One of our goals is to accumulate enough miles to fly to the United States in Singapore Airlines Suites for our honeymoon - once in a lifetime experience! We have finally turned that dream into a reality after 1.5 years of hard work (having > 10 credit cards and using the right credit card on the right occasion) with a confirmed Suites booking.

The last time we used miles for our flight - KrisFlyer 50% Redemption Promotion on SilkAir, the cashback equivalent for our return Economy SilkAir flight to Bandung was around 6.5%. What about this time round?

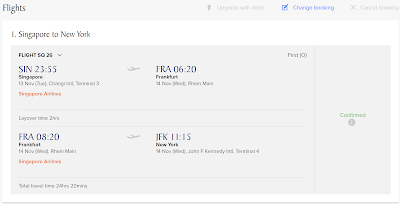

2 one way ticket to New York, John F. Kennedy International Airport can be redeemed for 240,000 KrisFlyer miles + $259.60! Let's take a look at how much it would cost to purchase the exact same ticket/flight for the same day.

Total fare (all in) would have been $23,419.60! We will never pay this amount of money for a flight! The correct way to generate/accumulate miles is to do it through specialized spending (paywave, dining and online) where one will be earning 4 miles per dollar.

As you can see, the miles earned on average till date is about 4 miles per dollar. The reason why UOB and Citi are below 4 is that there are general spending credit cards (UOB PRVI Miles and Citi Premier Miles) giving about 1.2 - 1.4 miles per dollar. SCB is on a different level because we simply signed up for the Visa Infinite card and paid the annual fee without any spending.

With this assumption, the estimated spending would be around $60,000 (240,000 / 4).

Simple maths:

240,000 miles = $23,160 ($23,419.60 - $259.60)

Cashback equivalent: $23,160 / $60,000 = 38.6%

Wahahahaha. Can cashback card beat that? Milelion shifu/master has already written an article about it so I will not go down that path - The ugly truth of cashback cards banks don’t want you to know.

Our miles journey started March 2016 and our 1st card was AMEX Ascend.

During this period, we had quite a few major expenses such as CZM's ring, wedding banquet, those holidays to London, Iceland, Paris, Hong Kong and Bandung, etc. that gave us the opportunity to accumulate miles at a much faster. We have to thank our parents as well whenever they take out cash to make payment, it will be intercepted by us and replace with our credit card. lol.

The question is should you cancel all your cashback credit card and start accumulating miles? My answer would be nope! Similar to all financial decisions, there is no one/best way to go about doing things. Before we started, we spent hours reading all the articles in Milelion to ensure that we know what we are getting into!

Miles may not be suitable for you due to the following reasons:

1. There is an expiry to it and we know cashback does not expire (but there is a cap/limit). lol. If you cannot generate miles fast enough, it might not be ideal for you. Credit card points expire around 1/2 years so you have to transfer the points out to KrisFlyer miles which has an expiry of 3 years. In total, the lifespan of miles would be around 4-5 years.

2. Devaluation of miles! Collecting miles would mean you will be at the mercy of the airlines. Our initial goal was to get return tickets to the United States but SQ devalued its KrisFlyer earlier this year which I blogged about previously - Felt Cheated by OCBC & SIA on the Same Day. In the end, we got to change our plan instead to one-way tickets.

3. Big family. First class/business ticket for your child/children does not really make sense.

4. You prefer to have only 1/2 credit cards for whatever reasons (too many cards make the wallet fat, forget to pay bills, etc.) because the common misconception is that people think they can accumulate miles with just 1 credit card. Sure, never say never :)

5. It is your principles in life that you will NEVER EVER pay any credit card annual fee. It is perfectly normal, we used to think that way too. However, playing the miles game would require you to do that because that is the best arbitrage opportunity! KPO simply cannot resist the thought of paying $2 for a $10 service.

