Insurance is all about transferring risk to another party. Our recent experience tells us again that it is simply better to self insure...

In our previous posts - 1 Month as a Parent and Mount Alvernia Delivery & Phototherapy Charges, we mentioned that our baby had severe jaundice (290+ level) and had to be admitted for phototherapy 6 days after she was born.

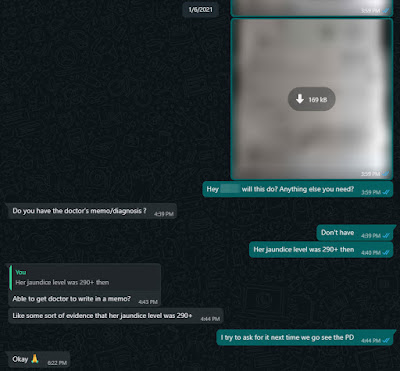

Long story short, we tried to claim the phototherapy treatment from the ReadyMummy policy but was rejected. To be honest, the amount that can be claimed was supposedly just $100 which is a relatively small amount considering the phototherapy treatment cost $967.92 while the ReadyMummy premium cost $798.00. What really pisses me off was the lack of transparency in the way Manulife promotes/markets ReadyMummy and the lack of product knowledge from this agent.

One fine day, I received the rejected claim letter. The agent is so cui (lousy) that he made no effort in communicating the result of the claim to me. I had to find out from the slow mail while he would have received an email. The reason for rejecting it was ridiculous! Apparently, it was not severe enough because Baby Ong was admitted for less than 3 days. Why would the severity be determined by the number of days admitted? Regardless, I went to their website, brochure and even the documents (e.g. product summary) my agent sent me previously but I did not find the minimum 3 days being stated/mentioned anywhere.

He responded that he will appeal only after I confronted him. Shouldn't the approach be him informing me that the claim has been rejected and proceeding to appeal for me?

When we buy insurance, we do not want to find out how good the policy is or to make any claim. To be fair, the Manulife ReadyMummy plan has many other coverages too (on paper and maybe possibly other hidden T&Cs) and it is not right for us to say that it is a bad policy simply based on the above but it was really a bad experience we had to go through. Will we buy this policy if we were to have a second child or any Manulife policy? Definitely not. Is it fair to expect the agent to be well versed in the product he/she is selling? I certainly think so.

End of the day, is it agent cui or policy cui? ¯\_(ツ)_/¯

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

Think maybe you need to read the policy documents for your other insurance as well lol.

ReplyDeleteThe most important part of an insurance policy is the policy document or contract (which spells the conditions & exceptions) as well as any Endorsements.

The other parts like BI & product summary are more of marketing with some facts thrown in & a lot of projections.

We don't really believe in insurance and have the most basic coverage. Term and hospitalization which are pretty straightforward and I guess most importantly service by another agent. We got it from this agent because the other agent does not sell Manulife product.

DeleteHi there, Jaundice is very common for newborns. 9 out of 10 friends i know, their child have jaundice within days from birth. If you read up jaundice, it is a natural process as newborn liver is not 'running' at 100% yet. (on the side, i'm quite pissed off why all Gyne sell 'fear' to new parents, for our 2nd child - we refuse to do phototherapy, breastfed and it went away naturally after 1 week).

ReplyDeleteBack to your concern, I do agree that the agent should be more pro-active and have better communication in the process. But end of the day, Life Insurance is a safety net for unforeseen situation that is severe enough to disrupt your day-day. In other words, without the reimbursement of $100 benefit.. would it disrupt your day-day? If its doesn't then its technically not 'severe' enough to warrant a claim.

Anyway, no one buys an insurance and hope they can claim from it.

Brighten up and Happy Parenting! Congrats!!

Yes, we did read up quite a bit on jaundice and I got to disagree with you. Very common doesn't mean it can't be risky/dangerous to the newborn. It's good that it went away after 1 week for your case but what if it didn't and the bilirubin level continued to increase and things got serious? Would you have view it as selling "fear"? For our case, the jaundice only went away after 2 months. In my opinion, they are professional/specialist who are expert in their field and I'm definitely in no position to judge/question their recommendation. If necessary, one can seek a second opinion elsewhere but we shouldn't discount it as "fear".

DeleteAgain, I got to disagree with you. Like I mentioned above, it's not about the $100 benefit. It's about how the agent isn't familiar with the product and handled the whole situation as well as how Manulife hid the clause which the agent acknowledges that fact himself. Anyway, your rationale of how the $100 benefit does not disrupts one's day-day and hence not being 'severe' enough to warrant a claim is extremely flawed. If that's the case, why would the insurance provide such benefits given that the $100 will never disrupt anyone's day-day? The severity should be based on facts/number/threshold. For example, one of the condition to determine the severity of jaundice is as such:

The presence of neonatal jaundice must be confirmed and supported with relevant diagnostic

testing, blood tests results showing total serum bilirubin level for a term infant, at or greater than 37 weeks gestational age:

- 25 to 72 hours after birth: 260 to 310 μmol/L (micromol/litre)

- more than 72 hours after birth: 290 to 340 μ mol/L (micromol/litre)

Unfortunately, our baby met the above condition and would have been eligible to claim if it was an outpatient treatment (without any minimum number of days of treatment) as compared to the inpatient treatment which for whatever reason requires minimum 3 days of treatment to be claimable.

Ah. I am glad that I can finally agree with you. Of course no one would want to claim from their insurance :)

Thanks! Happy parenting to you too!