

What can I say other than you sound like a hurt TenX/PAY holder. Probably a very hurt one. Anyway, end of the day, crypto is all a scam right? Even the so called legit defi projects like PancakeSwap can be replaced anytime by some other projects on some other network and the CAKE token will just lose its value as more people pull out from the project.

As usual, I am just blogging about my own experience after putting my own money in. If I do take them out, I will blog about it too. Whether my readers decide to invest in whatever I am in, I believe they will do their own research and decide for themselves so you definitely don't have to worry about it :)

Hi,

ReplyDeleteThanks again for your detailed information sharing on another aspect of crypto investment.

What is your strategy for crypto investing? If I read correctly, you have placed USD $30k in BlockFi and Celsius Network earning 8% to 10% interest per annum. And you plan to increase your investment in CakeDeFi to similar value? What is the investment return like for CakeDeFi/PancakeSwap, seems like easily above 100% per annum.

I just find the whole crypto world to be a real eye opener and definitely seems like a missed opportunity not to participate in it! Thanks.

Hi Nightmare_Angel,

DeleteYes, I have placed US$30k all in Celsius Network earning around 10% interest per annum. I was merely using BlockFi to receive the wire and to transfer the GUSD to Celsius Network. I am planning to keep my BTC and ETH with BlockFi though.

Nope, I don't plan on increasing the SG$5k I have allocated in CakeDeFi. I have also allocated another SG$5k on PancakeSwap and have no plan on increasing that as well. That's because they are so much more risky! Too early to judge, it has only been about 1-2 weeks so if I were to annualize it now, it will be like ridiculously high. lol.

Haha. I know man. I decided to just whack a bit, if lose then so be it. Life goes on! For starters, BlockFi and Celsius Network will be a good start. Relatively safer and better return than those cash management/fixed deposit if you don't foresee yourself needing the money in the near future.

YES, high risk, high return! I think there's huge growth for Crypto still although it has been around for some time as there's so much innovation going on. It's going to stay here for a long time!

DeleteBtw, how do you plan to perform withdrawal from CakeDeFi? Convert the BTC-DFI shares to BTC --> withdraw to Luno exchange --> to your designated USD bank account? I'm sure in time to come (probably soon? haha) you will start to withdraw at least your capital + abit of gains out from CakeDeFi since the growth is so ridiculously high! haha

I'll probably start off with Celsius Network and maybe put a small sum into CakeDeFi once I understand the whole flow. Going to cap Crypto at 5% of my total investment which I'm fine to lose if the whole Crypto system collapses!

Thanks again for your sharing which provides me with the first layer of information as the amount of information is pretty overwhelming especially this is so new to me. :)

Hahaha. Yes, it is interesting to see more companies entering the crypto space. In addition, it seems that regulation is going to kick in anytime and that's probably going to scare off some people or damper the growth. Let's see how thing goes.

DeleteI have not thought of withdrawing at the moment but I would not be converting DFI to BTC within CakeDeFi again. It's a heavy/expensive price to pay for laziness as shown above. I will probably transfer DFI out to exchange (hopefully it get listed/traded at more exchanges) to sell/convert to fiat. For BTC, I am not planning to sell at all. Will probably transfer out to BlockFi to earn interest instead.

Yes, try with money you can afford to lose. I will probably find time and blog about PancakeSwap this weekend. I think that will interest you more if you think CakeDeFi's yield is high. lol.

You are welcome! I'm glad that you found them helpful!

Hi thanks for your helpful post! May i know which platform do you use to purchase your BTC/ETH prior to transferring to BlockFi? I'm thinking of using Binance.com but noted the withdrawal fees of ~30-40USD if withdrawing to BlockFi.

ReplyDeleteThank you!

Hi cheezels,

DeleteThanks! Glad that you found it useful! Unfortunately, the transfer fees are just that high. To avoid the transfer fee totally, you can wire USD to BlockFi first, then use the GUSD to buy BTC/ETH on BlockFi. Alternatively, you can buy through Luno and their transfer fee varies between SG$5-$10 based on my own experience. I did not go compare which one offers the best rate though.

Hi cheezels,

DeleteThe reader below pointed out Gemini has free transfer and I believe that is a better alternative than Luno. Will update my articles later.

Hi, just to share, I use FTX, cheap and good if you trade mainly BTC, wire transfer USD and ready to go!

DeleteMaker fee: 0.02% (yes, very low)

Small BTC withdrawal fees: BTC withdrawals > 0.01 BTC are free. BTC withdrawals < 0.01 BTC are charged withdrawal fees after your first free one per day. Means they allow you to do a test withdrawal with small amount, then go for bigger amount.

my referral link: https://ftx.com/#a=51853949

Maker fee will fee 0.02% less 5% = 0.19%, if you use the above link. Thanks & happy HODL-ing.

Hi czs,

DeleteThanks for sharing. I am using ftx now. This article is old/not so updated and I'm not buying BTC anymore :)

Hi KPO,

ReplyDeleteThanks for sharing all your experience such as Blockfi, Celsius and etc. I have learn alot from here.

"I chose to do it through Luno because it has the least transfer fee" but Gemini no transfer fee for first 10 transactions? Is Luno safer then Gemini?

If we buy DFI @ exchange, meaning we need to transfer BTC and DFI to cake?

Thank you!

Hi Defi newebie,

DeleteGlad that you found them useful :) Oh my, I did not know it is free transfer for Gemini and I didn't have a Gemini account at the point of writing. Only created the account few weeks back when I was planning to transfer GUSD back to bank. Let me update the article. Gemini seems like the better choice!

Yes, it is more cost effective that way although it is more troublesome. If I would do it again, I will definitely transfer DFI from exchange.

How do you sell your DFI tokens in the future since Cake does not have a feature to convert DFI back to BTC

ReplyDeleteYou will have to transfer the DFI out to one of the exchange that is trading DFI. Can check from here - https://coinmarketcap.com/currencies/defichain/

DeleteAt the moment, that will be:

KuCoin and Bittrex

Hi,

ReplyDeleteGot inspired to start on crypto after reading your posts. Just a quick question, how long did your Gemini account take to verify your identity? I've been waiting for two weeks and I'm still under verification.

Hi unluckid,

DeleteCool, just make sure you know what are the risks associated with crypto. I remember it was fairly quick, maybe 1/2 days? Definitely less than 2 weeks.