I received an email in the morning that there is a new portfolio. This is the content of the email and you can read more about it here - Introducing Our Income Portfolio:

I immediately logged in to take a deeper look.

You need a minimum of SGD $10,000 for this portfolio as compared to its previously no minimum balance portfolio which is pretty high to start...

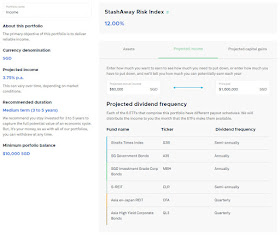

The portfolio is denominated in SGD (no foreign currency risk) and is at 12% StashAway Risk Index. This means there is a 1% chance of losing >= 12% in any year (even during a recession). The projected income/dividend yield is at 3.75% which I would consider it to be low. We will be able to see what are the underlying ETFs below.

It uses these 6 ETFs to pay out dividends and they will be distributed the month the ETFs pay them. Due to the low income/dividend yield, one will require a much higher capital.

Will I create one? To be honest, I am not a fan, so nope! My opinion is that the projected income/dividend for the portfolio is too low for me to achieve our goals and the reason for it being so low is due to the fees involved. The above income portfolio can be easily replicated since they are all listed on SGX for one-time trading fees of ~0.2+%.

If you still have a long investment horizon, the USD portfolio with similar risk index probably will provide a higher/better return. That few dollars of dividends you can get now isn't going to be life-changing but a $550k portfolio vs a $210k portfolio after 30 years will be.

The income portfolio is much more suitable for people who already have a huge amount of money and would prefer stability, ease of investment over growth. Another valid use case I can think of is for one to change their USD portfolio into the SGD income portfolio after it has grown/reached a significant size which is not available now (I tried).

Overall, I think StashAway is doing pretty well. All these changes show that they are still innovating and on the ball. They have also raised another USD $12 million in funding and should be around for some time. lol.

What are your thoughts?

Anyway, if you are interested in signing up for StashAway, do use our referral link - KPO and CZM Referral Link. You will get $10,000 free management fees for 6 months and we will get $16!

You might be interested in previous months update too:

StashAway - January 2019 - $16,051.10

StashAway - February 2019 - $17,397.81

StashAway - March 2019 - $18,780.96

StashAway - April 2019 - $19,702.85

StashAway - May 2019 - $20,823.09

StashAway - June 2019 - $22,031.43

StashAway - July 2019 - $23,486.36

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

I immediately logged in to take a deeper look.

You need a minimum of SGD $10,000 for this portfolio as compared to its previously no minimum balance portfolio which is pretty high to start...

The portfolio is denominated in SGD (no foreign currency risk) and is at 12% StashAway Risk Index. This means there is a 1% chance of losing >= 12% in any year (even during a recession). The projected income/dividend yield is at 3.75% which I would consider it to be low. We will be able to see what are the underlying ETFs below.

It uses these 6 ETFs to pay out dividends and they will be distributed the month the ETFs pay them. Due to the low income/dividend yield, one will require a much higher capital.

Similarly, one can also take a look at the projection of the portfolio. The difference between reinvesting the dividends is quite significant.

Will I create one? To be honest, I am not a fan, so nope! My opinion is that the projected income/dividend for the portfolio is too low for me to achieve our goals and the reason for it being so low is due to the fees involved. The above income portfolio can be easily replicated since they are all listed on SGX for one-time trading fees of ~0.2+%.

If you still have a long investment horizon, the USD portfolio with similar risk index probably will provide a higher/better return. That few dollars of dividends you can get now isn't going to be life-changing but a $550k portfolio vs a $210k portfolio after 30 years will be.

The income portfolio is much more suitable for people who already have a huge amount of money and would prefer stability, ease of investment over growth. Another valid use case I can think of is for one to change their USD portfolio into the SGD income portfolio after it has grown/reached a significant size which is not available now (I tried).

Overall, I think StashAway is doing pretty well. All these changes show that they are still innovating and on the ball. They have also raised another USD $12 million in funding and should be around for some time. lol.

What are your thoughts?

Anyway, if you are interested in signing up for StashAway, do use our referral link - KPO and CZM Referral Link. You will get $10,000 free management fees for 6 months and we will get $16!

You might be interested in previous months update too:

StashAway - January 2019 - $16,051.10

StashAway - February 2019 - $17,397.81

StashAway - March 2019 - $18,780.96

StashAway - April 2019 - $19,702.85

StashAway - May 2019 - $20,823.09

StashAway - June 2019 - $22,031.43

StashAway - July 2019 - $23,486.36

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)