The simple maths behind paying for annual fee:

Citi Premier Miles: $192.60 / 10,000 miles = 1.926 cents per mile

SCB Visa Infinite: $538.5 / 35,000 miles = 1.539 cents per mile

Singapore Airlines Suites: $23,160 / 240,000 miles = 9.65 cents per mile

6. Last but not least, "I am not interested in flying First Class/Business, Economy will bring me from point A to B just fine". The choice is obvious then. Stick to your cashback cards :)

Having said that, we do have cashback card where we make sure that we spent at least $500 on our OCBC cards every month to get the additional interest and everything else goes into miles. Who says one cannot have the best of both world? Hahahaha.

Hope that this article will encourage you guys to start playing the miles game or reinforce your plan to continue using cashback cards. No right or wrong :)

Time to research on what are the must do, must eat, must visit places in the US! We also need to look for a cheap economy ticket back... Hahaha.

The last time we used miles for our flight - KrisFlyer 50% Redemption Promotion on SilkAir, the cashback equivalent for our return Economy SilkAir flight to Bandung was around 6.5%. What about this time round?

2 one way ticket to New York, John F. Kennedy International Airport can be redeemed for 240,000 KrisFlyer miles + $259.60! Let's take a look at how much it would cost to purchase the exact same ticket/flight for the same day.

Total fare (all in) would have been $23,419.60! We will never pay this amount of money for a flight! The correct way to generate/accumulate miles is to do it through specialized spending (paywave, dining and online) where one will be earning 4 miles per dollar.

As you can see, the miles earned on average till date is about 4 miles per dollar. The reason why UOB and Citi are below 4 is that there are general spending credit cards (UOB PRVI Miles and Citi Premier Miles) giving about 1.2 - 1.4 miles per dollar. SCB is on a different level because we simply signed up for the Visa Infinite card and paid the annual fee without any spending.

With this assumption, the estimated spending would be around $60,000 (240,000 / 4).

Simple maths:

240,000 miles = $23,160 ($23,419.60 - $259.60)

Cashback equivalent: $23,160 / $60,000 = 38.6%

Wahahahaha. Can cashback card beat that? Milelion shifu/master has already written an article about it so I will not go down that path - The ugly truth of cashback cards banks don’t want you to know.

Our miles journey started March 2016 and our 1st card was AMEX Ascend.

During this period, we had quite a few major expenses such as CZM's ring, wedding banquet, those holidays to London, Iceland, Paris, Hong Kong and Bandung, etc. that gave us the opportunity to accumulate miles at a much faster. We have to thank our parents as well whenever they take out cash to make payment, it will be intercepted by us and replace with our credit card. lol.

The question is should you cancel all your cashback credit card and start accumulating miles? My answer would be nope! Similar to all financial decisions, there is no one/best way to go about doing things. Before we started, we spent hours reading all the articles in Milelion to ensure that we know what we are getting into!

Miles may not be suitable for you due to the following reasons:

1. There is an expiry to it and we know cashback does not expire (but there is a cap/limit). lol. If you cannot generate miles fast enough, it might not be ideal for you. Credit card points expire around 1/2 years so you have to transfer the points out to KrisFlyer miles which has an expiry of 3 years. In total, the lifespan of miles would be around 4-5 years.

2. Devaluation of miles! Collecting miles would mean you will be at the mercy of the airlines. Our initial goal was to get return tickets to the United States but SQ devalued its KrisFlyer earlier this year which I blogged about previously - Felt Cheated by OCBC & SIA on the Same Day. In the end, we got to change our plan instead to one-way tickets.

3. Big family. First class/business ticket for your child/children does not really make sense.

4. You prefer to have only 1/2 credit cards for whatever reasons (too many cards make the wallet fat, forget to pay bills, etc.) because the common misconception is that people think they can accumulate miles with just 1 credit card. Sure, never say never :)

5. It is your principles in life that you will NEVER EVER pay any credit card annual fee. It is perfectly normal, we used to think that way too. However, playing the miles game would require you to do that because that is the best arbitrage opportunity! KPO simply cannot resist the thought of paying $2 for a $10 service.

