We were back from our RTW last week but CZM got us addicted to this show - Crash Landing on You. CZM is crazy over Hyun Bin too. Hence, there were no new blog posts and lots of backlogs too. CZM wrote a bunch of RTW drafts which I have yet to add the photos and publish the content. You can read what was already published here :)

On the bright side, we managed to chiong finish the show (lots of crying/tears). Not so bright side, the market is in a sea of red but... Life goes on! A few months back, we were complaining that there isn't much to buy, now there are so many opportunities!

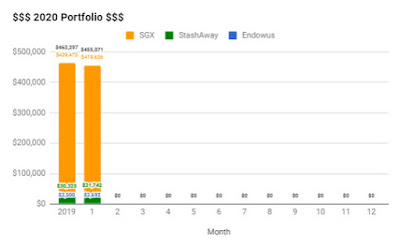

Our portfolio decreases by 1.78% to $455,071 - $163.50 of capital injection and $8,390.26 of capital loss.

If you prefer to look at numbers, this is the raw data used to generate the above bar graph. These numbers are as of the last day of the month.

"Cash Flow" is the amount of money being injected/withdrawn from the portfolio (buying stocks = +ve cash flow while selling stocks and collecting dividends = -ve cash flow)

SOLD

None

BOUGHT

None

Nothing exciting in January but we started buying STI ETF and IWDA in February... Do keep a lookout for our next post!

Dividends

The total dividends collected this month is $277.48. The breakdown is as follows:

Total dividends collected for 2020: $277.48

Average dividends per month for 2020: $277.48

StashAway

Capital: $28,000.00

Current: $31,775.08

Endowus

Capital: $3,750.00

Current: $3,692.00

On a side note, Endowus has reached out and offered a masked referral link for our readers! You will get S$10,000 managed free for 6 months ($20 equivalent) and we will get $20 too! Shall start doing monthly statement updates for it soon too!

You might be interested in these blog posts too:

- Portfolio Performance in 2019

- 2019 Net Worth

- Portfolio - December 2019 - $463,297

- Portfolio - January 2020 - $455,071

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

On the bright side, we managed to chiong finish the show (lots of crying/tears). Not so bright side, the market is in a sea of red but... Life goes on! A few months back, we were complaining that there isn't much to buy, now there are so many opportunities!

Our portfolio decreases by 1.78% to $455,071 - $163.50 of capital injection and $8,390.26 of capital loss.

If you prefer to look at numbers, this is the raw data used to generate the above bar graph. These numbers are as of the last day of the month.

"Cash Flow" is the amount of money being injected/withdrawn from the portfolio (buying stocks = +ve cash flow while selling stocks and collecting dividends = -ve cash flow)

SOLD

None

BOUGHT

None

Nothing exciting in January but we started buying STI ETF and IWDA in February... Do keep a lookout for our next post!

Dividends

The total dividends collected this month is $277.48. The breakdown is as follows:

| Company | PayDate | Amount | Shares | Total |

| SSB Jul 2018 | 1-Jan-20 | 0.01095 | 500 | $5.48 |

| Singapore Telecommunications Limited | 10-Jan-20 | 0.068 | 4,000 | $272.00 |

Total dividends collected for 2020: $277.48

Average dividends per month for 2020: $277.48

StashAway

|

| KPO |

|

| CZM |

Capital: $28,000.00

Current: $31,775.08

Endowus

Capital: $3,750.00

Current: $3,692.00

On a side note, Endowus has reached out and offered a masked referral link for our readers! You will get S$10,000 managed free for 6 months ($20 equivalent) and we will get $20 too! Shall start doing monthly statement updates for it soon too!

You might be interested in these blog posts too:

- Portfolio Performance in 2019

- 2019 Net Worth

- Portfolio - December 2019 - $463,297

- Portfolio - January 2020 - $455,071

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

No comments:

Post a Comment