The simple maths behind paying for annual fee:

Citi Premier Miles: $192.60 / 10,000 miles = 1.926 cents per mile

SCB Visa Infinite: $538.5 / 35,000 miles = 1.539 cents per mile

Singapore Airlines Suites: $23,160 / 240,000 miles = 9.65 cents per mile

6. Last but not least, "I am not interested in flying First Class/Business, Economy will bring me from point A to B just fine". The choice is obvious then. Stick to your cashback cards :)

Having said that, we do have cashback card where we make sure that we spent at least $500 on our OCBC cards every month to get the additional interest and everything else goes into miles. Who says one cannot have the best of both world? Hahahaha.

Hope that this article will encourage you guys to start playing the miles game or reinforce your plan to continue using cashback cards. No right or wrong :)

Time to research on what are the must do, must eat, must visit places in the US! We also need to look for a cheap economy ticket back... Hahaha.

Congratulations KPO and CZM HAHAHA! Your wish came true!! Suites to New York! Envy!!

ReplyDeleteShit. This post is so addictive and I’m feeling so motivated to “get a credit card” now :(

one day I will do this too.. :( when will you be visiting New York? USD is getting cheaper now!

Haha. Thanks! You need to find the other half first! Easier to accumulate miles with 2 people expenses. lol. Going next year, the flight was booked 1 year in advance.

DeleteThanks! That is one way to look at it. If the company ever send us for overseas trip, it is going to be business class. First class is on a different level. Either damn rich or you work for it. We think the effort is worth it for the experience :)

ReplyDeleteI'm thinking of switching cashback cc to miles cc. But I realise one fallacy that is not being address: when you actually pay for miles by annual fees and such, that's actually cash not use for any 'real' expenditure, so be calculating that in the total expenditure of large ticket items together, it's not accurate. It should be somewhat excluded and calculated in as part of the actual ticket costs, right?

ReplyDeleteHi Unknown,

DeleteThat's interesting. I think it is all a matter of perspective. But since you asked, I can compute just for you :)

We have paid a total of $1,192 annual fees for 95,000 miles.

Based on the updated calculation with annual fees as cost of tickets:

240,000 miles = $21,968 ($23,419.60 - $259.60 - $1,192)

Cashback equivalent: $21,968 / $60,000 = 36.6%

The difference isn't too much? lol. The whole point of miles is that it gives you the opportunity to experience something you will never pay for.

Hi Alucard,

ReplyDeleteThank you for dropping by the blog again after 2 months :)

Yes I do have the breakdown. The $60k consists of daily expenses and necessity. Not all from wedding. A rough estimation is as follows:

Wedding Expenses: ~$15k so far (more coming)

Proposal Ring: ~$8k

Travelling: ~$15k (london, paris, iceland, hong kong, indonesia and malaysia)

Annual Fees: $1,192

Both of Our Daily Expenses: Remaining

If you follow my yearly expenses update, you should see that I/we are quite thrifty. Kinda funny someone trying to lecture us on spending/wedding. As for the comparison, I think is just a matter of perspective :)

Hope this is clearer now!

Hi KPO thanks for this post! Very insightful. Did your expenses include home renovation as well? If so, did you pay via credit card as well to earn the miles?

ReplyDeleteHi Li Yuan,

DeleteThank you! Nope. We have yet to reach the home renovation stage. Our banquet and bridal package were paid through credit cards.

Thats 240k miles for 2 pax one way to JFK. How much did the one way return ticket from JFK-SIN cost?

ReplyDeleteHi midnitefrog,

DeleteWe bought return economy tickets from Expedia operated by American Airline for $640+ per pax! I blogged about it here - http://kpo-and-czm.blogspot.com/2018/03/expenses-january-2018.html